ECB cut rates by 25bps as expected (along with a stagflationary cut to growth and hike to inflation forecasts) but all eyes were on US data. A hotter than expected PPI followed the hotter than expected core CPI pushed rate-cut expectations lower (although jobless claims fell). Interestingly, rate cut expectations for 2024 jumped after the ugly 30Y auction and WSJ Fed-whisperer Nick Timiraos comments (which were entirely useless, merely stating that policymakers were considering whether to cut by 25bp or 50bp)...

Source: Bloomberg

As the chart above shows, the shift in rate cut expectations was away from 2024 and into 2025 today... even though Sept rate-cut odds shifted dovishly after Timiraos (erasing all of yesterday's CPI-driven hawkish shoft)...

Source: Bloomberg

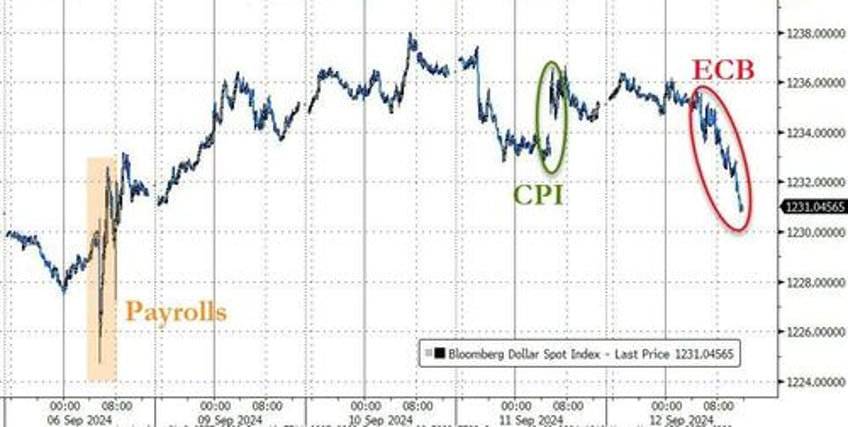

...and despite the hawkish shift in US STIRs, the dollar dumped as EURUSD rallied after The ECB statement had a smidge of hawkishness (about domestic inflation fears) and then the WSJ comments accelerated the decline...

Source: Bloomberg

...the dollar weakness drove gold to a new record high above $2550...

Source: Bloomberg

Small Caps (big short squeeze) and Mega-Cap tech (safe haven flows and NVDA) dominated the equity indices today with the Dow lagging (but still higher)...

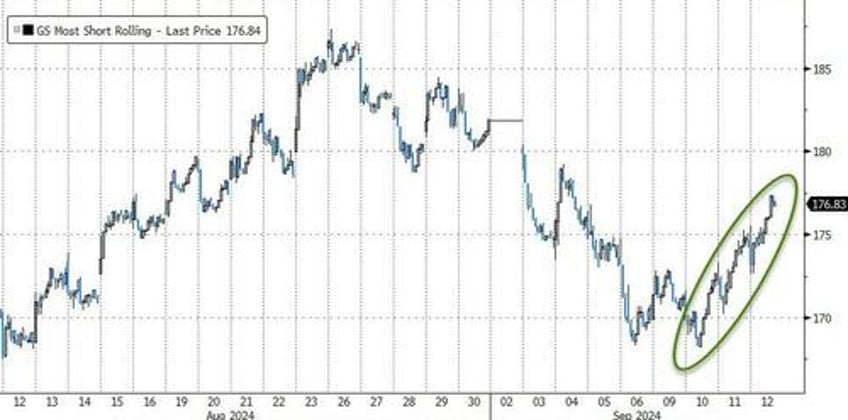

'Most Shorted' stocks dipped and ripped...

Source: Bloomberg

...and Mag7 stocks extended their rebound...

Source: Bloomberg

Goldman's trading desk noted that they were seeing the market "quiet flow wise with volumes muted and S&P top of book tracking lower."

Our floor is -3% better for sale with HF’s $120mm net for sale (Short sales are outpacing long sales) and LO’s $250mm net to buy. LOs buying Hcare and Tech vs HFs selling Discretionary + macro Products.

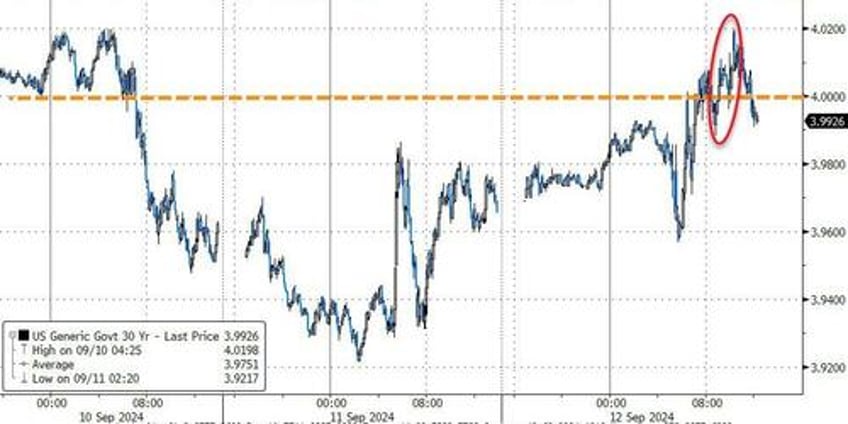

Back to bond land, yields were higher across the curve (with the long-end marginally underperforming - 30Y +3bps, 2Y +1bp) leaving rates back to unchanged on the week...

Source: Bloomberg

...with the 30Y yield breaking back above 4.00% (after the ugly auction)...

Source: Bloomberg

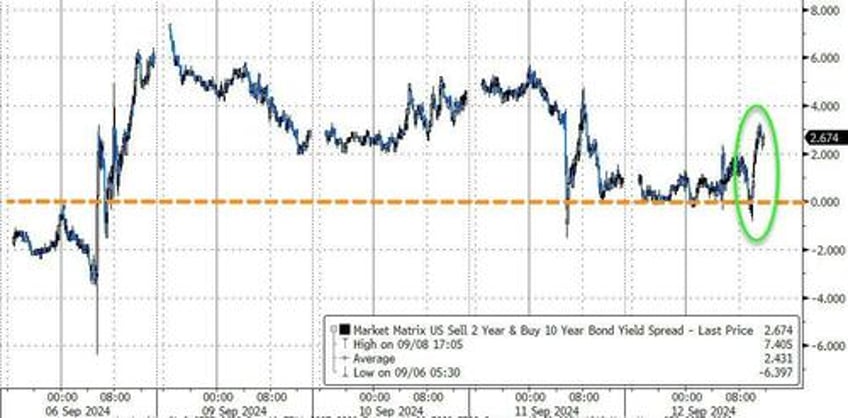

...and 2s10s briefly inverted again today, before reverting back to bear steepening and dis-inversion...

Source: Bloomberg

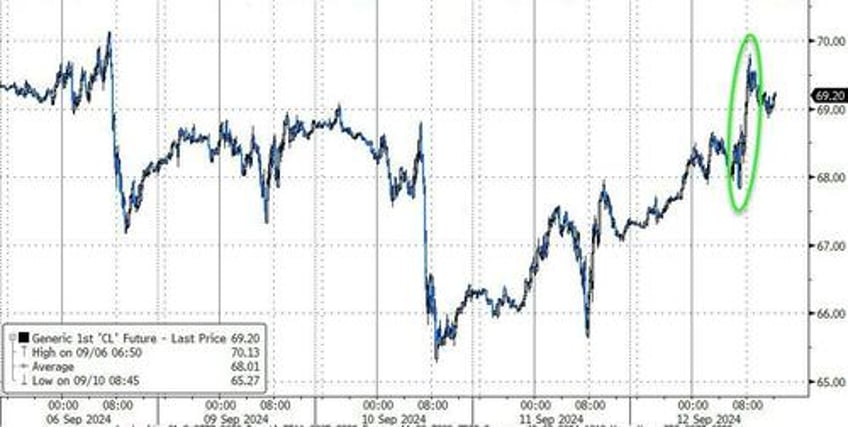

Oil prices extended their rebound with WTI testing up towards $70 handle again...

Source: Bloomberg

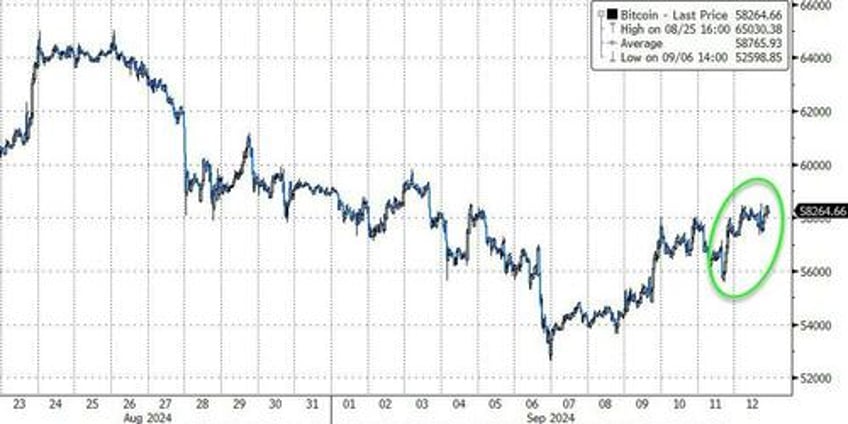

Bitcoin also extended its rebound, back above $58,000...

Source: Bloomberg

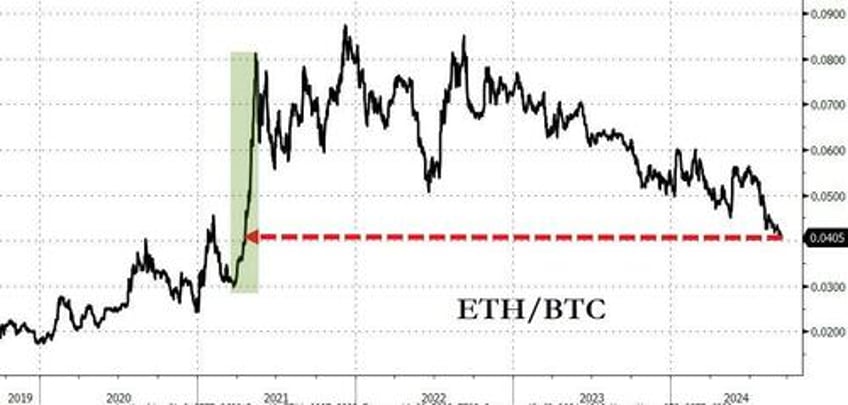

Ethereum continues to underperform, dropping to a new post-DeFi-boom low relative to bitcoin...

Source: Bloomberg

Finally, with gold at record highs, real yields have started to shift back lower...

Source: Bloomberg

What's more likely a return to negative real yields or gold back at $500?