Goldman reported Q4 results that topped expectations (thanks to a jump in Equity sales and trading which however was offset by a miss and slump in the all-important FICC group), yet the bank also reported its lowest annual profits in four years, as losses caused by its pullback from retail banking compounded a slowdown in its core business.

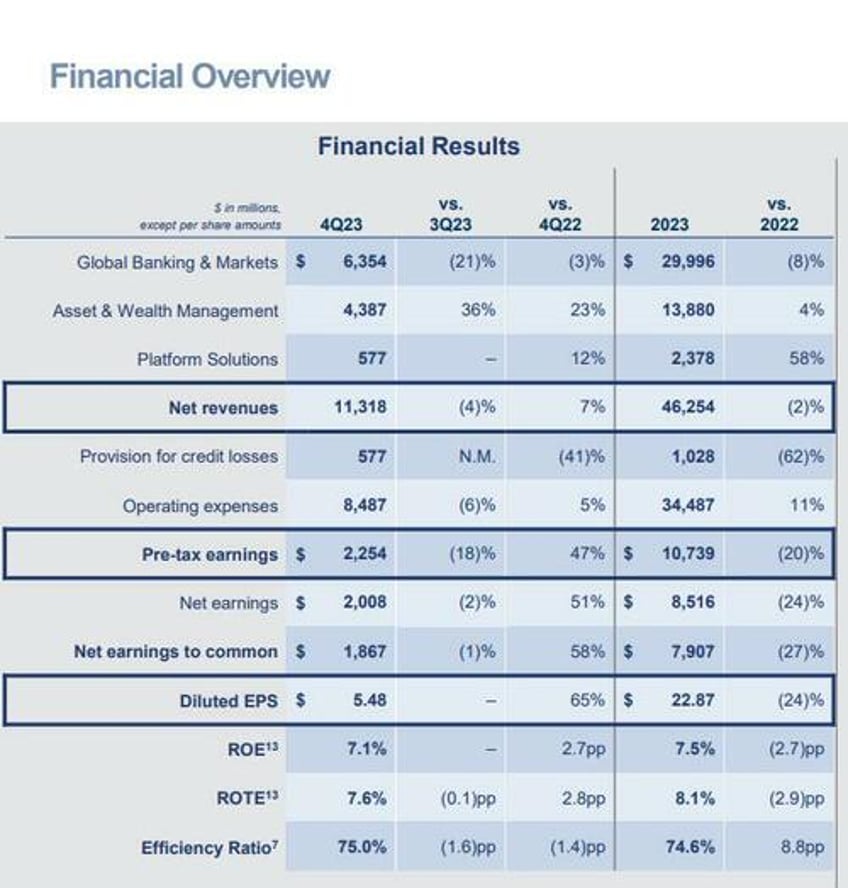

But while net income for the full-year 2023 fell 24% to $8.5BN, the lowest level since 2019, as full-year revenue dipped 2% to $46.3BN "reflecting lower net revenues in Global Banking & Markets, largely offset by higher net revenues in Platform Solutions and Asset & Wealth Management", net earnings in the 4th quarter climbed a solid 51% from a year earlier to $2bn, resulting in EPS of $5.48 which handily beat estimates of a $3.51 print (and up 65% from the $3.32 year prior); Q4 revenue of $11.318BN rose 7% YoY and also came in stronger than the $10.8BN expected.

Some more highlights on the quarter:

- 4Q23 net revenues were higher YoY reflecting higher net revenues in Asset & Wealth Management and Platform Solutions, partially offset by lower net revenues in Global Banking & Markets

- Global Banking & Markets net revenues $6.35 billion, -2.5% y/y, missing estimates of $6.47 billion

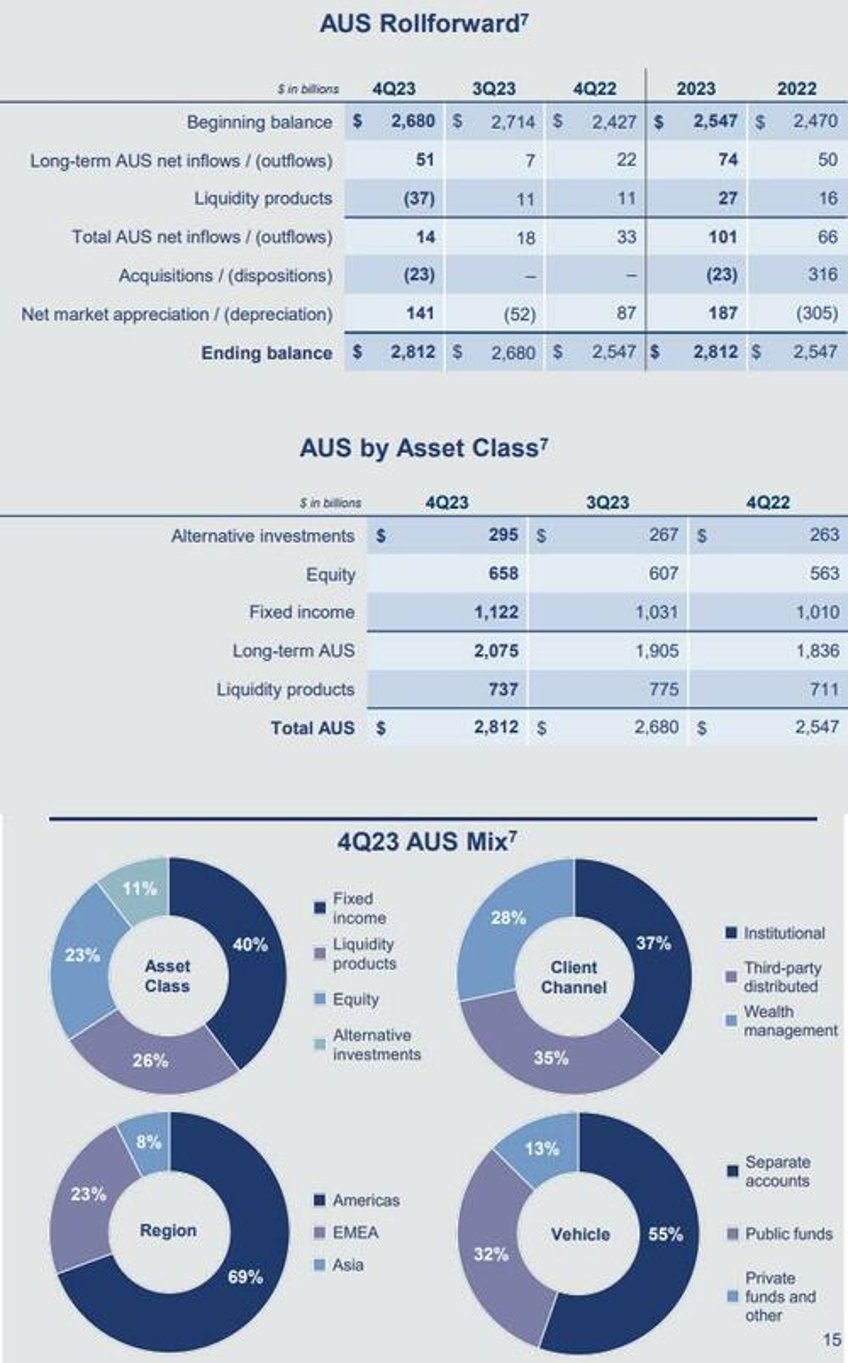

- Assets under management $2.81 trillion, +10% y/y, beating estimate $2.77 trillion

- 4Q23 provision for credit losses was $577 million, below the exp. $622 million, reflecting net provisions related to both the credit card portfolio (primarily driven by net charge-offs and seasonal portfolio growth, partially offset by a reserve reduction of $160 million related to the transfer of the GM card portfolio to held for sale) and wholesale loans (driven by impairments)

- 4Q23 operating expenses were slightly higher YoY primarily reflecting the FDIC special assessment fee of $529 million tied to the failure of Silicon Valley and Signature Bank.

- Platform Solutions pretax loss $390 million, estimate loss $596.8 million

- Total operating expenses $8.49 billion, +4.9% y/y, estimate $8.3 billion

- Compensation expenses $3.60 billion, -4.3% y/y, estimate $3.72 billion

- Return on tangible equity +7.6%, estimate +5.56%

- Standardized CET1 ratio 14.5%, estimate 14.8%

- Book value per share $313.56 vs. $303.55 y/y

- Assets under management $2.81 trillion, +10% y/y, estimate $2.77 trillion

- Total AUS net inflows $14 billion, -58% y/y, estimate $23.96 billion

One especially concerning data point was that net interest income collapsed -35% y/y to $1.34 billion, far below the estimate of $1.73 billion, and "reflecting an increase in funding costs supporting trading activities" as well as average interest-earning assets of $1.44 trillion for 2023 and $1.47 trillion for 4Q23." What was hilarious is how Goldman's PR department tried to mask the spectacular implosion in Net Interest Income: see if you can spot what's wrong with the chart below which we can only assume was created by either a first-year analyst or the bank's equivalent of Goebbels.

For the full year, Goldman took out a $1.03 billion provision for credit losses "reflecting net provisions related to both the credit card portfolio (primarily driven by net charge-offs) and wholesale loans (primarily driven by impairments)... partially offset by reserve reductions of $637 million related to the transfer of the GreenSky loan portfolio to held for sale and $442 million related to the sale of substantially all of the Marcus loans portfolio."

Goldman took several one-off hits to profits last year — including selling its online lending business GreenSky at a loss — in what analysts characterised as a “kitchen sink” approach to clear the decks for 2024.

Also for the full year, Goldman said that 2023 operating expenses were higher YoY "primarily reflecting significantly higher impairments related to consolidated real estate investments ($1.46 billion recognized in 2023), a write-down of intangibles of $506 million related to GreenSky and an impairment of goodwill of $504 million related to Consumer platforms, as well as the FDIC special assessment fee of $529 million."

“This was a year of execution for Goldman Sachs,” the bank's embattled Disc Jockey and CEO David Solomon said in a statement Tuesday. “With everything we achieved in 2023 coupled with our clear and simplified strategy, we have a much stronger platform for 2024.” The market has yet to be convinced, however.

Solomon, who has been chief since October 2018, originally continued his predecessor Lloyd Blankfein’s strategy of expanding in consumer lending.

But he has since focused more on building up the bank’s asset and wealth management division to balance out the lumpier investment banking business and give Goldman the same sort of diversification that investors have welcomed at rivals JPMorgan Chase and Morgan Stanley.

Turning to the bank's various key markets divisions, we find the following:

- Goldman's equities business generated $2.61 billion in revenue, a 26% jump compared to expectations for an increase of just about 8%, and beating estimates of $2.25 billion. Equities "reflected significantly higher net revenues in intermediation and higher net revenues in financing"

- FICC brought in just $2.03 billion, badly missing estimates of $2.58BN and a 24% drop YoY driven by "significantly lower net revenues in intermediation."

- Investment banking fees also dropped, sliding 12% YoY to $1.652 billion, and missing estimates of $1.68 billion. Investment banking fees "reflected significantly lower net revenues in Advisory, partially offset by significantly higher net revenues in Debt underwriting and higher net revenues in Equity underwriting."

- Advisory revenue in Q4 was $1.01 billion, down 29% YoY but beating estimates of $902.3 million as an uptick in new deal announcements lifted hopes of revival in the merger business, although realized fees from completed deals still came in substantially lower than a year earlier.

- Debt-underwriting revenue was $395 million (missing estimates of $439 million) and up 40% YoY,

- Equity underwriting revenue was $252 million (also missing estimates of $335.4 million) and up 38% YoY.

- Signs of life in capital markets helped lift fees from selling stock and raising debt for companies compared to the same period a year earlier.

- The investment banking fees backlog increased vs 3Q23, reflecting a significant increase in Advisory, partially offset by decreases in Debt underwriting and Equity underwriting

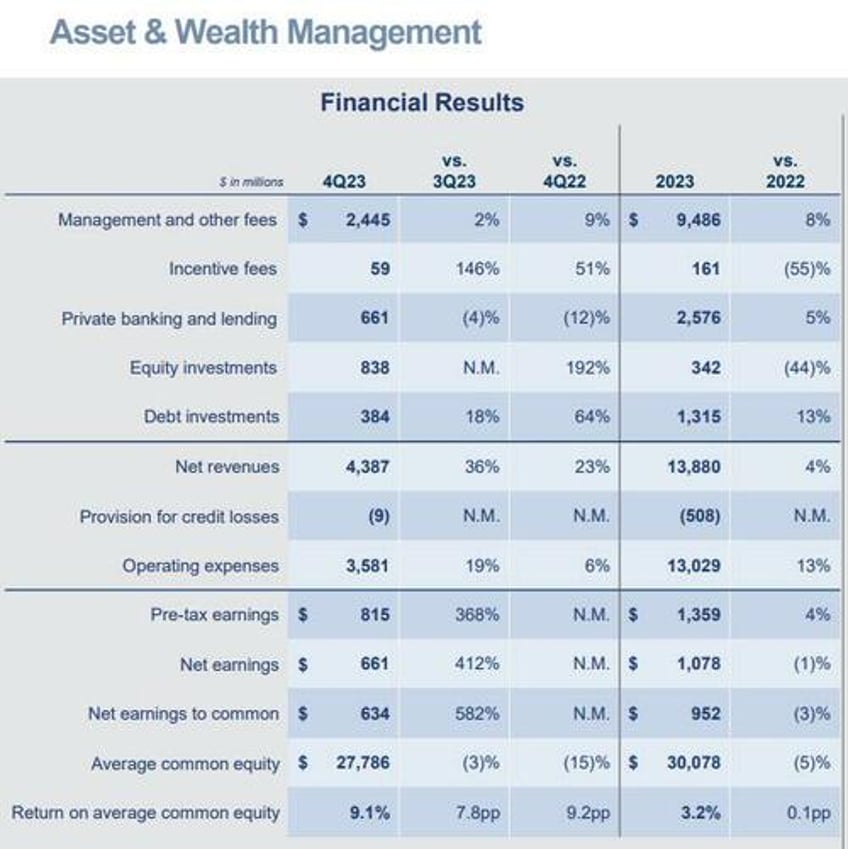

Unlike the mediocre Banking and Markets group, Goldman's asset and wealth division had its highest quarterly revenue in two years, buoyed by a gain tied to the sale of a financial-management business. Some highlights:

- Management and other fees rose 9% YoY to $2.445 billion, primarily reflecting the impact of higher average AUM

- Private banking and lending net revenues primarily reflected the impact of the sale of substantially all of the Marcus loans portfolio earlier in the year

- Equity investments reflected:

- Private: 4Q23 ~$800 million, compared to 4Q22 ~$770 million; slight increase due to a gain of $349 million related to the sale of PFM in 4Q23, partially offset by significantly lower net gains from real estate investments

- Public: 4Q23 ~$40 million, compared to 4Q22 ~$(485) million

- Debt investments reflected net mark-ups compared with net mark-downs in 4Q22, partially offset by lower net interest income due to a reduction in the debt investments balance sheet

- 4Q23 operating expenses included impairments of $262 million related to consolidated real estate investments

- 4Q23 select data

- Total assets of $192 billion

- Loan balance of $46 billion, of which $33 billion related to Private banking and lending

- Net interest income of $697 million

Here is a breakdown of the Assets Under Supervisions

During the year, AUS increased $265 billion, or 10%, to a record $2.81 trillion, beating estimates of $2.77 trillion

- Net inflows in fixed income, liquidity products and alternative investment assets

- Net market appreciation primarily in equity and fixed income assets

- Dispositions related to the sale of PFM

What we found most interesting, however, was the bank's details on the continued shrinkage of its principal investments: as shown in the chart below, the bank has been aggressively liquidating its alternative investment book, which has shrunk by almost 50%...

... as a result of a whopping $12.9 billion in Dispositions and Paydowns, which cut the total amount of principal investments by almost 50% from $29.7 billion to just $16.3 billion.

Some more details:

- 2023 Management and other fees from alternative investments were $2.13 billion (including $571 million in 4Q23), up 15% from 2022

- During the year, alternative investments AUS increased $32 billion to $295 billion

- 2023 gross third-party alternatives fundraising across strategies was $72 billion, including:

- $25 billion in corporate equity, $23 billion in credit, $10 billion in real estate and $14 billion in hedge funds and other

- $251 billion raised since the end of 2019

- During the year, on-balance sheet alternative investments declined by $12.4 billion to $46.2 billion

- Historical principal investments declined by $13.4 billion to $16.3 billion and included $3.5 billion of loans, $3.6 billion of debt securities, $4.0 billion of equity securities and $5.2 billion of CIE investments and other

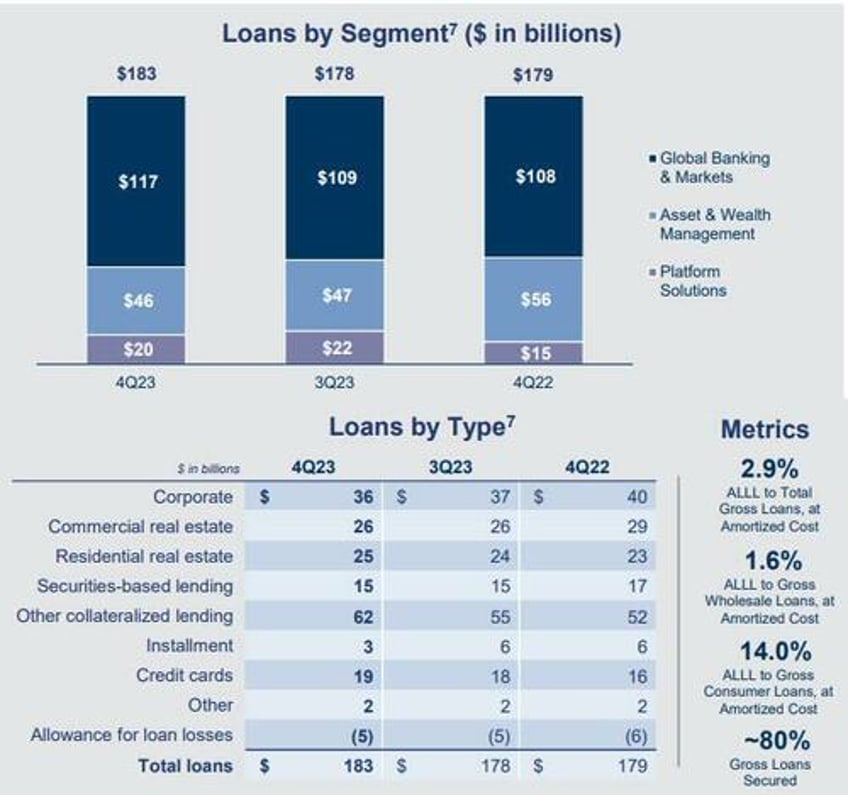

Turning to the bank's balance sheet, we find that total deposits rose 6.2% QoQ to $428 billion, while total loans rose 2.2% YoY $183 billion, +2.2% y/y, estimate $180.86 billion

Finally, let's take a quick look at the bank's Commercial Real Estate portfolio which luckily had just $1 billion in office exposure.

Some more details on the portfolio:

- 46% of the CRE loan portfolio was investment-grade, based on internally determined public rating agency equivalents

- Office-related loans were primarily secured by Class A office properties

- Additionally, the firm has $3.4 billion of CRE-related unfunded lending commitments, including $0.5 billion of office-related commitments

Turning to just the bank's office exposure, Goldman said it was primarily secured by Class A office properties, and that "~38% of the CRE-related on-balance sheet alternative investments consisted of historical principal investments, which the firm intends to exit over the medium term."

Elsewhere, the bank said it is still in the process of attempting to get out of its credit-card partnerships with Apple and General Motors after acknowledging defeat in its desire to storm the consumer-lending market, and having been swamped with subprime borrowers who have no intention of paying down their Goldman card.

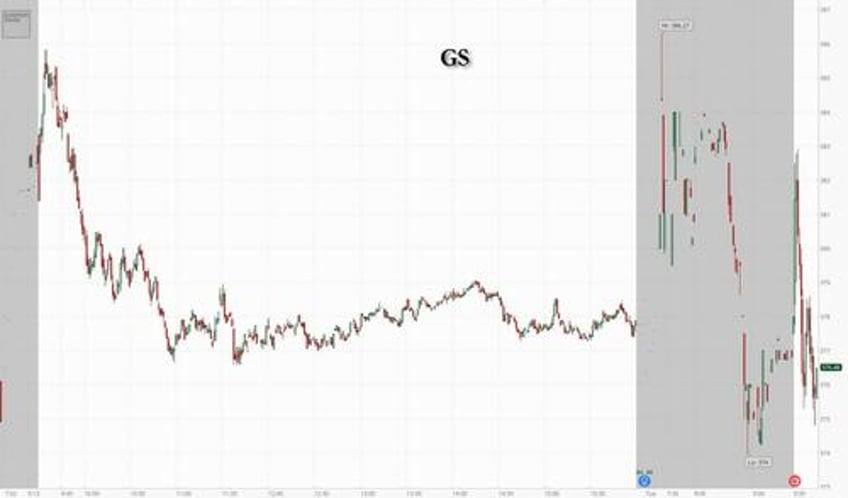

After a modest bounce higher on the top and bottom line beat, Goldman stock saw the initial enthusiasm fizzle and was last trading fractionally lower after market opened for trading.

Full investor presentation below (pdf link).