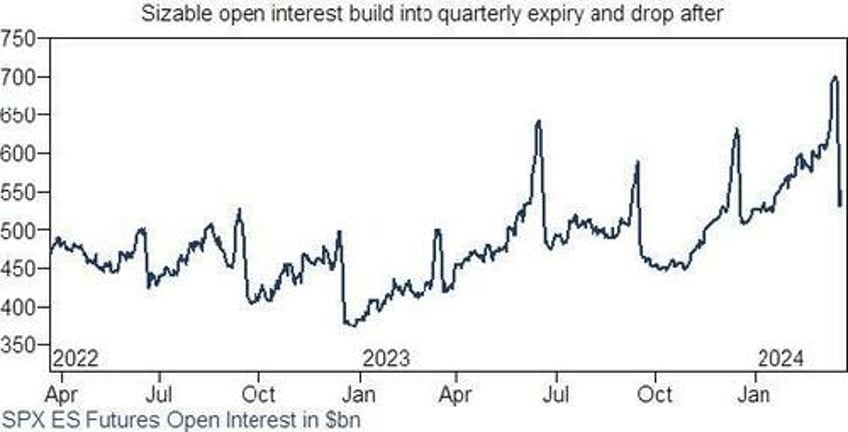

According to the Goldman Sales and Trading Strategies desk, total S&P futures open interest reached a near record level of around $700bn before expiration last Friday, before falling to $530bn on the Monday after the massive triple-witching expiry (and again edging higher since then) which was one of the larger expiry-related open interest drop changes but overall common enough behavior for the event (and some of the TOI is mechanically and seasonally built during the roll-period before expiry).

Goldman also estimates that within the systematic community CTA/trend followers remain max net long, while risk-parity style strategies have been gradual buyers in recent months, with length above multi-year average levels as e.g. SPX 6-12mth realized vol is not far form 5-year lows.