Over the weekend we took a close look at one of the bigger market mysteries to emerge in recent years, namely the relentless collapse in implied vol (i.e. VIX) coupled with a record low skew.

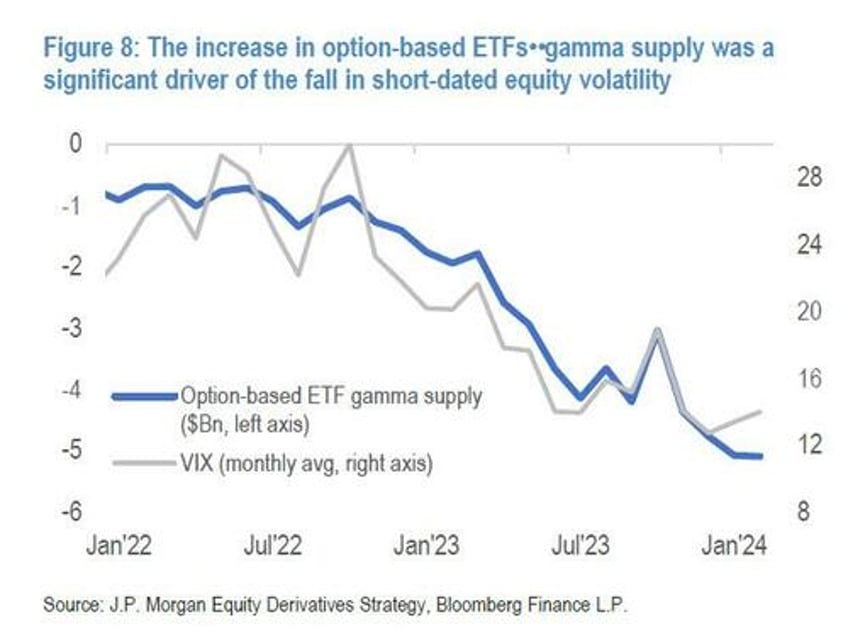

Here, the discussion has shifted over the past year, with some - most notably JPMorgan's Marko Kolanovic - initially blaming 0DTE derivatives for depressing the VIX and suppressing true risk levels; Marko went so far as predicting that 0DTE trading would lead to another Volmageddon-like market crash (over a year later, that forecast like so many others made by the Croat strategist, has yet to come true). Then, perhaps after getting tired of being ignored, last week the JPM strategist, piggybacking on the work of JPMorgan's best derivatives analyst Bram Kaplan, shifted his thesis and said that volatility was artificially low not because of 0DTE but due to call overwriting. This thesis can be visualized by overlaying the seemingly neverending option-based ETF gamma supply and the the collapse in the VIX which have tracked each other tick for tick in recent years.