Last week we reported that after 2 weeks of selling, and especially after the most recent notable surge in shorting by hedge funds which culminated in the last week of February with the biggest selling of tech names in over 7 months (as discussed here) US equities saw the largest net buying by hedge funds since mid-Jan, led by long buys in Single Stocks and short covers in Macro Products, while Tech was the most notionally net bought sector.

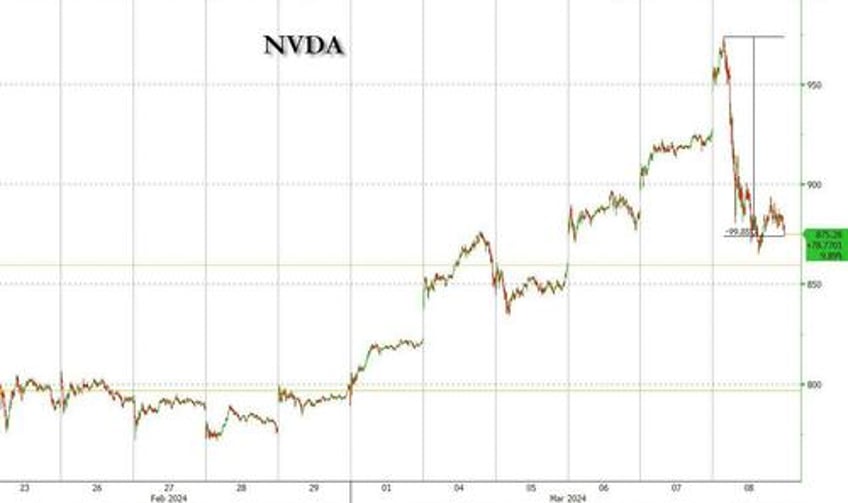

Fast forward to last week when with the S&P ending fractionally lower denying a historic feat of 16 weekly gains in the past 18 - in no small part due to the violent plunge in NVDA on Friday when more than a quarter trillion of its market cap was wiped out...