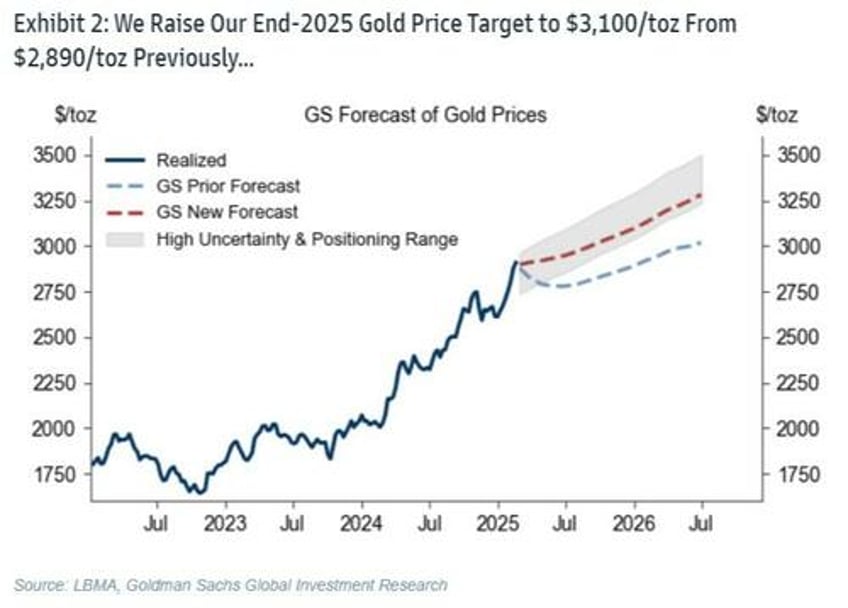

"Structurally higher central bank demand" has pressured Goldman Sachs Precious Metals Research team to shift their year-end 2025 gold price forecast dramatically higher, from $2890 to $3100/toz with Lina Thomas and the team reiterating their 'long gold' trading recommendation.

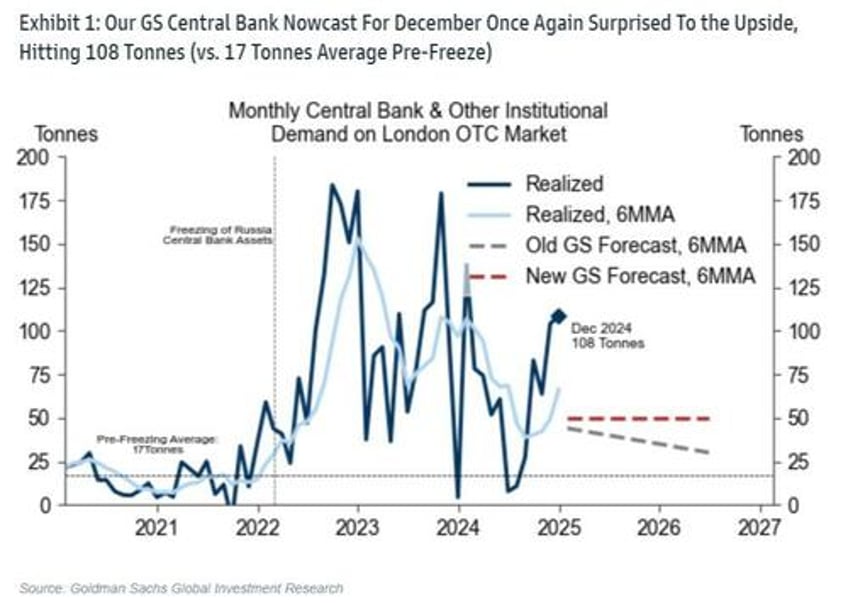

The December reading of our GS nowcast of central bank and other institutional gold demand on the London OTC market came in strong at 108 tonnes in December (vs. pre-2022 average of 17 tonnes) (Exhibit 1).

China was again the largest buyer, adding 45 tonnes. We thus upgrade our central bank demand assumption to 50 tonnes per month (vs. 41 tonnes prior).

We estimate that structurally higher central bank demand--averaging 50 tonnes per month going forward--will add 9% to the December 2025 gold price.

This, combined with a gradual boost to ETF holdings as our economists expect the Fed to cut twice this year (+ 2%), should outweigh the drag from normalizing positioning (-4%), assuming uncertainty diminishes.

Additionally, Goldman highlight that fears of US tariffs on gold are reshaping gold flows.