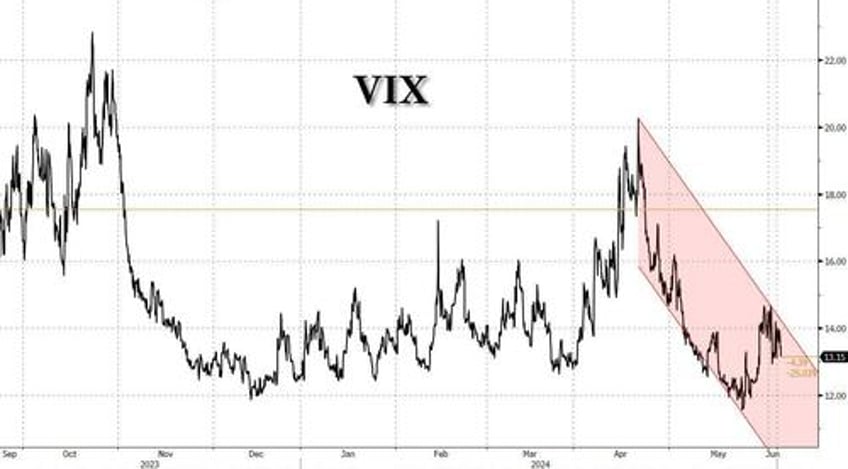

Just when it seemed like the VIX was about break out of its relentless downward channel which had earlier prompted discussion that a single-digit VIX was once again in the cards as was the case last in late 2017, gravity once again managed to suck in the implied volatility index, with the VIX closing at a session low just above 13, and reverting to its prior trajectory onward to cycle lows.

What is behind the relentless VIX selling? Two things: first, as Goldman derivative trader Brian Garrett notes when looking at the chart of SPX vols by strike and expiry today as of last Friday, "there is ZERO panic in the vol market with SPX down around -2% the last three days."