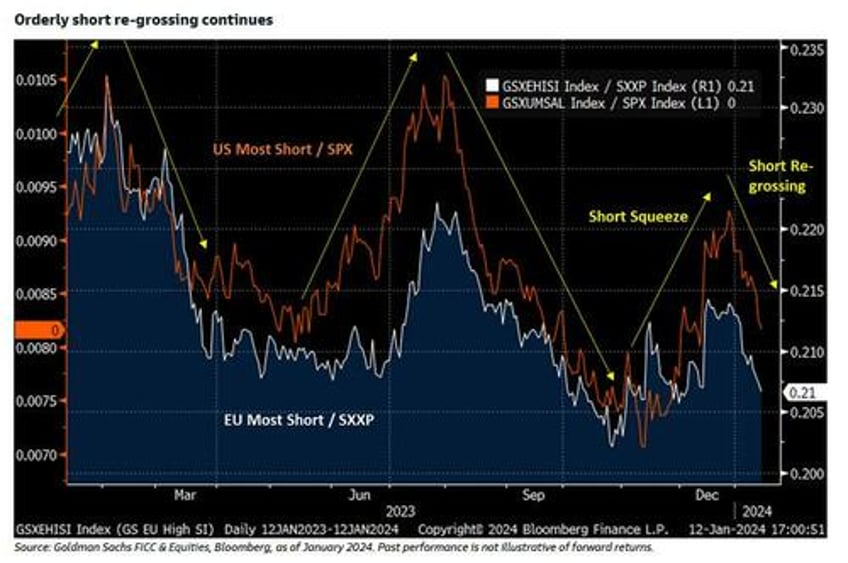

After a shaky first week of the year, the "dominant" macro narrative of November and December - i.e., the tech-fueled meltup - reasserted itself this week, with lower rates despite a hotter than expected CPI and despite a stronger than expected jobs report - helping quality & long duration assets while short re-risking quietly continues in the background.

For an extended view of these and other topic, we defer to Goldman's Matthieu Martal, author of the bank's weekly Movers and Trending report (available to pro subs in the usual place) - and who believes that the orderly short re-risking playbook (something we discussed earlier when we noted that Goldman's Prime Brokerage had observed the first hedge fund buying after several months of acute selling) remains valid: "we continue look for a clearance of the positioning technical and systematic overhangs before weighing on value and quality in a barbell approach. The desk is also closely monitoring China GDP geared and commodity exposed stocks given the steep sentiment and positioning asymmetries in the space."