By Peter Tchir of Academy Securities

Good Thing Markets Don’t Close at 2:30 pm

Sometimes weeks shortened by holidays are painful to follow. It somehow seems difficult to get a good sense of flows and momentum. In addition, last week had a dearth of economic data, at least until Friday. Let’s be honest, when we are looking at Treasury auction results for direction, we are in a market devoid of much else going on.

The market did seem to digest the news that a former president and presumptive nominee was found guilty of felonies. At some point, markets are likely to focus on the election. The one thing I’m reasonably sure about regarding the election is that as the campaigning begins in earnest, it will not be great for Treasuries. Neither candidate/party seems particularly interested in doing anything about the ballooning national debt and that will weigh on markets yet again.

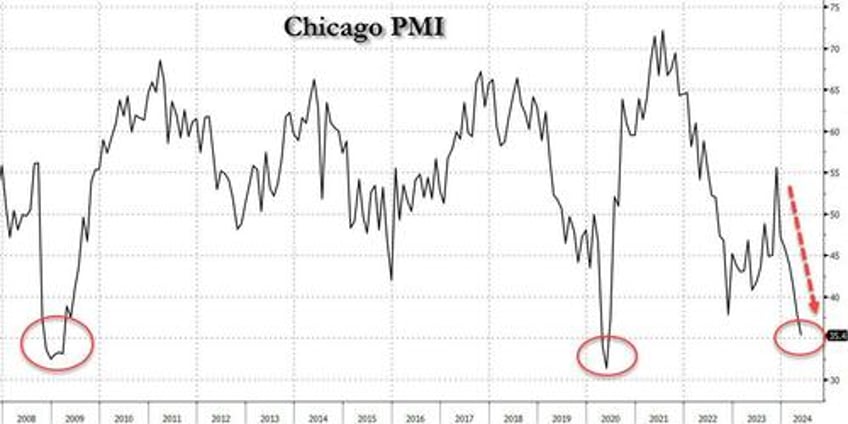

Other factors such as “okay” inflation data will also impact Treasuries. We crawled back into our 4.3% to 4.5% range, but largely on a simply atrocious Chicago PMI report. While we can all agree that neither Chicago, nor Manufacturing are as important to the nation as they once were, it is at least mildly disturbing that we surpassed the 2001 trough (though we are marginally higher than the 2008/2009 and COVID troughs).

Which brings me to the chart of the day.

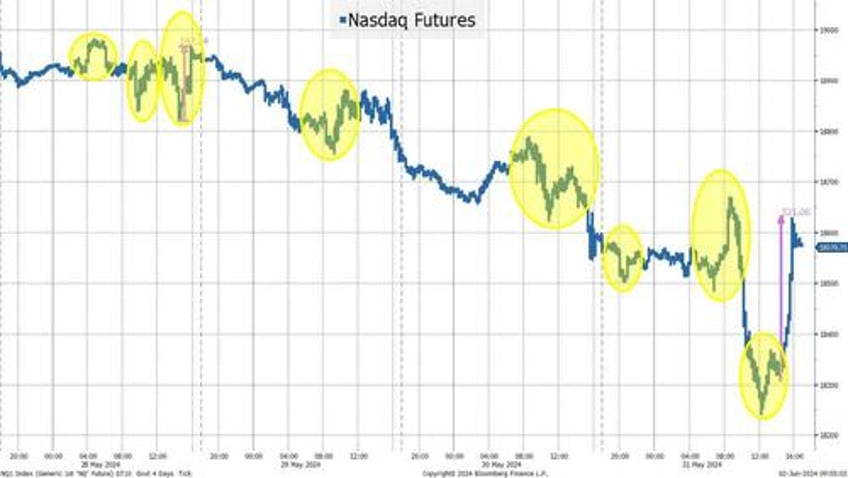

The Nasdaq 100 dropped about 300 points on the week or about 1.5%. Not horrible, but late into the day on Tuesday and late into the day on Friday (which also happened to be month-end), the Nasdaq 100 gained about 470 points (about 2.5%). Now, maybe the “hockey stick” save into the close on Tuesday is explicable, but we saw those gains fade as the week progressed. However, Friday’s action seemed bizarre at best. Presumably, it was due to some sort of month-end rebalancing, but it was hardly something that a continued rally seems likely to be based on.

That is in addition to some of the moves (up and down) highlighted in yellow, that seem almost random. Sure, some can be tied to a specific headline, but many just seem to be reactions to flows.

I’m increasingly worried about a lack of “true” liquidity in the markets. Sure, algos create a perception of liquidity (one that can be used in reasonable size), but those pockets of liquidity seem to disperse more and more frequently.

Without a doubt, in a quiet tape, the relentless buying from share repurchases has helped, but that didn’t seem to work last week.

One thing that caught me somewhat by surprise was that going back to March 1st, the S&P 500 is up 2.4%. No, I’m not surprised that despite all the hype and relentless “all-time high” headlines, stocks are barely up over the last 3 months. What surprised me (a little) was that the utilities sector was by far the best performing sector in the S&P 500 (up a whopping 16.4% over that period).

We have stretched the AI Deputization theme to its limit. Yes, data centers are being built. More and more computing power is also being built. They will need energy to run, but I suspect that will take time and the markets are “compressing” time. We’ve pulled forward lots and lots of expected cashflows and benefits from AI. NVDA remains strong and is up over 30% since March 1st, but even the AI leadership doesn’t seem broad and has relied on utilities. That all seems “stretched” to me.

We continue to see large stocks react 10% (or far more) to earnings, which I interpret to be a function of options and a lack of true liquidity.

Maybe we will grind higher again, but markets seem stretched, leadership is flagging, and we should get some interesting data this week. I care far less about the inflation data and far more about the data pointing to economic activity and the consumer.

The May jobs data should be really interesting. From a “seasonal” perspective, it should pick up summer hiring in the Northeast. I continue to wonder if our “seasonal” adjustments no longer match the reality of a country where the demographic mix and manufacturing/service hubs have changed over time (away from the Northeast). Maybe the corollary of Chicago doesn’t matter, but is this why we’ve been overstating jobs due to seasonality, which is no longer accurate?

Bottom Line

I expect “American Exceptionalism” to be sorely tested this coming week with the onslaught of data (jobs in particular).

I'm increasingly nervous that we are about to undergo another round of selling pressure in Treasuries. Foreign bond yields are getting more attractive, the deficit is concerning, and China (amongst others) needs to raise money to fund stimulus. However, I think the economic data will outweigh that and keep us drifting back towards 4.3% on 10s.

Equities got the “stick save” on Friday, but I think that will fade and every attempt to rally on lower yields that are a result of weaker data will fade. I just don’t see a third “save” coming and it won’t matter that markets don’t close at 2:30 pm, because there won’t be the late day rally!