After two superb coupon auctions, where both the 3Y and 10Y sales earlier this week showing remarkable buyside demand, we were wondering if today's 30Y auction would be just as strong. And then we read bloomberg's always wrong preview which said that the auction was "likely to stop through"...

... at which point we knew it would be a tailing mess.

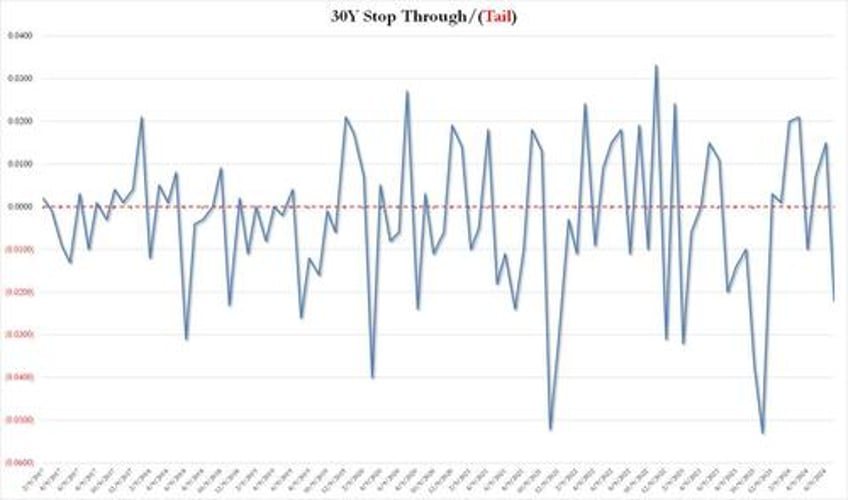

And sure enough, pricing at a high yield of 4.405%, not only was the yield higher than last month by 0.2bps - when all previous auctions saw a drop in yields - but the auction also tailed the When Issued 4.383% by 2.2bps, the biggest tail since last November's record 5.3bps tail. So much for that "likely stop through."

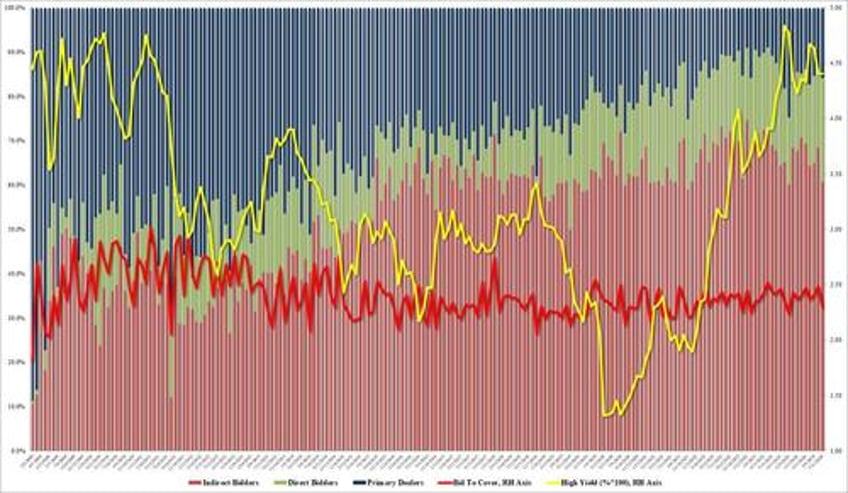

The bid-to-cover was just as ugly, sliding to 2.299 from 2.486 in June and the lowest since November (obviously it was below last month's 2.417).

Lastly, the internals were very subpar with Indirects awarded just 60.8%, the lowest since - you guessed it - last November which followed the Fed's dovish pivot. And with Directs at a surprisingly high 23.4%, the highest since August 2014, Dealers were left holding just 15.9% of the final auction, above last month's 13.7%.

Overall, this was a very ugly auction and it managed to do the seemingly impossible: in a day when the plunge in CPI guaranteed a September rate cut and sent yields tumbling across the curve, it pushed the 10Y by 2bps from session lows, last trading just above 4.18%.