A few months ago, BofA's Michael Hartnett coyly suggested that AI is a "baby bubble" just waiting, like HR Giger's alien, for its moment to spawn into fully-grown form (with several million human shorts as hosts). Today, the coyness is gone, and in his latest Flow Show note titled aptly enough "A short history of bubbles", Hartnett - perhaps after observing the recent move in names like ARM and SMCI - is no longer shy about calling the parabolic spade a spade and details not only a "short history of bubbles" but where the Magnificent 7 fits in.

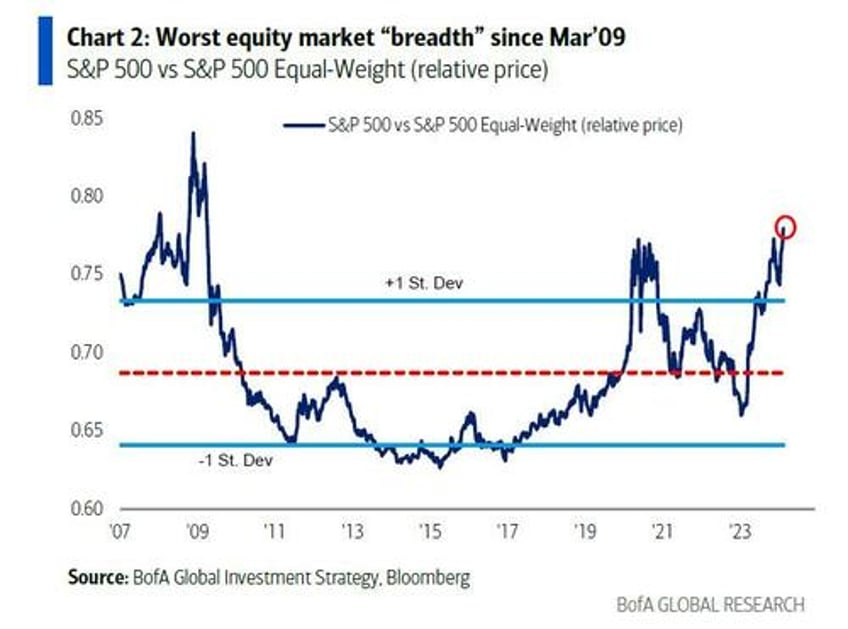

But before digging in, Hartnett starts off by highlighting the indispensable "glue" of any bull market, and hence bubble, namely credit... and sure enough there is plenty of glue right now with Investment Grade spreads "tight-as-a-drum", and close to post-Covid lows of 86bps (despite a record $310BN in YTD issuance). Yet if credit is rock solid (and after 2020 when the Fed ended up buying IG ETFs making it clear the Fed would never allow credit to lock up again, why not?) the same can not be said for equities, where the bull market is so narrow: just the top 5 stocks account for 75% of all S&P YTD gains, and just the top 3 tech stocks account for 90% of tech sector YTD gains. Indeed, as shown in the next charts, US equity breadth is now the worst since March 2009, when the S&P troughed its post-Lehman crash around 666.