While Michael Hartnett may have (massively) underestimated the impact of the April 2 "liberation day" which has so far turned out to be mostly a liberation from all LTM capital gains, he has generally gotten the rest of the year correct, having pounded the table on his Long BIG concept - namely Bonds, Gold and International stocks - all year, and indeed so far in 2025 gold is up 25%, government bonds are up 6%, the MSCI World ex US index is up 5.5%, credit is also up (IG +3.9%, HY +1.7%) cash 1.3%, commodities -1.3%, while US stocks are down more than 10%... but it could be worse: oil is down 9.8%, and crypto is the biggest loser so far in 2025, down 34.0% YTD. But the most surprising mover is the US dollar which is down 8.4% in 2025, a historic plunge and one which suggests that all those Mar-A-Lago accord rumors were on to something (more on that in a second).

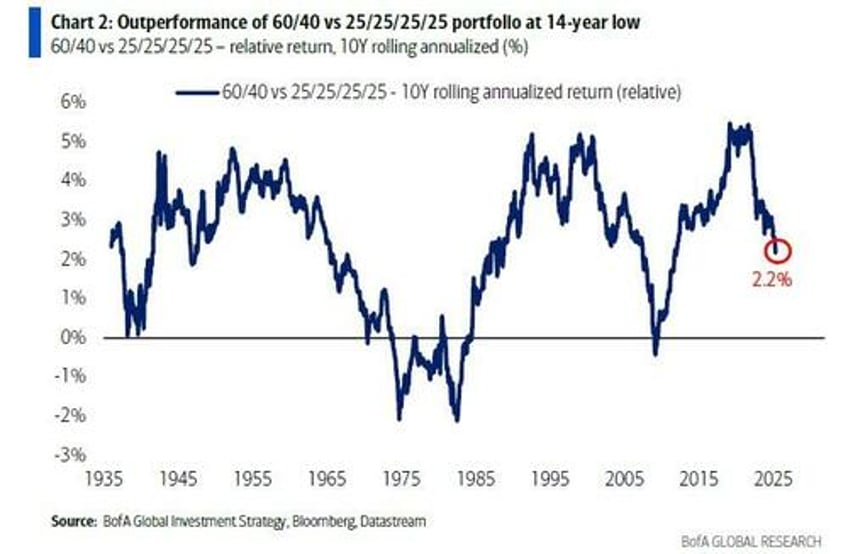

What's behind this dramatic reversal of fortune for US equities? On one hand, the proximal catalyst was the April 2 reciprocal tariff announcement (which we warned the market was dramatically underestimating back in February) which sparked a stark reassessment of the US role in the global financial order, but which Hartnett would argue is just the natural evolution of events in the past 5 years, to wit: "2020s is the decade of “big change,” end of “Wall St” bullish “globalization” - this is manifesting in the conservative 25/25/25/25 cash/bonds/gold/stocks “permanent portfolio” up 4.7% YTD (mostly thanks to gold and bonds) vs -5.4% for traditional 60/40 portfolio…and while decade-to-date 60/40 is annualizing 4.6% vs 3.8% for 25/25/25/25, the 60/40 long-run outperformance at 14-year low and plunging fast.