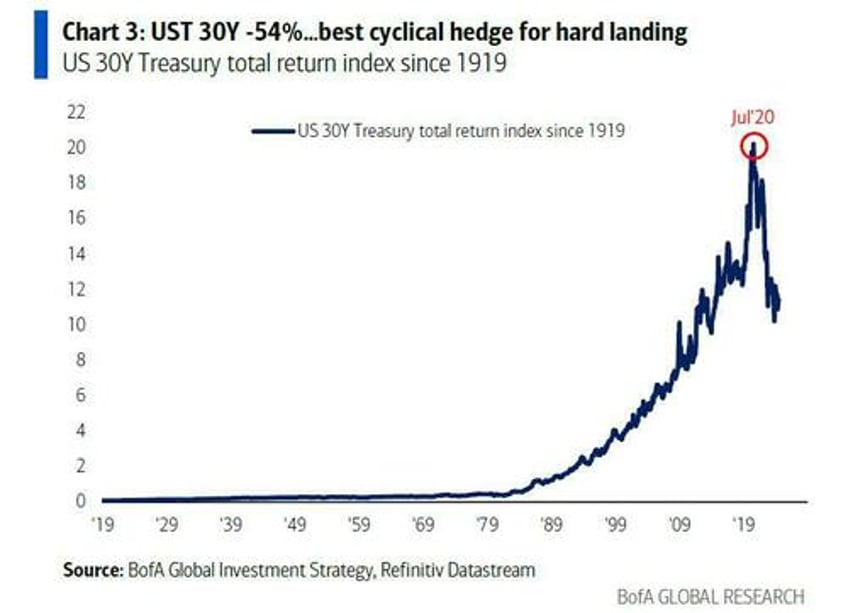

One week after Michael Hartnett revealed the signal to start selling tech giants (and judging by the very rare 5% drop in the Mag7 since, his timing was pretty much spot on), the Bank of America strategist is back to his favorite topic: discussing the most hated "pain trade" du jour (and of the entire second half of 2024), namely going long bonds, which he still believes is the best cyclical hedge for a hard landing which, yes, he still believes is coming...

... even if others don't share his conviction. That's because as he writes in his latest Flow Show note (available to pro subs in the usual place), the Tale of the Tape is one where, at a time when all investors appear to be rotating from one asset class to another, nobody is rotating from stocks to bonds... at least not yet: "soft landing = breadth, no landing = bubble, hard landing = bonds; risk rotation not retreat is Q3 client zeitgeist, rotation from US$ to gold, momentum to volatility, monopolies to leverage, large to small - note the 2nd largest inflow to small stocks ever this week..."