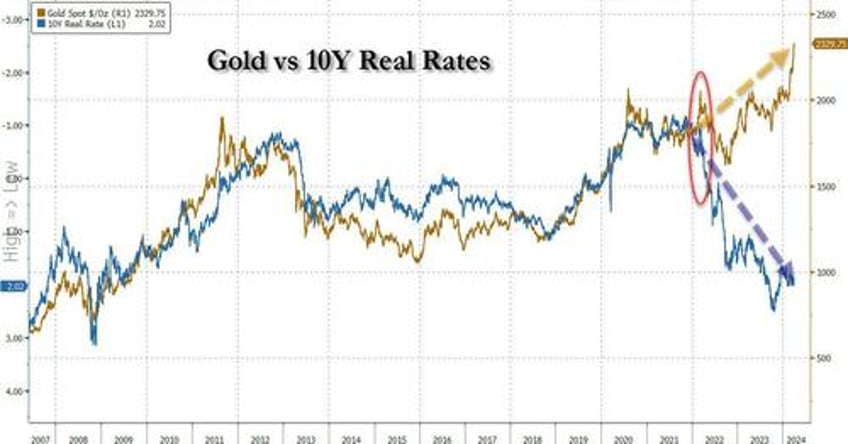

Earlier this week we noted that back in the start of 2022, something snapped in the long-term correlation between gold and real rates: as BBG's Garfield Reynolds pointed out, gold’s recent - and ongoing - surge to record highs was quite extraordinary as it is coming in the face of elevated real yields (which at 2% are at levels not seen since 2009, when gold was trading below $1000) that would normally bring it crashing down.

That, to Reynolds, the fact that real yields are the highest in 15 years - a level which should hurt a non-interest bearing asset like gold, but clearly doesn't - signals one of two outcomes: i) either the metal is likely to rapidly reverse this year’s staggering ascent, or ii) risk assets are due to collapse because of an economic or financial crisis.