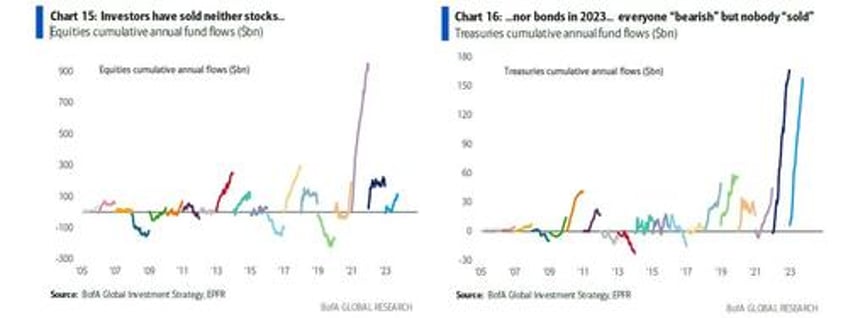

Three weeks ago, BofA's bearish CIO Michael Hartnett pointed out something curious: the markets were heavily oversold according to most conventional metrics, and yet when looking at actual fund flows, nobody was actually panic selling, or selling at all for that matter: "we have seen $158bn in inflows to Treasuries YTD and $110bn inflows to stocks YTD (despite the pervasive gloom)." Hence, a paradox : how can both stocks and bonds be tumbling when there has been a quarter trillion in inflows into both asset classes?

We summarized Harnett's take home message thus: "everyone is "bearish” but nobody "sold."That will change, of course, and furthermore with roughly $70 trillion in bad dent losses across global markets, it will get very ugly when it does."