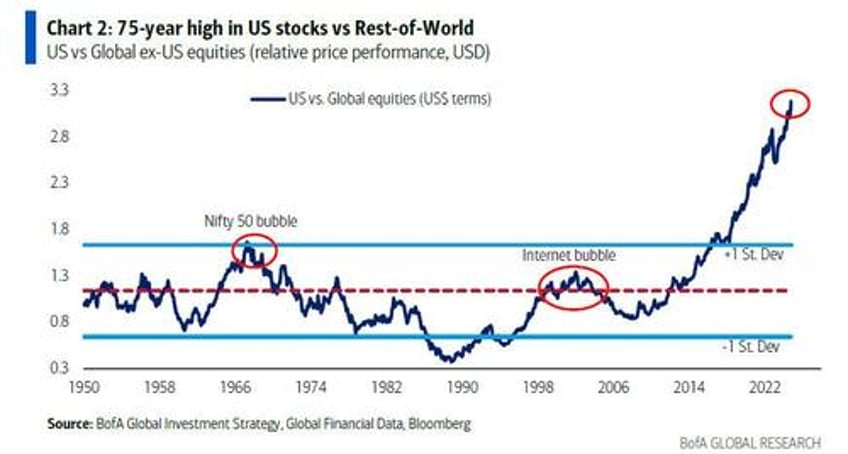

There has been a remarkable divergence in the fates of global stocks since the unexpected sweep by Trump/Republicans on November 5: US stocks have exploded higher, surging as much as $1.8 trillion, while on the other side Emerging Markets have lost half a trillion in value and EAFE (Europe, Australasia and the Far East) is down $0.6tn. In short, only the US has benefited and as Michael Hartnett writes in his latest flow show, investors are all-in on Trump 2.0 which equals "US exceptionalism" and so it is tough for allocators to call top in US asset price hubris, but with the US dollar (real effective exchange rate) now at 55-year high, US stocks vs the world are at a 75-year high.

To Hartnett, this means that it's just a matter of time before "US humiliation" surely follows, which is why the theme of his latest Flow Show (available to pro subscribers) is to "Sell Hubris, Buy Humiliation."