By Elwin de Groot, Head of Macro Strategy at Rabobank

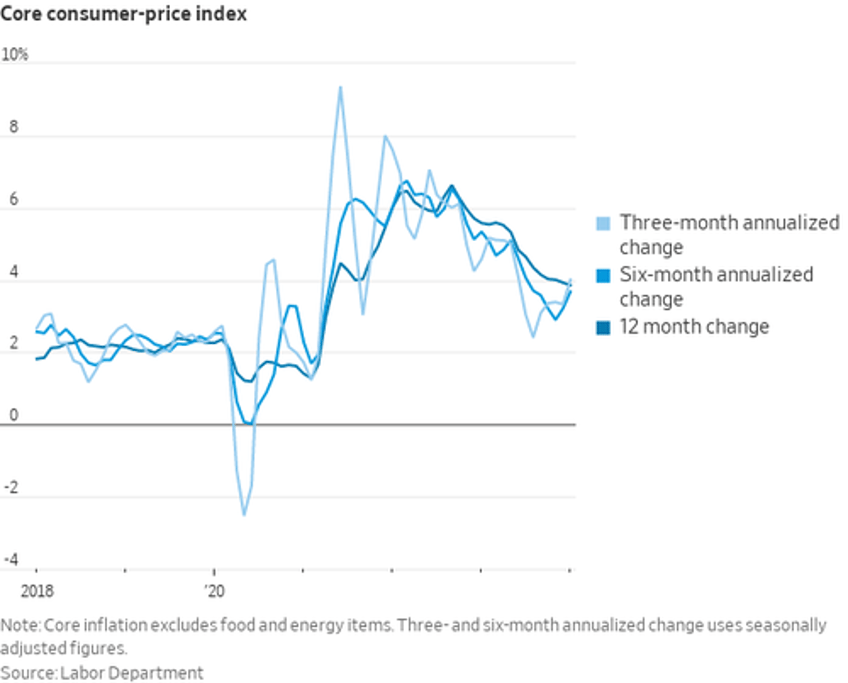

Have markets been fooled by the base effect? Have they been basing too much? One would almost think so, as the decline in the y/y rate in US CPI core inflation since the summer of 2023 seems to have largely informed market participants (alongside some weaker economic data perhaps), whereas the seasonally adjusted annual rate of monthly changes in core inflation has actually been trending up. The latter, albeit more erratic, is not subject to echoes from the past.

In any case, some fresh cold turkey arrived with yesterday’s US CPI report for January, which kicked rate cut expectations further into the long grass. Not so long ago, end-December to be more precise, OIS forwards priced in 3-4 Fed rate cuts by June 2024. Yesterday, that gauge had dropped to just one rate cut. Of course these very date-specific contracts are not only very sensitive to expectations about broader trends but also the specific timing of decisions. Yesterday, both were actually thrown into doubt, lifting yields in a broad spectrum of maturities and even filtering through to European rates. 2Y UST yields jumped no less than 18bps, its maturity equivalent inflation swap by 13bps, and the curve unsurprisingly bear-flattened as 10y yields rose 13bps. European rates inched up several basis points (10y Bund +3bps).

Turning to the culprit, US consumer prices rose 3.1% y/y in January (0.2%-points more than the consensus forecast) whilst core inflation, as already mentioned, similarly disappointed, rising by 3.9% versus 3.7% expected. But the most interesting observation was that the seasonally adjusted monthly changes actually showed a rebound. The core m/m annual rate came in at 4.8%, pushing north of the y/y core number in January, for the first time since April last year.

As our US strategist Philip Marey remarks, the unexpected resilience in core inflation can largely be attributed to services less rent of shelter which rose 3.6% year-on-year from 3.4% a month before. This means a rebound in the segment of inflation that the FOMC watches most closely, because it is assumed to largely reflect wage growth. In contrast, shelter inflation continued its decline to 6.0% from 6.2%. The latter determines a sizeable chunk of the overall inflation rate and the Council of Economic Advisors tweeted that this has remained elevated lately, although it is still expected to decline progressively going forward, keeping core inflation on a downward trend. Philip believes that this CPI report is confirmation for the FOMC that patience is required before the first rate cut but doesn’t alter the view that disinflation is still making some progress. We thus reconfirm and maintain our view of three Fed rate cuts this year, starting in June.

The UK’s inflation rate held steady at 4% y/y in January, lower than the 4.1% predicted by the Bank of England and the 4.2% expected by analysts. A rise was anticipated due to a small increase in energy bills, as regulated household gas and electricity tariffs went up, but this was offset by a surprisingly sharp drop in food prices. They fell by 0.4% on the month, the first such decline in more than two years. Headline inflation is now firmly on track to fall below the 2% target in April, when the UK’s energy price cap will reflect the recent slump in wholesale gas prices. Core inflation also steadied, at a rate of 5.1% y/y. This was also a bit softer than expected. However, services inflation edged up to 6.5% from 6.4% in December.

As Stefan Koopman notes, the numbers remain roughly in line with the growth of private-sector wages, which increased by 6.3% year-on-year in the three months to December. Yesterday’s jobs data indicated that the labour market continues to rebalance, with businesses less keen to hire. Unemployment, however, fell to 3.8%. This is mostly a story of rising economic inactivity, with historically high numbers of people saying they are long-term sick (an additional 850,000 since early-2019, or 2.5% of the workforce!). This suggests that the labour market is still a lot tighter than one would have assumed after 515 basis points of rate hikes and that wage pressures could therefore still persist. The upcoming 9.8% rise of the National Living Wage in April, together with higher benefits and pension rates, may be a factor that pushes wage growth back up. We will only know this by the summer. Unless the labour market implodes, time is therefore on the Bank of England’s side. We forecast a first rate cut in September. The market is positioned for such a cut in August. Note that this was May only a month ago..

Turning to other Europe, it is mostly ‘geopolitical’ news that is grabbing the headlines. China responded to plans by the EU, announced earlier this week, to put sanctions/restrictions on some two dozen firms. This includes three China-based firms, which would be the first time since Russia invaded Ukraine. The Chinese Ministry of Foreign Affairs said in a statement that “China firmly opposes illegal sanctions or ‘long-arm jurisdiction’ against China on the grounds of cooperation between China and Russia.” Most interesting, of course, is that China apparently was also speaking on behalf of Russia here and, at face value, this may only confirm sentiments in Brussels that it’s ‘on to something’. Although European leaders remain at loggerheads as to how to shape and implement its ‘de-risking’ agenda, international relations are obviously not improving.

Meanwhile, Bloomberg reports that outgoing Dutch prime minister Mark Rutte is moving up the likelihood scales of becoming the next NATO secretary general. But Türkiye, who is said to be favorable to Rutte’s bid in principle, also demands Rutte’s assurance that he will take a ‘neutral’ stance in the long-standing tensions between Türkiye and Greece/Cyprus. Discussions on this front have been gaining momentum in recent days. The US ambassador and US permanent representative to NATO Julianne Smith said during a press conference yesterday that it is “eager to bring this [selection] process to a close”. The ambassador also said she remained “confident that Congress will pass another assistance package soon”. Although the Senate yesterday approved USD95bn of fresh assistance measures to Ukraine, Israel and Taiwan, the legislation is facing huge resistance in the House, as a border enforcement deal was dropped from the package following pressure from Donald Trump, who fears it may take the wind out of his sails. This, however, has lowered the chances of passing this legislation in the House altogether.