Earlier, we shared a comprehensive Fed preview which explained why following up on the December dovish pivot, today's statement and Powell presser were likely to explain why the central bank has no more tightening bias, and provide more detail on whether a March rate cut is coming. For those strapped for time, we recap the key highlights, namely what the Fed statement will say today.

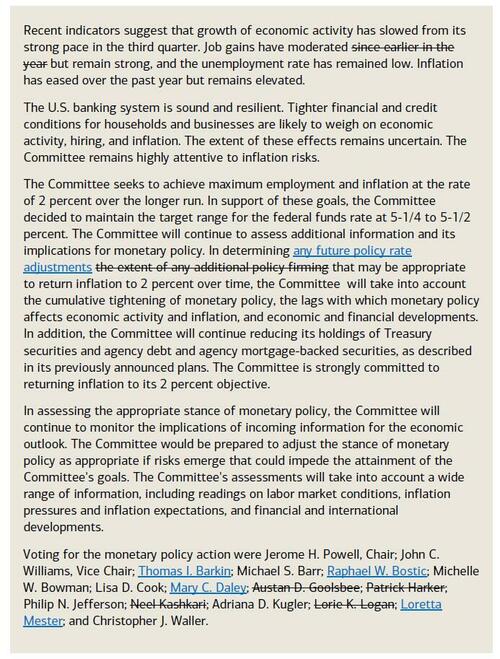

As noted previously, there is consensus for another dovish tweak to the statement guidance after the December statement's adjustment: "In determining the extent of ANY [new word] additional policy firming that may be appropriate...". WSJ's Nikileaks wrote that "Fed officials are likely to take a symbolically important step this week by no longer signalling in their policy statement that rates are more likely to rise than fall." That is a view held by many analysts too. Using the 2006-07 guidance history as a benchmark, BofA suggests the following, "in determining any future policy rate adjustments that may be appropriate...".