Shares of Hormel Foods plunged the most since the fall of 2008, following concerns among investors about a new labor contract the company ratified with a union on Thursday. Simultaneously, the company held an investor presentation where at least one analyst was spooked by executives' comments on 'investments.'

On Thursday morning, the United Food Commercial Workers International Union (UFCW) announced workers at Hormel Foods locations in Minnesota, Georgia, Wisconsin, and Iowa voted to ratify a contract that includes the largest wage increase in the company's history

UFCW announces unionized Hormel workers ratified a new four-year contract at four facilities — in Minnesota, Wisconsin, Iowa and Georgia — with the "largest wage increase in the company's history" pic.twitter.com/c9RPBxuJg0

— Max Nesterak (@maxnesterak) October 12, 2023

Workers are expected to gain an extra $3-$6 an hour, increases in pension and 401k benefits, enhanced healthcare coverage, and a doubling of bereavement leave.

Hormel shares have been sliding since May 2022, down nearly 40% to the $33 handle. Earnings have deteriorated due to a recent acquisition and inflationary pressure, forcing the company to slash full-year earnings guidance.

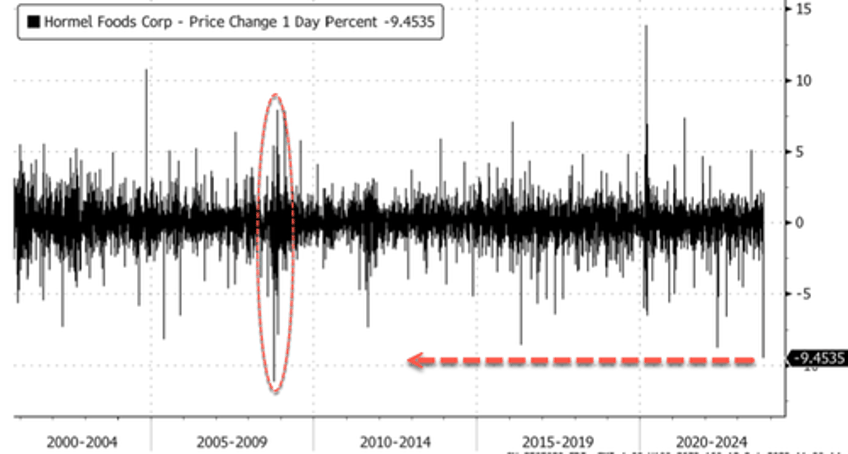

Shares plunged 9.45% in the early US cash session, the most since October 2008.

Hormel's investor day began earlier this morning. The company outlined its long-term financial targets.

Bloomberg released a headline, "Hormel Foods Tumbles as Analyst Flags Investment Commentary," pointing out Vital Knowledge's Adam Crisafulli's concern about the company's "year of significant investment" in 2024.

Regardless of the underlying reason, investors are panic-dumping shares and asking questions later.