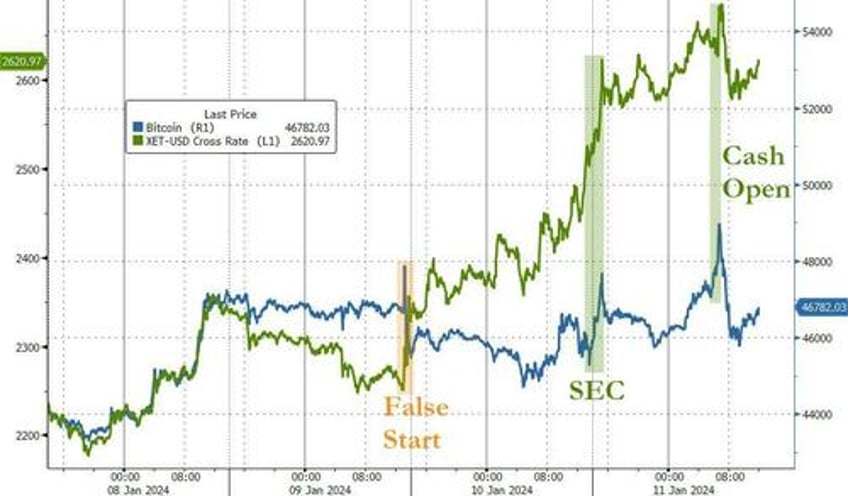

Bitcoin (spot) ETFs dominated the overnight headlines as they started trading after the begrudging SEC approval last night. That sparked a large wave of buying in both the ETFs (when cash markets opened) and the underlying with both ETH and BTC soaring to cycle highs (before some profit-taking hit). Ethereum has been the big winner...

Source: Bloomberg

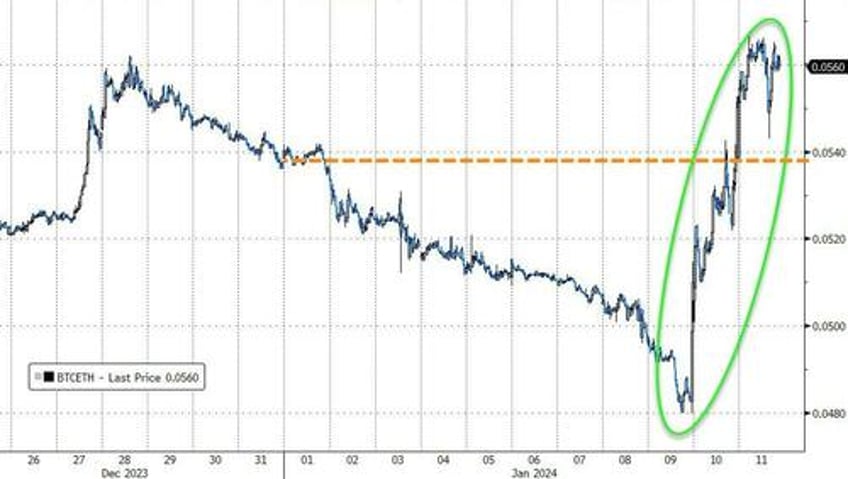

That erased all of Ethereum's relative weakness to Bitcoin YTD...

Source: Bloomberg

Bloomberg's Eric Balchinas points out that the Spot Bitcoin ETFs were a huge hit...

HOME STRETCH: $IBIT has just passed $1b in volume today (will break $BITO's record) w/ group hitting $4.3b or $2.2b ex-GBTC (which isn't 'new' per se). Also good sign to see 4 issuers over $100m. Strong middle class in the works. Easily the biggest Day One splash in ETF history. pic.twitter.com/LeVJKvWj3V

— Eric Balchunas (@EricBalchunas) January 11, 2024

+0.31% MoM - 1 basis point above consensus (+0.30%) and 3 basis points hotter than November (+0.28%) - that was enough to wipe the lipstick off the goldilocks Core CPI disinflation-extrapolation narrative and spook markets back to a less-than-utopian soft-landing scenario possibility today. Additionally, initial and continuing jobless-claims both declined more than expected - adding to the 'well, how are you going to cut rates into that' argument.

A quick look under the hood of the S&P 500 early in the day was illustrative of this concern: sectors that benefit from a lower rate regime - Utilities and the FANGMAT complex - were underperforming; while traditionally defensive sectors including Consumer Staples and Health Care were outperforming... but that all changed as yields fell and stocks ripped back higher...

Nasdaq outperformed, battling to stay green for the last hour or so. Small Caps were the biggest loser...

FedSpeak today pushed back a little on the dovish bias we have heard recently - but not aggressively

1150ET *FED'S MESTER SAYS MARCH IS PROBABLY TOO EARLY FOR A RATE CUT

1300ET *FED'S BARKIN: NEED TO BE CONVINCED INFLATION IS STABILIZING

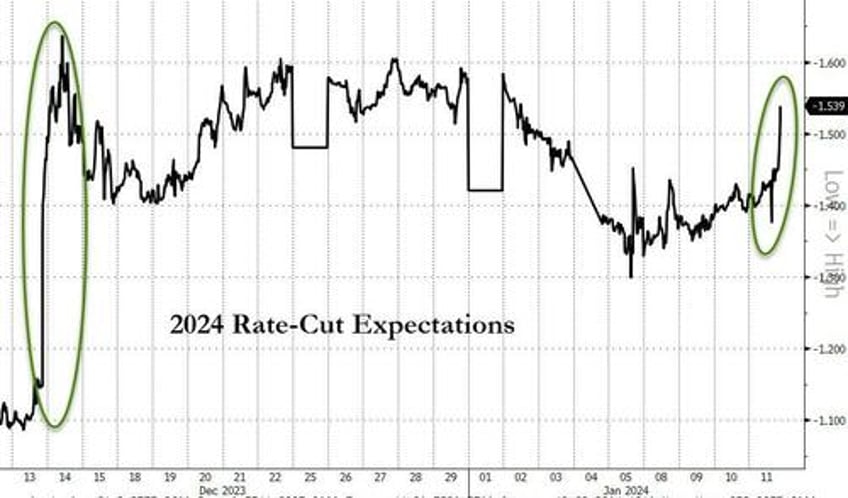

but, despite that and hotter CPI, rate-cut expectations soared (perhaps as traders look-ahead at higher frequency indicators of shelter, used-car costs slowing)...

Source: Bloomberg

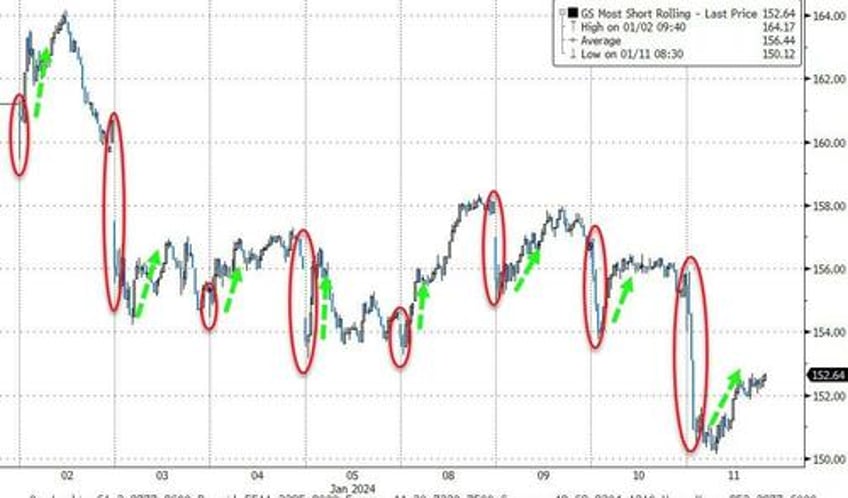

'Most Shorted' stocks were hammered lower today as once again (every day in 2024) they were hit at the open. Today, the squeeze back failed to impress...

Source: Bloomberg

'Magnificent 7' stocks spiked at the open, tumbled and then were bid back to unchanged by the close...

Source: Bloomberg

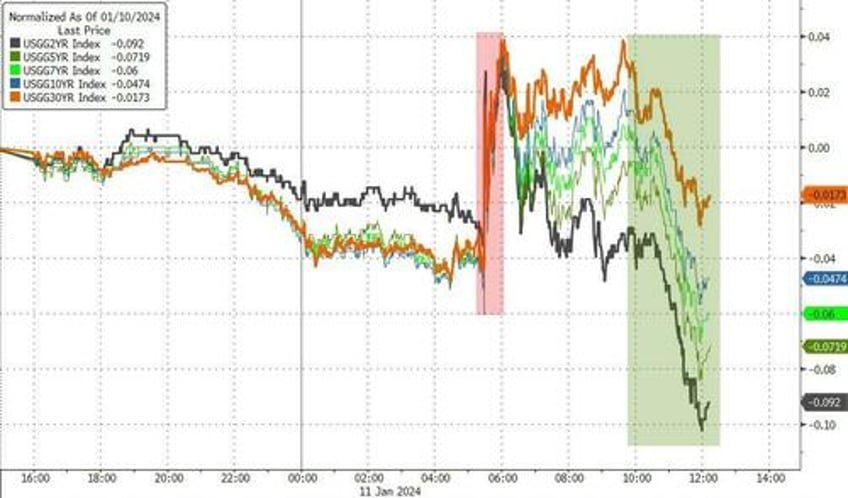

Treasury yields were all lower on the day - tumbling hard after the initial kneejerk higher on the hot CPI. The short-end of the curve dramatically outperformed...

Source: Bloomberg

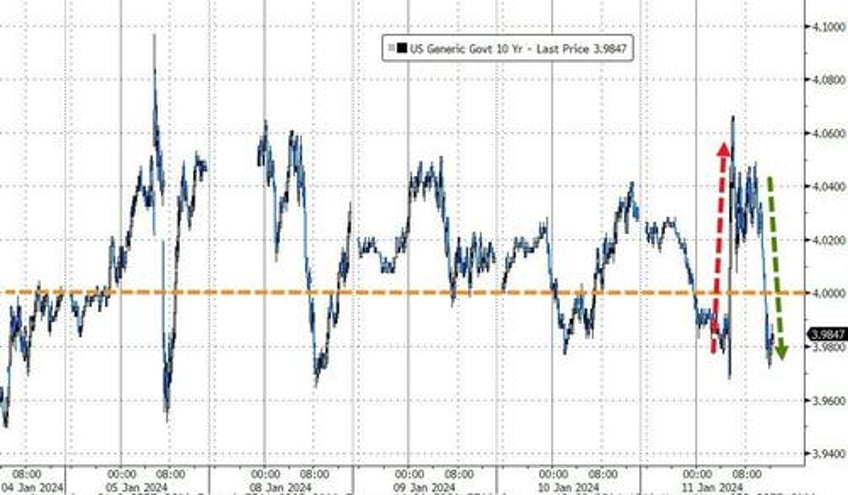

Once again all the action in 10Y pivoted around 4.00% - this time ending below it...

Source: Bloomberg

Massive yield-curve bull-steepening today lifted 2s30s to its least inverted since early November...

Source: Bloomberg

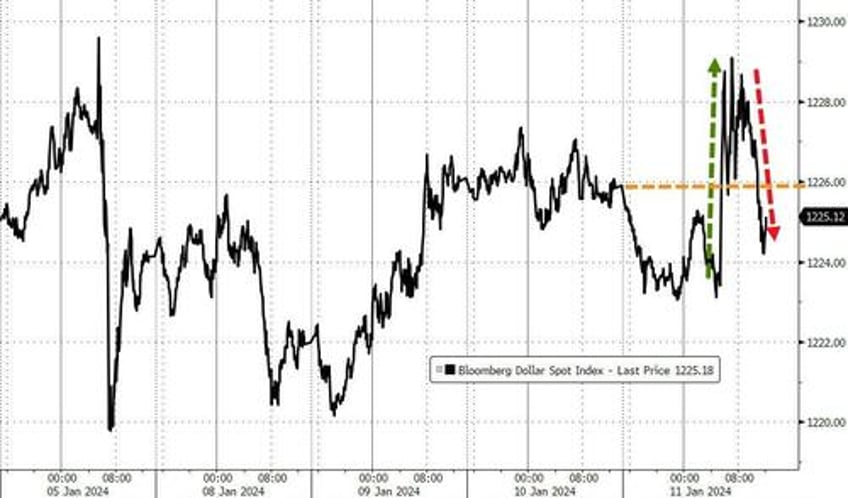

The dollar round-tripped on the day, ramping on the hit CPI then fading the rest of the day and ending lower...

Source: Bloomberg

Spot Gold prices tumbled back below $2020 on the hot CPI then bounced back (again)...

Source: Bloomberg

Oil prices managed to hold on to gains today with WTI falling back to $72 after nearing $74 (the top of its recent range)...

Source: Bloomberg

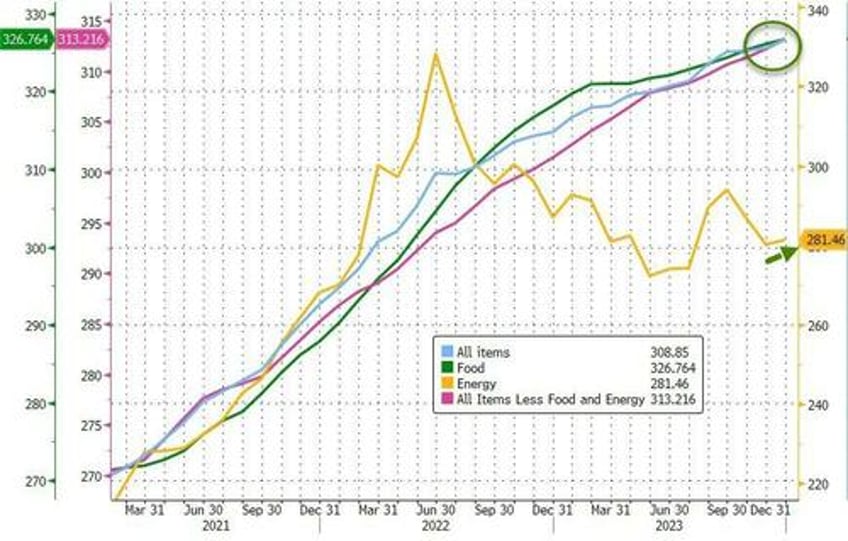

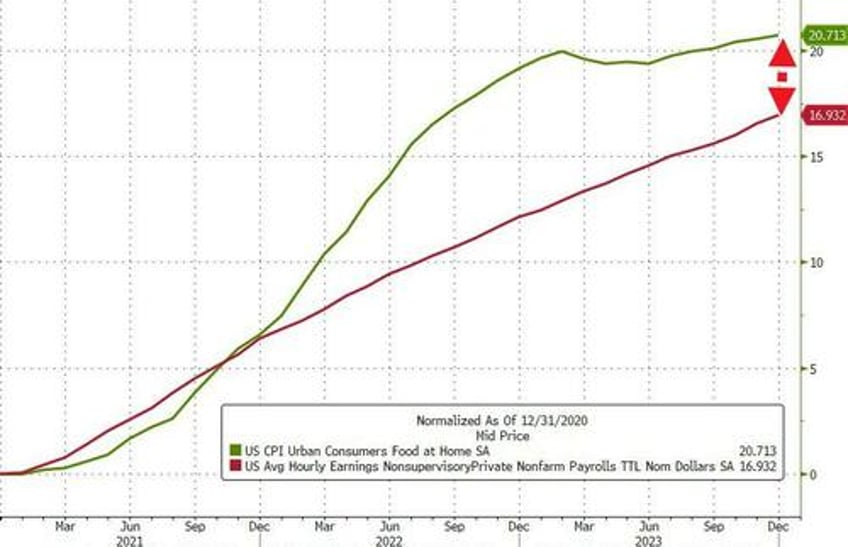

Finally, the price of stuff (CPI) - most notably food - has never - ever been higher than today...

Source: Bloomberg

...and, no matter what your politician tells you, the average joe is simply not keeping up in terms of wages...

Source: Bloomberg

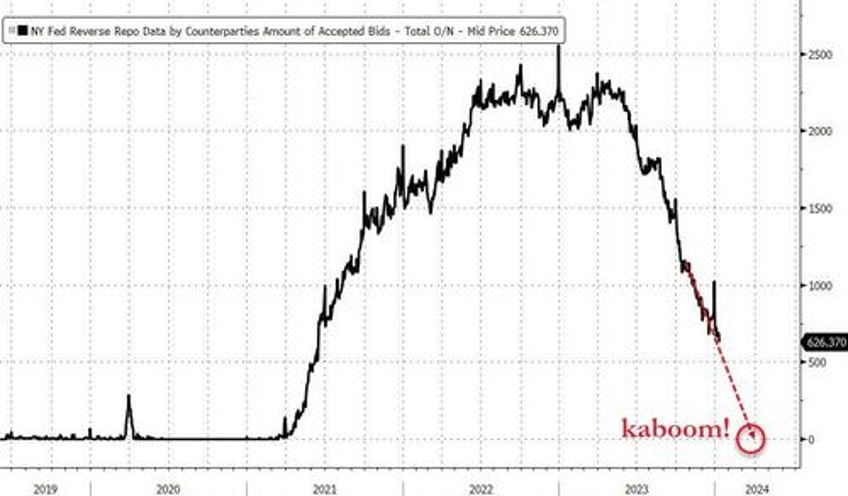

Additionally, The Fed's reverse repo facility was over $53BN withdrawn from it today to a new cycle low...

Source: Bloomberg

...tick tock for The Fed as the March expiry of BTFP (and a 'zero' RRP) mean QT has to taper, but can they do that without cutting rates?