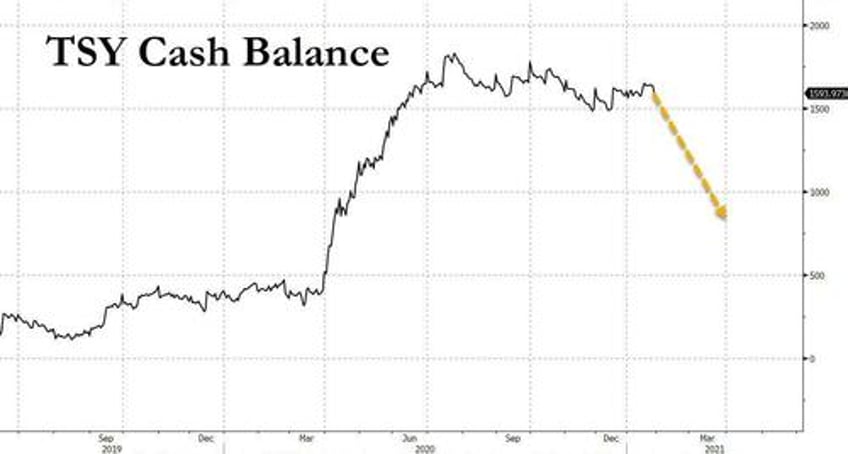

Back in February 2021, long before most had heard of the Treasury General Account or the Quarterly Refunding Statement, we were the first to point out - and correctly predict - how the Treasury's then near-record $1.1 trillion cash balance would serve as a liquidity tsunami as it was rapidly drawn down, boosting asset prices in parallel with the Fed's still massive QE, a unprecedented tidal wave of money which was the primary catalyst sending bitcoin from $10,000 in October 2020 to $$65,000 in April 2021.

Fast forward to last week when we pointed out something, if not quite as dramatic, then certainly comparable: while the Treasury projected a cash balance of $750BN at March 31 and then again at June 30 in its most recent quarterly Sources and Uses of funds forecast published in late January...