It has been a space in EVs that has been mostly ignored, especially since the auto market is drifting back toward hybrids...but now, eyes are starting to turn to charging for large electric trucks...

Spending is increasing for charging infrastructure, according to Bloomberg, who writes that "hundreds of millions of dollars" in grants awarded by both state and federal programs are being written.

For example, Greenlane Infrastructure LLC, a $675 million joint venture involving Daimler Truck North America, NextEra Energy, and a BlackRock fund, has begun construction on its flagship site for a 280-mile commercial charging corridor between Los Angeles and Las Vegas.

Additionally, the Bloomberg report states that TeraWatt Infrastructure Inc., backed by over $1 billion in funding, is building a heavy-duty charging network from California's Port of Long Beach to El Paso, Texas. WattEV, supported by Apollo Global Management and Vitol, currently operates several charging depots and has 15 more planned along the West Coast.

Erika Myers, executive director of Charging Interface Initiative North America said: “We’re seeing industry making bigger investments.”

She added that there's a lot of “excitement and enthusiasm for the development of electrification in the medium- and heavy-duty space.”

Electrifying medium- and heavy-duty trucks seems like an obvious solution for cutting emissions, as these vehicles make up just 5% of US road traffic but generate nearly a quarter of the transportation sector's greenhouse gases.

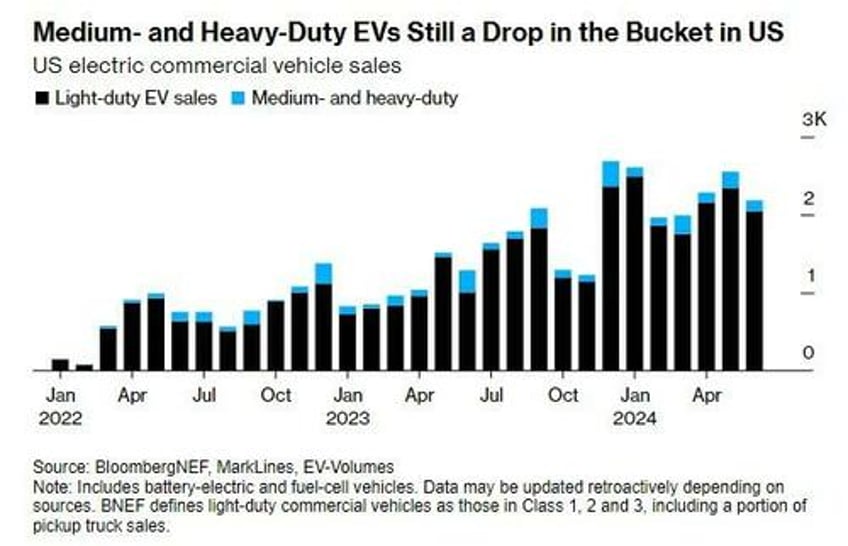

Yet adoption has been sluggish. BloombergNEF even labels the US a global “laggard” in decarbonizing its commercial fleets, with electric medium- and heavy-duty trucks accounting for only 6% of sales as of June and fewer than 1,000 sold in the first half of 2024.

Bloomberg calls the issue a "classic chicken-and-egg problem": manufacturers hesitate to produce electric trucks due to a lack of charging infrastructure, while infrastructure developers are reluctant to invest without a substantial EV fleet in place.

A strained power grid, high vehicle costs, and uncertain policy support—especially with the upcoming presidential election—further complicate the transition.

Recall days ago we wrote that EV semi prices still needed to fall between 30-50% to compete with diesel trucks, according to a new study.

Currently, less than 2% of the EU's heavy freight vehicles are electric or hydrogen-powered, but this must rise to 40% of new sales by 2030 to meet EU climate goals. Electric trucks cost 2.5-3 times more to produce than diesel ones, and logistics companies are reluctant to bear the higher costs, making this target challenging, the report says.

McKinsey suggests electric truck prices should be no more than 30% higher than diesel models, requiring major battery advancements.

Reuters writes that a 25% reduction in charging costs and 900,000 private charging points by 2035, needing a $20 billion investment, are also key to the EU’s CO2 strategy. Additionally, European truckmakers face competition from Chinese manufacturers, who have captured 20% of the bus market with cheaper products.