One month ago, when multiple discount retailers (here and here) were lamenting the sudden collapse in US consumer purchasing power, we highlighted the reason this unexpected hit to US consumption: as the US personal savings rate had collapsed, the growth in consumer credit was slowing, and in last month, the Fed reported that credit card debt growth posted its first decline since the covid crash.

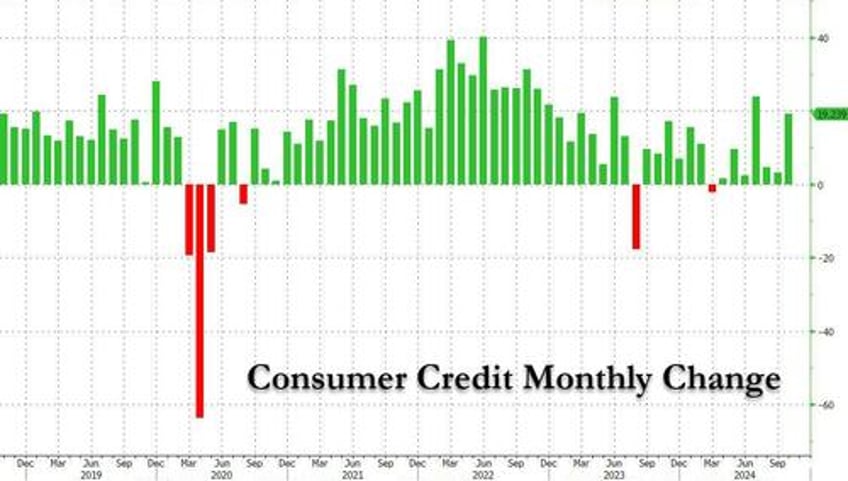

But fast forwarding just one month later, when in a striking reversal, October consumer credit growth unexpectedly reversed the dramatic September slowdown, and soared more than $19 billion, to a new record high of $5.084 trillion.

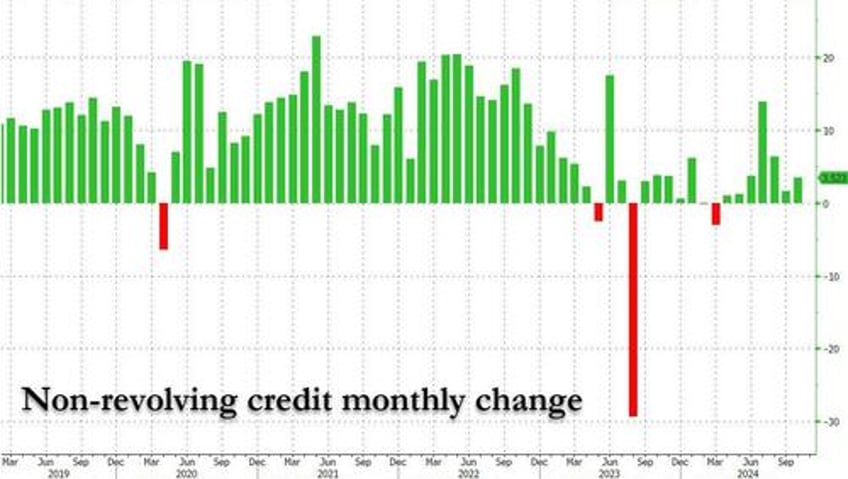

And while non-revolving credit - which is far less volatile and much more predictable - grew $3.5 billion, a bounce from last month's tiny $1.54 billion but a far cry from the $10+ billion average in the post-covid era...

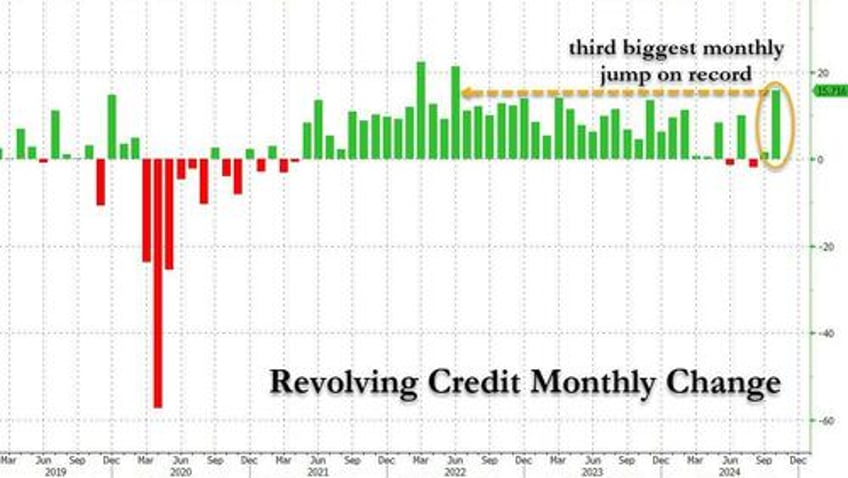

... the highlight was that the much more consumer-outlook sensitive revolving credit (i.e. credit card debt) exploded, and in October surged the most since the covid crash and was - amazingly - the third biggest monthly increase on record!

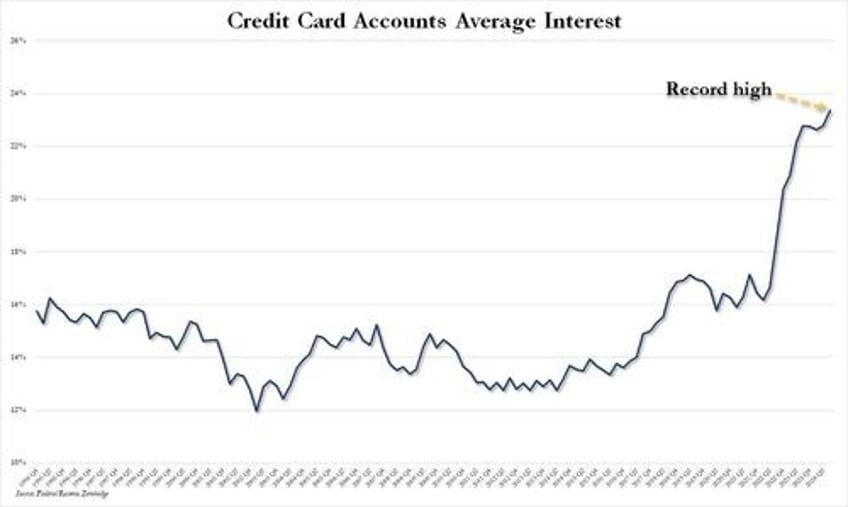

But what was truly remarkable about the latest consumer credit data, is what the Federal Reserve's own website said was the average APR on credit cards across the US. Readers may recall that in September, just after the Fed's jumbo rate cut - the first rate cut in years - we made a prediction that while rates on deposits and savings accounts immediately dropped, interest rates on debt - such as credit card APRs - will barely budge (if not keep rising).

Here's what happens next: savjngs account rates drop by 0.5% instantly while credit card APRs remain unchanged

— zerohedge (@zerohedge) September 18, 2024

Once again we were right, because three months later, the Fed admitted that despite its rate cut, the interest rate on credit cards at the end of Q3 - two weeks after the Fed cut rates - rose more than half a percent from average rate at the end of Q2, from 22.78% to 23.37%, a new all time high!

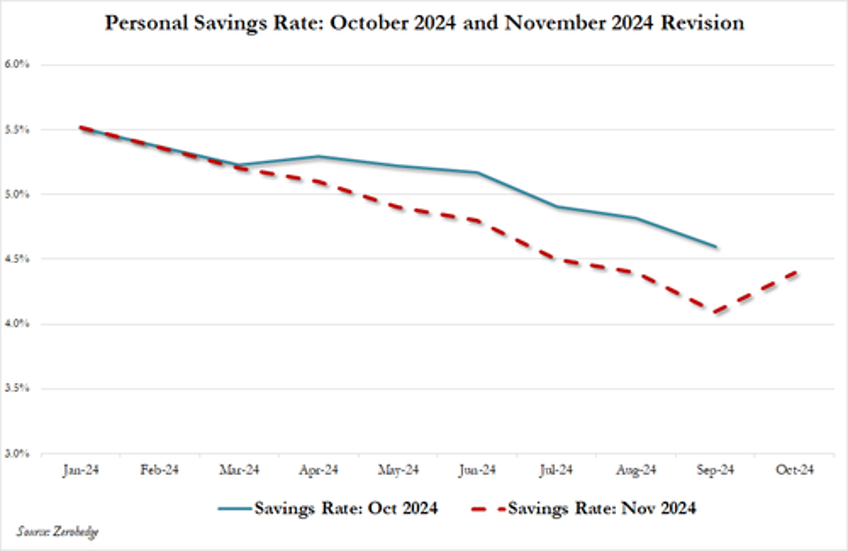

Finally, we remind readers of what we said last month namely that "we can stop pretending that the government's recent fabrication of savings data, which was upwardly "revised" from a record low 2.9% to a nice and balmy 4.8%, is even remotely credible." Sure enough, just a few days later we shoed that - with the election now over - the Biden Department of Commerce dramatically revised said data, and over $140 billion in "savings" were magically erased.

This collapse in savings explains why most US consumers are not only living paycheck to paycheck, but have maxed out both their Buy Now, Pay Later accounts and, as we now learn, their credit cards too as everyone braces for the moment when the US economy suddenly grinds to a halt and collapses under the weight of its own debt.