By Michael Msika, Bloomberg Markets Live reporter and strategist

In a market scaling record highs thanks to a steady stream of dovish central bank comments, investors are more concerned about catching the next leg higher rather than worrying over a pullback.

US and European stocks may be overbought, but the frenzied buying of large caps is pushing indexes to all-time highs. Comments from the Fed and ECB last week appeared very dovish, with the bond market indicating that June rate cuts are firmly on the agenda for both, even with another set of strong payroll data on Friday.

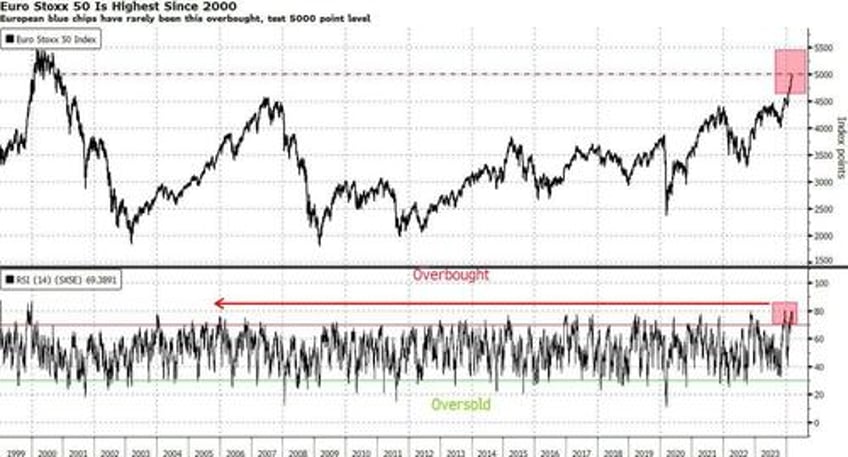

Technically, the picture is getting relatively stretched, and markets may not be able to go on like this without a pullback. “I am by no means bearish, but I think we will see some weakness in the coming weeks and months, even if we go a bit higher first,” says Thomas Hayes, chairman at Great Hill Capital.

Yet calling the top has become a very hard thing to do. The Euro Stoxx 50 has rarely been this overbought and is testing the 5,000 handle after hitting its highest since December 2000 last week.

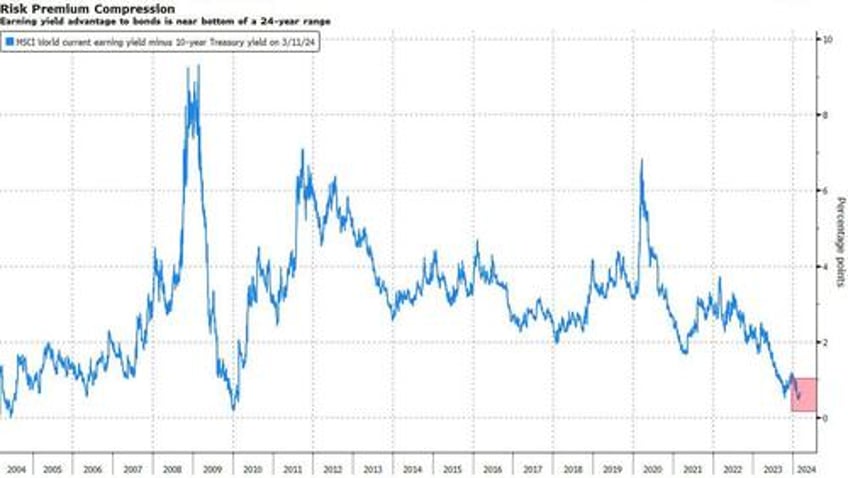

As valuations expand, equity risk premia have continued to compress — not just in the US but also globally — making stocks less and less attractive versus bonds. For the MSCI World, that premium has slipped to near the lowest of a 24-year range.

An improving economy and a slowing rate of inflation are making the case for bears a little harder. Exuberant positioning, stretched technicals and shaky earnings forecasts are among the few arguments left.

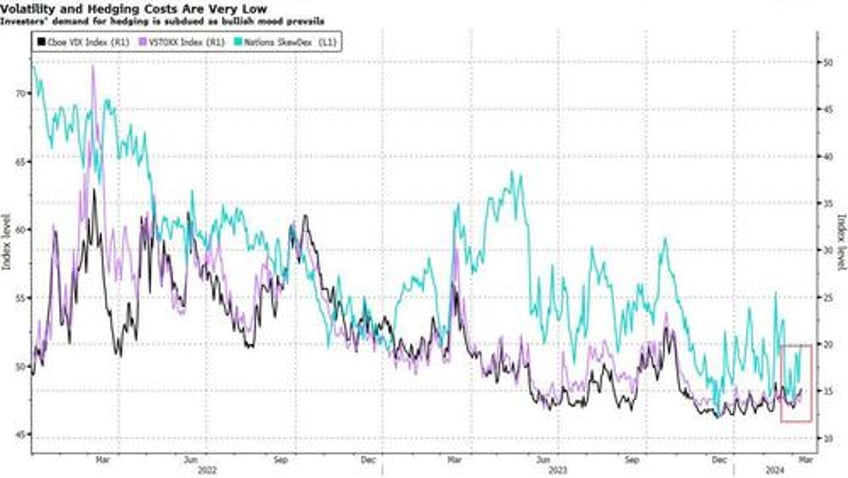

In this case, traders have been looking to protect themselves from what UBS strategists call “an extreme risk scenario” instead of a correction, by buying VIX upside calls. “Investors have largely thrown in the towel when it comes to buying downside protection in the index space,” UBS strategists including Maxwell Grinacoff said in a note.

The UBS team recommends what they call “the upside hedge,” which involves buying calls on the S&P 500 Index. “Given suppressed put activity and increased call activity, we believe dealers should theoretically be shorter gamma on the upside in the index space, while downside deformation should also be lower on an absolute basis.”

For Bank of America strategist Michael Hartnett, 2024 is a year of abnormal times and abnormal gains. The 25% rally in the last five months is typically only seen when markets emerged from recession lows like in 2009 and 2020, or at the start of bubbles, like in 1999. While the strategist sees the market “stretched and extended,” a history of bubbles shows it can go further. “Fed causes bubbles and Fed pops bubbles and in 2024 Fed’s determination to cut rates means we’re not too far from it,” he says.

According to Hartnett, it paid to be a “cynical bull” into 2024, and those in this camp are determined to stay long until the day before the Fed cuts rates, BofA’s Bull & Bear Indicator shows a sell signal, 10-year real rates exceed 2.5%, and the forward P/E of the S&P 500 exceeds 25. Until then, only a negative US payroll reading would be “likely to melt this determination,” he adds.

“The momentum of equities continues unabated, with still very low realized volatilities,” says Natixis strategist Emilie Tetard. “Outside the main risk scenarios — a strong macro slowdown or an inflation rebound disrupting expected monetary easing — risky assets will continue to trend upwards by default, at least until the focus on the US elections from the third quarter onwards.”