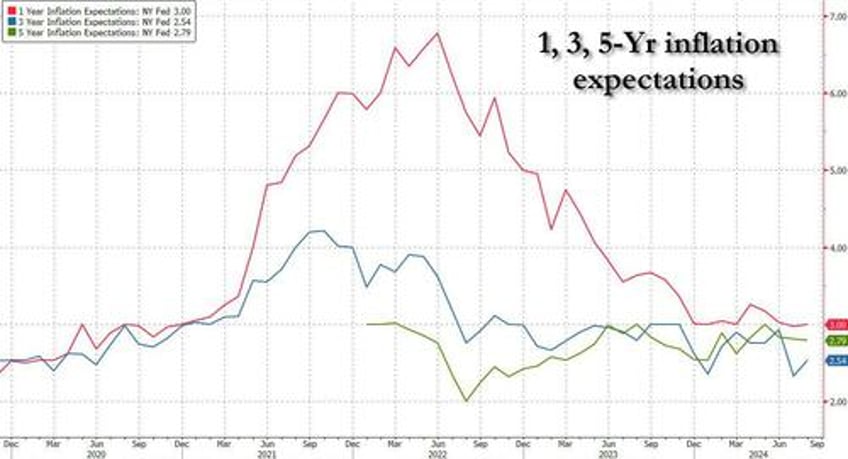

With the Fed now supposedly only focused on the jobs part of its mandate, as inflation has supposedly been tamed (even if it hasn't as we explained in "Powell Vows To Cut Rates With Stocks, Home Prices, Rents And Food At All Time Highs"), there is a growing risk that the Fed will be caught pants down launching an easing cycle just as inflation ramps up. An early warning of that eventuality came moments ago, when the NY Fed reported that in the month of August, while median inflation expectations at the one- and five-year horizons remained unchanged in August at 3.0% and 2.8%, respectively, the inflation expectations at the three-year horizon rebounded somewhat from the low July reading, increasing from 2.3% to 2.5%.

The survey also showed a growing amount of uncertainty in consumers’ inflation expectations. A measure of disagreement across respondents — the difference between the 25th and 75th percentile — increased at all time horizons, according to the report as those on the lower income scale are once again perceiving (correctly) that prices are rising.

Looking ahead five years, a quarter of consumers expect inflation to drop to zero or lower while another subset of respondents think inflation will double to 6% or higher. And at the one-year horizon, the 25th and 75th percentile spread has widened to the most in 15 months.

Also of note, the median home price growth expectations increased to 3.1% in August from 3.0% in July and the highest since May; expect this number to surge beyond its record highs in the low 6% if and when the Fed proceeds to slash rates over the coming years, sparking an even greater surge in home prices.

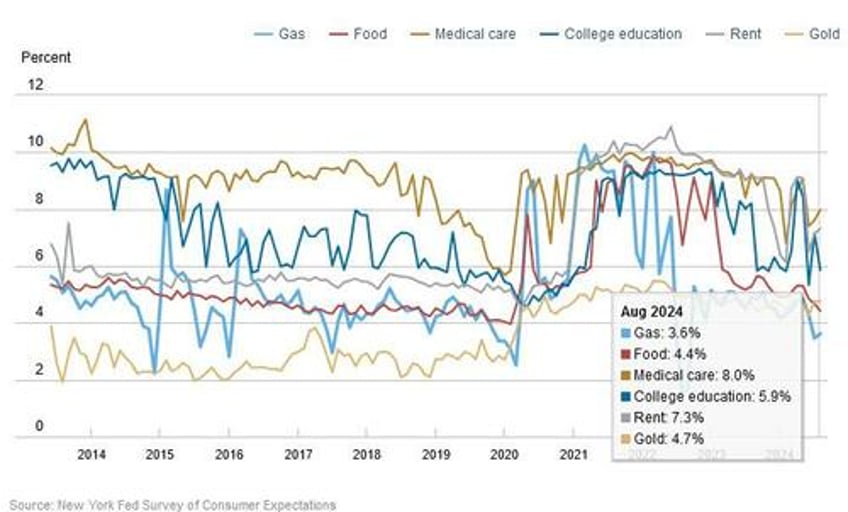

Elsewhere, median year-ahead expected price changes increased by 0.1 percentage point to 3.6% for gas, by 0.2 percentage point to 7.3% for rent, and 0.4 percentage point to 8.0% for medical care, but declined by 0.3 percentage point to 4.4% for food and 1.3 percentage points to 5.9% for the cost of a college education.

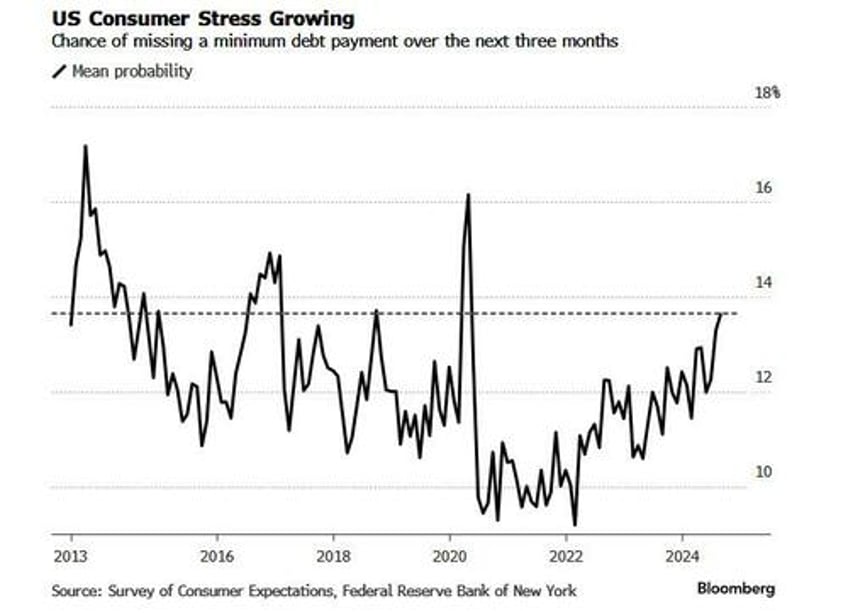

And while there was modest improvement in household income expectations, which rose by 0.1 percentage point to 3.1%, remaining within the narrow range of 3.0% to 3.1% the series has maintained for the past year, there was a very ominous increase in delinquency expectations which rose again, to the highest level since April 2020.

Perhaps tied to that, median household spending growth expectations increased by 0.1 percentage point to 5.0%. The series has moved within a narrow range of 4.9% to 5.2% since November 2023, remaining well above its February 2020 level of 3.1%. The problem, as we noted previously, is that it is unclear what will suspend this level of spending at time when the savings rate is at the lowest on record, while credit card debt has never been higher. Hence: surging delinquencies.

Savings rate record low; Credit card debt record high pic.twitter.com/ggmRlCvGcW

— zerohedge (@zerohedge) August 30, 2024

Labor market expectations were mixed, but largely stable; here are the details:

- Median one-year-ahead expected earnings growth increased to 2.9% from 2.7%, just above its 12-month trailing average of 2.8%. The increase was most pronounced for respondents in households with less than $50,000 annual income.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased to 37.7% from 36.6% in July.

- Amusingly, the mean perceived probability of losing one’s job in the next 12 months decreased by 1.0 percentage point to 13.3%, falling below the 12-month trailing average of 13.7%. Boy are people about to be disappointed.

- The mean probability of leaving one’s job voluntarily in the next 12 months also decreased, to 19.1% from 20.7%, falling slightly below the 12-month trailing average of 19.4%.

- The mean perceived probability of finding a job if one’s current job was lost decreased by 0.2 percentage point to 52.3%, remaining below the 12-month trailing average of 53.9% and well below its year-ago reading of 55.7%.

More in the full NY Fed report available to pro subs.