Inflation in Europe is showing signs of becoming entrenched, making it unlikely the ECB will be able to lower rates by as much as the Federal Reserve this year. Rates markets are currently pricing about the same amounts of cuts for both, leaving room for rapid repricing as the data rolls in.

As with many economies, the rapid decline in headline inflation in Europe has looked impressive.

But we are close to all the low-hanging fruit being eaten, leaving inflation prone to re-accelerating in the coming months.

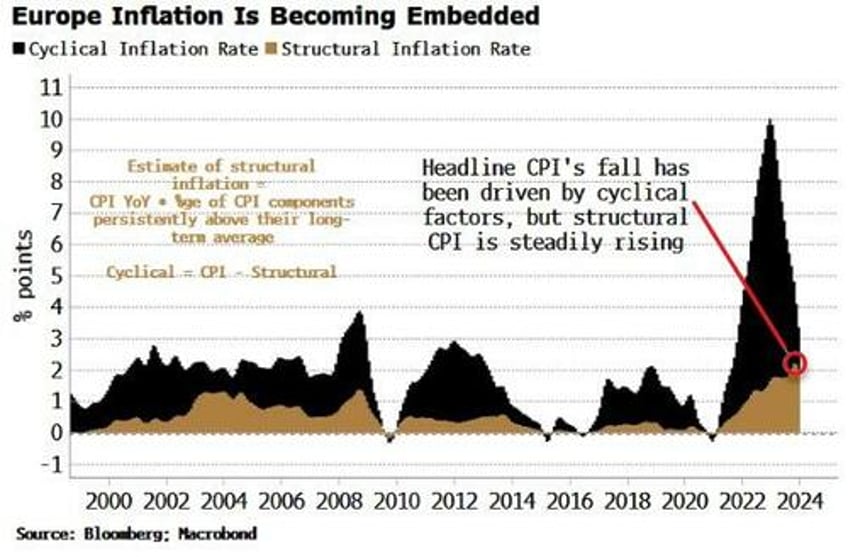

Europe’s disinflation has been driven by cyclical factors, e.g. oil and energy prices, but structural inflation has been rising, as can be seen in the chart below.

Structural CPI is defined as all those components in the basket that are persistently rising, with cyclical CPI what is left over.

The ECB is right to be concerned about wages, which are growing positively in real terms in Europe, as these are likely to be one of the sources of inflation that will be hard to shake. Another is profit margins, as firms are reluctant to completely reverse the rise in the mark-ups they took in the wake of the pandemic-driven surge in demand.

Cyclical inflation has already fallen a lot, but it is unlikely to keep doing so.

Leading indicators are pointing to rising oil-price growth in the next three-to-six months, which would reverse the cyclical CPI trend and reinforce already-rising structural CPI, boosting headline inflation.

China is another factor, with the growing chorus of easing measures continuing. A full-blooded recovery in China would boost growth in Europe that is already organically recovering, leading to further cyclical price pressures.

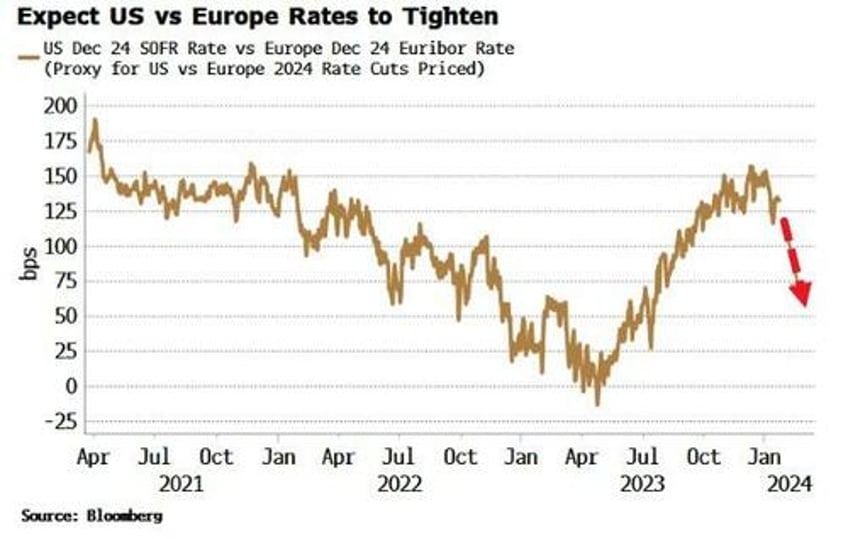

There are currently about five-and-a-half 25 bps cuts priced in for the ECB for 2024, similar to the Fed. But the European central bank is far less likely, on a relative basis, to meet this expectation.

For a start, the ECB’s deposit rate is 125 bps below the lower-end of the Fed’s target range. Secondly, the ECB’s only official mandate is inflation.

It will be easier for the Fed to cut rates – given it has stated a clear intention to do so – even if price growth is showing signs of rising again.

The ECB does not have the same flexibility if inflation is not behaving itself.

It’s likely the spread between rate cuts priced in for the Fed and the ECB for this year will narrow, i.e. the December 2024 Euribor contract will underperform the December 2024 SOFR contract (or using December Euribor and September SOFR so that contracts expire on same day).