Intel's disastrous second-quarter report has forced management to scramble for new strategies to rescue the sinking ship. With shares in freefall, sales plummeting, layoffs mounting, and the dividend suspended for the first time in decades, it's obvious the struggling chipmaker needs a major overhaul.

Bloomberg reports that Morgan Stanley and Goldman Sachs bankers are working with Intel to advise on several scenarios that could stop the market cap hemorrhaging, including a split of the chipmaker's product design and manufacturing businesses.

Morgan Stanley and Goldman Sachs Group Inc., Intel's longtime bankers, have been providing advice on the possibilities, which could also include potential M&A, the people said. The discussions have only grown more urgent since the Santa Clara, California-based company delivered a grim earnings report this month, which sent the shares plunging to their lowest level since 2013.

The various options are expected to be presented during a board meeting in September, the people said.

...

A potential separation or sale of Intel's foundry division, which is aimed at manufacturing chips for outside customers, would be an about-face for Chief Executive Officer Pat Gelsinger. Gelsinger has viewed the business as key to restoring Intel's standing among chipmakers and had hoped it would eventually compete with the likes of Taiwan Semiconductor Manufacturing Co., which pioneered the foundry industry. But it's more likely that Intel takes a less dramatic step before it reaches that point, such as holding off on some of its expansion plans, the people said.

Since Intel's advisors are exploring every possible option, have they considered this? It could be worth pitching to management at next month's board meeting.

Intel Is Said to Explore Options to Cope With Historic Slump: BBG https://t.co/AGB3k6ldxy

— zerohedge (@zerohedge) August 30, 2024

On Thursday, CEO Gelsinger told investors at the Deutsche Bank Technology Conference, "It's been a difficult few weeks." He noted that management tried to project a "clear view" of its next steps during its earnings report. He continued, "Obviously, the market didn't respond positively. We understand that."

In markets, Intel shares are up 3% to the high point of the $20 handle following the Bloomberg report. Shares are down 60% this year as the struggling chipmaker attempts a reboot.

Shares are currently at 2013 lows.

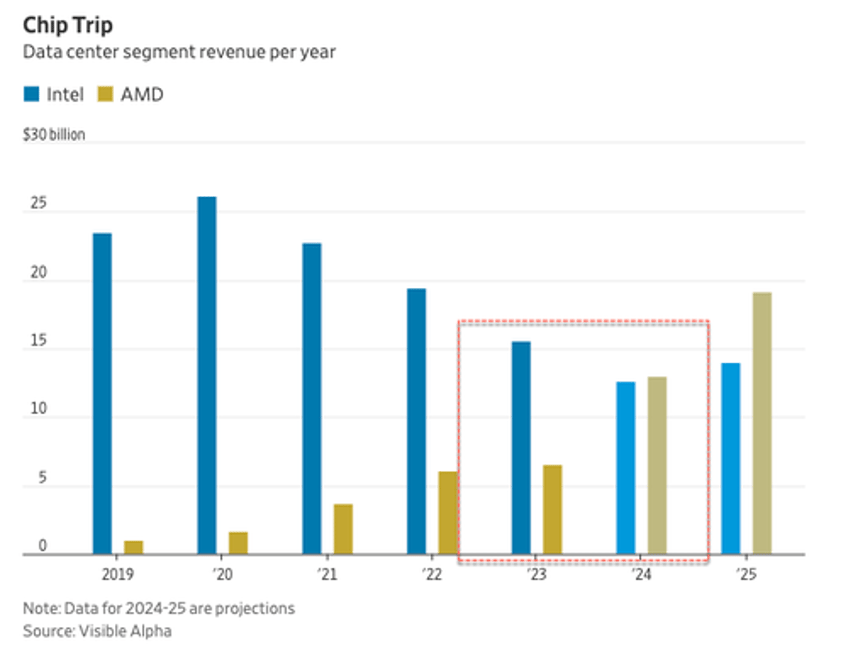

Intel's issue stems from its inability to read a rapidly shifting data center market to AI chips.

As for valuation, the Wall Street Journal recently pointed out, "Intel is also now trading below the company's book value for the first time since at least 1981, which is as far back as data from FactSet goes. This means investors are now valuing one of the world's largest chip manufacturers for less than the value of its facilities and other assets on its balance sheet."

Back to Bloomberg's report, Gelsinger's turnaround plan might split Intel into two divisions: one concentrated on chip design and the other on manufacturing. This would allow the production arm to increase business as a contract chipmaker.

Could this be a move to take on the world's largest contract chipmaker, Taiwan Semiconductor Manufacturing Company?