China's economic activity accelerated faster than some analysts expected in the fourth quarter of 2024 as stimulus measures worked their way into the real economy. However, the recovery remains murky, with Societe Generale SA economists Wei Yao and Michelle Lam cautioning clients, "The recovery is tentatively sustained in a still fragile mode."

Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, told clients, "The shift of policy stance in September last year helped the economy stabilize in Q4, but it requires large and persistent policy stimulus to boost economic momentum and sustain the recovery."

Friday's Chinese economic data dump comes just days before Donald Trump is set to be inaugurated as the next US president on Monday. Trump has pledged to impose additional tariffs of at least 10% on certain Chinese goods as part of his 'America First' agenda. He has also appointed prominent China hawks to key cabinet positions.

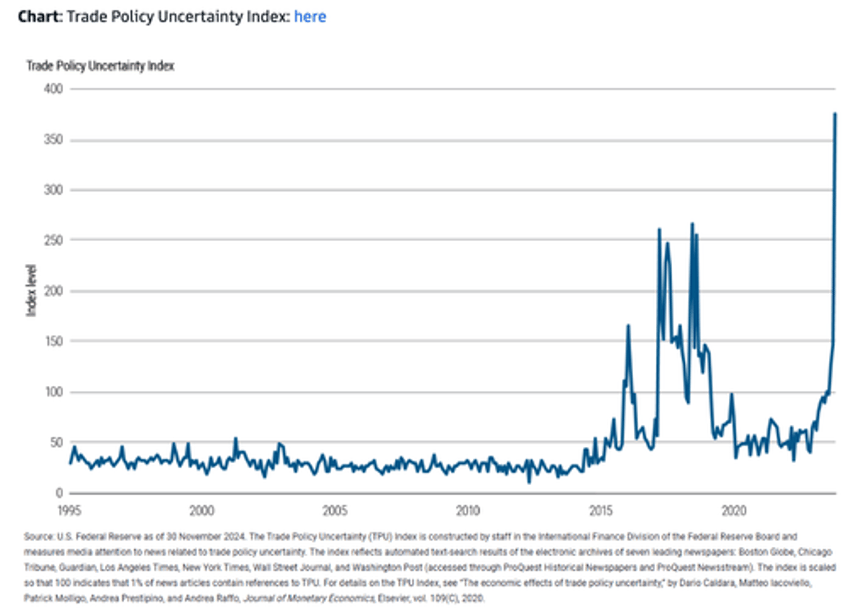

The re-emergence of a tit-for-tat trade war with China under Trump 2.0 has sent the Trade Policy Uncertainty Index, via Goldman, to record highs on data going back to the mid-1990s.

Given China's fragile recovery and mounting Sino-US trade uncertainties, Goldman Sachs published a note on Friday offering new insights into investor sentiment on China. This survey was conducted between Tuesday and Wednesday among top institutional investors who attended Goldman's 2025 Global Macro Conference Asia Pacific.

"Compared to early last year, when we had our 2024 Global Macro Conference, investors appear to be more downbeat on the Chinese medium-term growth outlook and reflation prospect," a team of Goldman analysts led by Hui Shan wrote in the note.

Here's the takeaway from the survey:

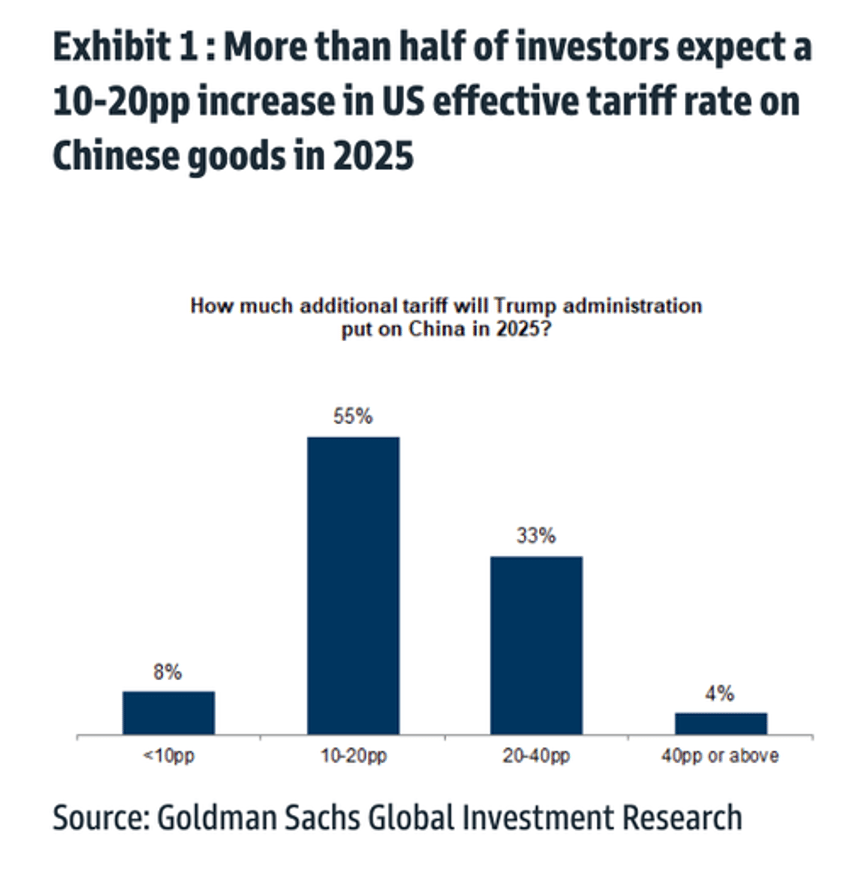

We held our 2025 Global Macro Conference Asia Pacific on January 14-15 in Hong Kong, during which we had two China-themed panels, met many domestic and global investors, and surveyed conference participants about their views on the Chinese economy, policy and markets. Compared to early last year, when we had our 2024 Global Macro Conference, investors appear to be more downbeat on the Chinese medium-term growth outlook and reflation prospect. On potential US tariffs on China, the modal expectation is a 10-20pp increase in effective tariff rate. Investors largely expect CNY to depreciate against the USD and the yield of the 10-year China Central Government Bond (CGB) to continue to decline. However, uncertainties are high and conviction is low for most conference participants. Frequently asked questions include how the Chinese government may respond to US tariff increases, "Two Sessions" expectations, PBOC's balancing act between loosening monetary policy and stabilizing USDCNY, the outlook for the property market, and how China can boost consumption and rebalance its economy away from investment and manufacturing in the coming years.

The survey also asked investors about their views and outlook on the Chinese economy, policy, and markets.

Here's additional color on those results:

More than half of surveyed clients expect a 10-20pp increase in US effective tariff rate on Chinese goods in 2025, while one-third expect a 20-40pp tariff hike (Exhibit 1). In our baseline scenario, we assume a 20pp increase in US effective tariff rate on Chinese goods this year and estimate this would reduce China's GDP by 0.7pp.

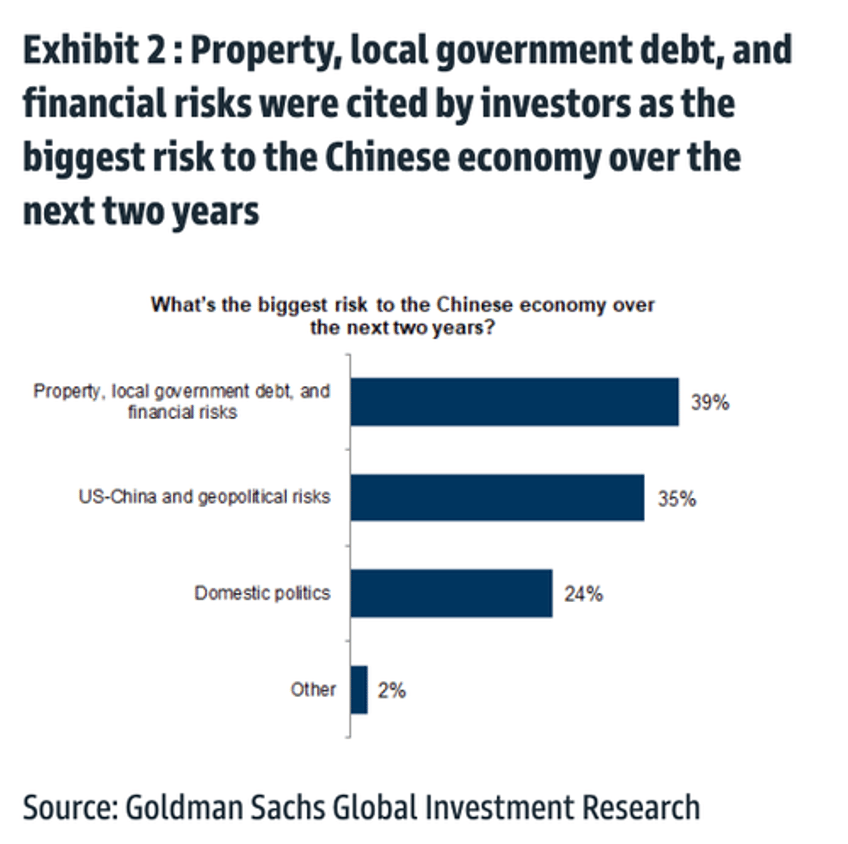

Most investors think the key problem with the Chinese economy lies in domestic factors rather than external factors. When asked about the largest risk to China in the next two years, around two-thirds of the participants chose domestic issues (property, local government debt, and financial risks; domestic politics) whereas one-third of investors pointed to external factors (US-China tensions and geopolitics; Exhibit 2).

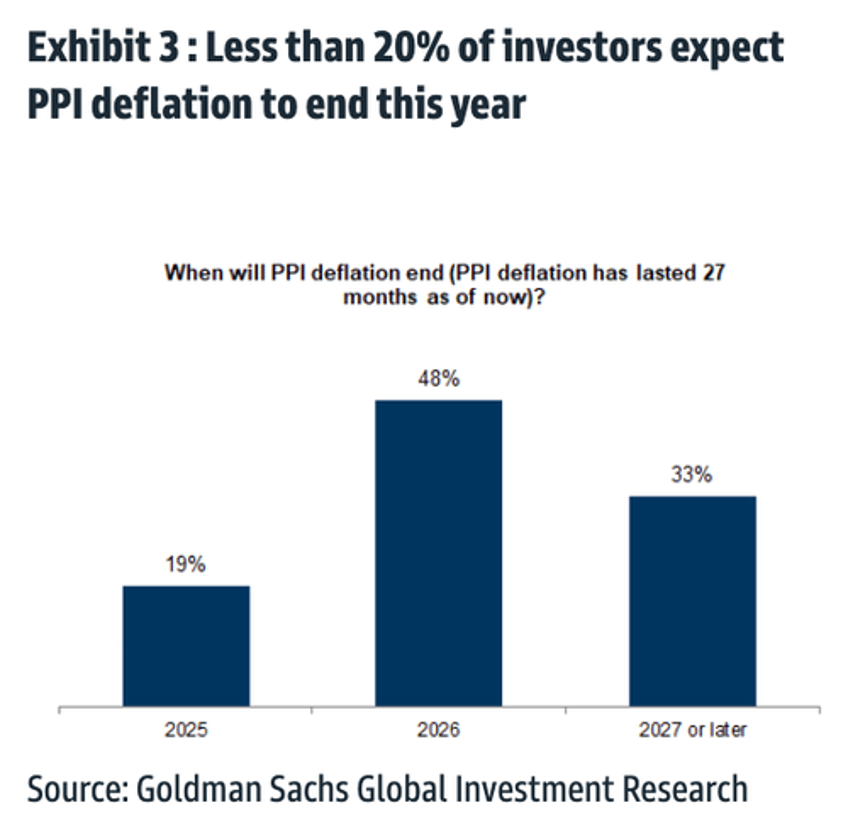

Investors believe China's reflation process will be lengthy. Less than 20% of the investors expect PPI deflation to end in 2025, while 33% think PPI inflation will only turn positive in 2027 or later (Exhibit 3).

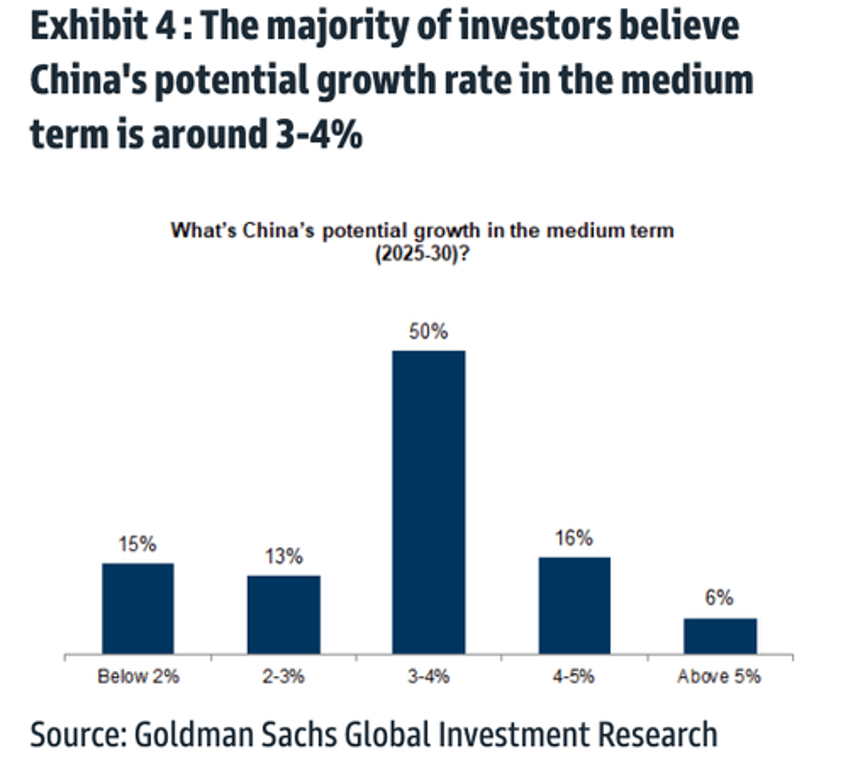

The majority of investors believe China's potential growth rate in the medium-term (2025-30) is in a range of 3-4% (Exhibit 4), implying an "around 5%" growth target would be above China's current trend growth. This is also in line with our baseline estimates (around 4% trend growth in recent years).

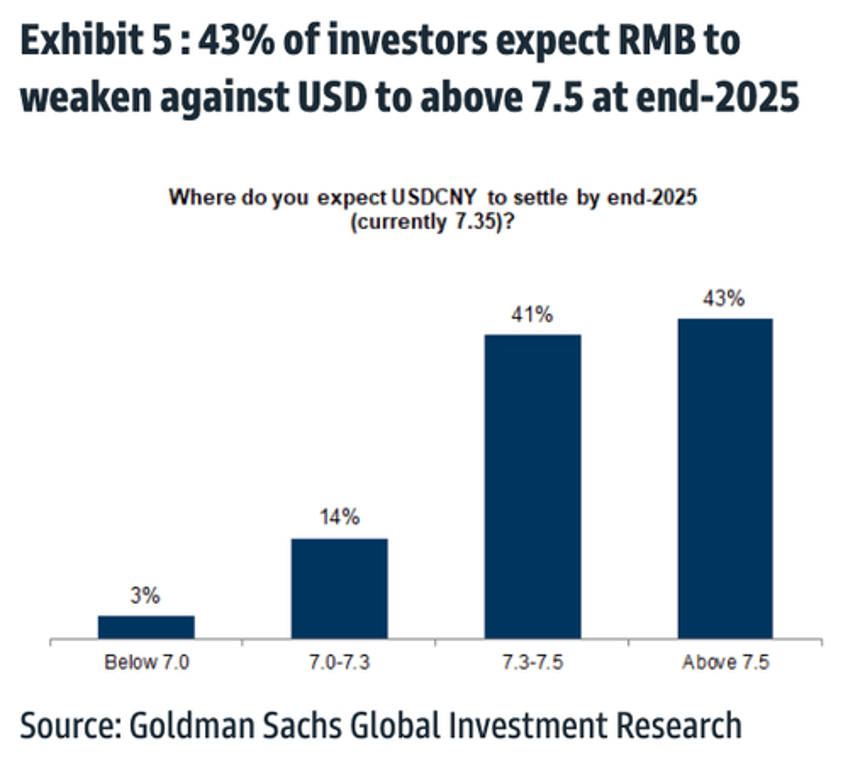

Most investors expect CNY to weaken against USD from the current level, with 43% expecting USDCNY to go above 7.5 at end-2025 (Exhibit 5; vs. GS 3/6/12m forecasts for USDCNY: 7.4/7.5/7.5).

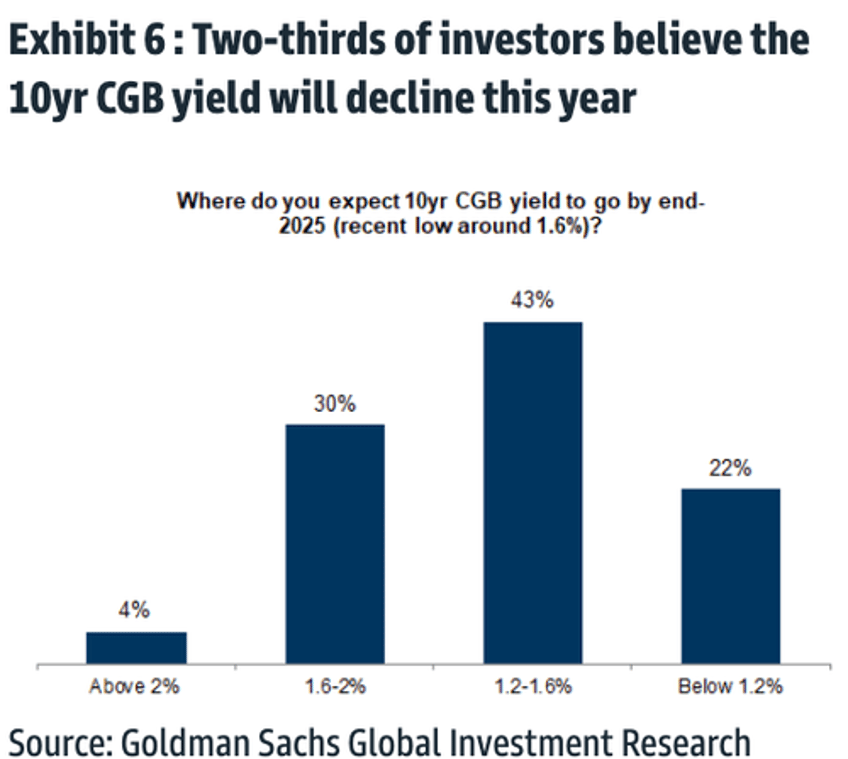

Two-thirds of the surveyed investors think the 10yr CGB yield will be below 1.6% at end-2025 (Exhibit 6), broadly in line with our view that China rates may remain low for longer.

The analysts noted that outside of the survey polls, some of the most asked questions by investors were on the incoming trade war, the Chinese government's responses, deflationary pressures and industrial sector production overcapacity, potential ways for the government to support the labor market, consumer confidence and household consumption, potential path for the property sector stabilization, coordination between monetary and fiscal policies, expectations for CGB yields and RMB exchange rates, the ongoing growth driver rotation and China's Japanification risk.

Meanwhile, the analysts noted, "Overall, client interest in China-related topics is high, but conviction on policy implementation, demand recovery and tariff impact on China is low."