Cathie Wood appears to be doing what she does best: buying the 'dip' in an overvalued market, socking away aggressively valued companies that have a knack for plunging far further than market indexes on selloffs.

The ARKK fund manager is buying shares of Amazon.com Inc., Advanced Micro Devices Inc. and Roku Inc. amidst the recent market volatility, Bloomberg reported this week.

But ARKK closed at its lowest levels since November and at YTD lows on Wednesday, amidst the volatility, while the NASDAQ was still in green territory for the year, the report says. Wood's flagship 'innovation' fund is down about -24% YTD versus the QQQ, which is up about 6.8%, as of Thursday mid-morning.

That's a pretty noticeable underperformance for just 8 months into the year. And investors seem to be taking note: about 75% of ARKK's value from 2021 has been wiped away and, as of Tuesday, investors have withdrawn $2.2 billion from ARKK in 2024, setting it up for its worst year of outflows since its 2014 inception, Bloomberg writes.

Overall, Cathie Wood's seven active ETFs have experienced $11.5 billion in outflows since early 2021, according to Strategas data.

Todd Sohn, an ETF strategist at Strategas said: “The past few years, really, have been a challenge. Ark has a history of high-conviction, concentrated investing via their ETFs — there’s a tendency for the team to use sharp market selloffs as an opportunity to add long exposure to their strongest ideas.”

The only problem? Many would argue a quick snapback from all time highs may not be a "sharp market selloff".

In late May, Zero Hedge contributor Quoth the Raven was quick to criticize Cathie Wood blaming a 'great depression' for her poor performance - all before the recent volatility even took place.

Post-Tesla's 2020 surge, QTR argued that Wood's fund has been dead money: "Since then, Wood’s ARKK flagship fund has been dead money when compared to its NASDAQ benchmark. One by one, investors have watched other investments that Wood has made alongside Tesla get decimated.

For example, the “visionary” tech investor made a strategic decision to hold off and miss the surge in Nvidia — literally the hottest name in tech the last 2 years — while riding names like Invitae and Ginkgo Bioworks into bankruptcy and the toilet, respectively."

"To compound her dreadful numbers, Wood has offered up bizarre, hallucinogenic price targets, unbridled optimism about her own performance going forward that, in my opinion, has been very misleading, and bursts of macro-sounding non-sequiturs as excuses," he wrote.

In May with the market sitting at all-time highs—Wood claimed markets were experiencing "a search for cash and safety."

In fact, she said the search for safety at the beginning of the summer had been "as intense as that during the Great Depression in the early 1930s."

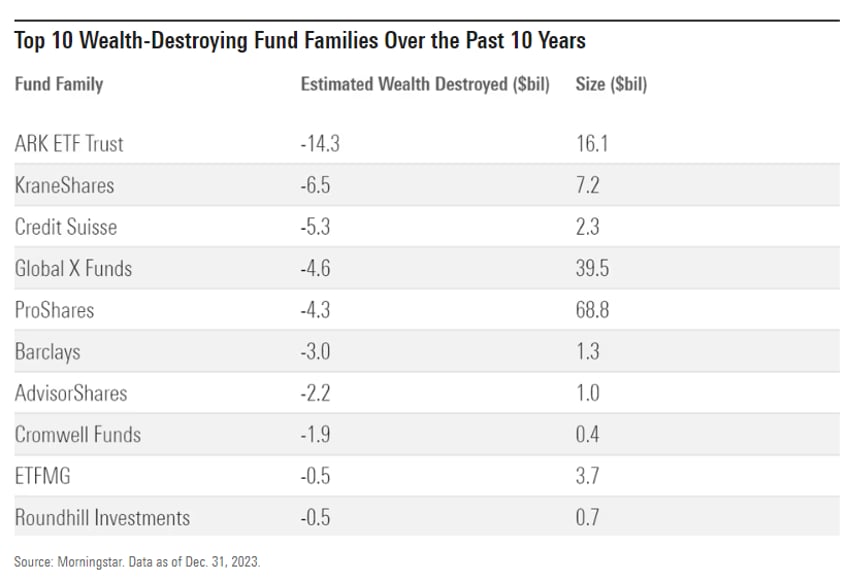

Back in February, Morningstar listed her as one of the top 15 funds that have destroyed the most wealth over the past decade and said the ARK family of funds had wiped out $14.3 billion in shareholder value.

ARK, home of the flagship ARK Innovation ETF ARKK, tops the list for value destruction. After garnering huge asset flows in 2020 and 2021 (totaling an estimated $29.2 billion), its funds were decimated in the 2022 bear market, with losses ranging from 34.1% to 67.5% for the year. Many of its funds enjoyed a strong rebound in 2023, but that wasn’t enough to offset their previous losses. As a result, the ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period—more than twice as much as the second-worst fund family on the list. ARK Innovation alone accounts for about $7.1 billion of value destruction over the trailing 10-year period.

Wood was top of the heap in wealth-destroying: