By Philip Marey, Senior US Strategist at Rabobank

Is the inflation dragon really dead?

Markets are a bit cautious as we are heading for the weekend. US stock markets declined yesterday and the 10 year US treasury yield moved up and down in an attempt to find direction. In the end it was down. China’s finance minister will give a fiscal policy briefing on Saturday. Markets are expecting Beijing to announce 2 trillion to 3 trillion yuan ($280-$420 billion) in new spending and worries about whether it will deliver. Meanwhile, the Middle East is still waiting for Israel’s retaliation against Iran. On the bright side, this morning monthly UK GDP growth turned positive (0.2%) again in August, after two months of zero growth.

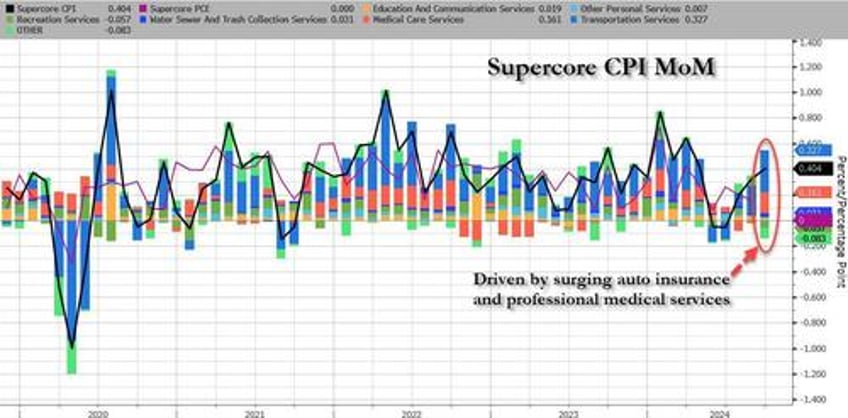

Yesterday, the US CPI figures were higher than expected: headline inflation fell to 2.4% (2.3% expected by the Bloomberg consensus) and core inflation even rebounded to 3.3% (expected unchanged at 3.2%). The month-on-month rates were also higher than anticipated. The headline continued to rise at 0.2%, in contrast to an expected slowdown to 0.1%. The core kept rising at 0.3%, instead of slowing down to 0.2% as foreseen by the consensus. Looking inside the core, services-less-rent-of-shelter inflation rebounded from 4.3% to 4.4% and showed a strong acceleration from 0.1% to 0.6% month-on-month. This is the part of the core that is supposed to be most closely related to wage growth and should be affected by the Fed’s attempts to bring the labor market in better balance. In the minutes of the September 17-18 meeting released on Wednesday, some participants had proudly noted that “the rate of increase in core nonhousing services prices had moved down further.” Well, think again. On the bright side, shelter inflation fell from 5.2% to 4.9% and eased in month-on-month terms from 0.5% to 0.2%. Nevertheless, core inflation still seems a bit sticky.

In contrast, the initial jobless claims for the first week of October rose to 258K from 225K a week earlier. A big jump, but a large part of this seems to be weather-related. There were large percentage increases in Southeastern states such as North Carolina, South Carolina, Florida and Tennessee that were hammered by Hurricane Helene. Therefore, the Fed will look through it. Instead, for the labor market the picture drawn by the Employment Report will prevail: strong employment growth, a decline in unemployment, and stronger average hourly earnings growth. So to summarize, September saw a strong labor market, a rebound in core inflation…. and a 50 bps cut by the Fed.

Nevertheless, three Fed speakers remain convinced that inflation is heading in the right direction and the FOMC can continue to cut rates. John Williams (New York Fed) said that “Month to month, there’s wiggles and bumps in the data, but we’ve seen this pretty steady process of inflation moving downward … I expect that that will continue.” He also said that he thought it would be appropriate to “continue the process of moving the stance of monetary policy to a more neutral setting over time.” Austan Goolsbee (Chicago Fed) said “the overall trend for inflation over 12 to 18 months was clearly moving down.” Thomas Barkin (Richmond Fed), said inflation was “definitely headed in the right direction.” In contrast to these three, Raphael Bostic (Atlanta Fed) said “I am totally comfortable with skipping a meeting if the data suggests that’s appropriate.” He also revealed that his September projections would imply one more 25 bps cut this year, after the 50 in September.

Yesterday French prime minister Michel Barnier presented the 2025 budget. Given the dire state of France’s public finances, it was closely watched. Our France watcher Erik-Jan van Harn notes that beforehand Barnier warned that without intervention next year’s deficit could swell to 7% of GDP. Swift action is thus needed so Barnier presented plans to reduce the deficit by EUR60bn next year, around 2% of GDP. The package includes a combination of broad spending cuts and tax rises on big corporations and affluent individuals.

Even though these plans are quite detailed, prime minister Barnier stressed that the budget draft is a starting point for lawmakers. He welcomes any amendments to the plans provided they don't undermine the budget's integrity. However, this openness raises the concern that certain secure cost-saving measures or revenue boosts might be swapped for overly optimistic proposals. Moreover, this open stance clearly shows that Barnier lacks a parliamentary majority. His government relies on opposition backing, which remains uncertain. Chances are that Barnier will have to significantly water down his proposals or that he will face another vote of no confidence.

Consequently, we don’t believe that this budget will take away the market’s worries. Rating agencies are likely to look at this in a similar fashion. Fitch, who currently rates France as AA- with a stable outlook having downgraded the country one notch in April 2023, will review France’s rating after market’s close on October 11.

Our Rates Strategy team notes that it is likely that this review will lead to a downgrade. As of the end of June, the agency saw French budget deficits standing at 5.1% of GDP in 2024 and 4.2% over the ensuing two years. It also warned that a political paralysis risked the introduction of expansionary items into the country’s budget plan in order to ensure its approval whilst also limiting the scope for fiscal consolidation. Given the risks already highlighted by the agency and the comparatively optimistic nature of its earlier projections, we see a rating downgrade as likely. While clearly not a positive from a spread perspective we believe that the market is already largely pricing for such a move. For more details, please read Erik-Jan’s report on the French budget.