Market observers have been puzzled by Warren Buffett's Berkshire Hathaway's abrupt selling of billions of dollars of its long-held stake in Bank of America since mid-July.

Buffett's stock dumps could be driven by looming recession threats and the Federal Reserve's interest rate-cutting cycle, which could begin as early as mid-September and dent the bank's interest earnings. Or perhaps the 94-year-old billionaire has increased cash reserves to record levels because of elevated stock valuations amid the artificial intelligence bubble.

Whatever keeps Buffett up at night about BofA has certainly been intriguing across institutional desks, FinTwit X, and various financial media outlets. Some believe this could be a critical market inflection point. Since mid-July, the billionaire has trimmed about 13% of its BofA stake, generating $5.4 billion in proceeds...

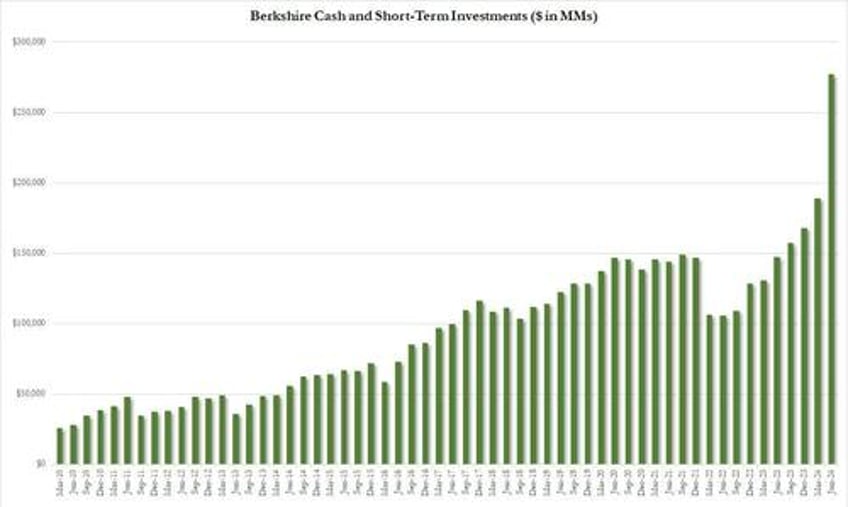

... and adding to Berkshire's record cash holdings.

The billionaire has remained silent about the stock dumps. Bloomberg noted Buffett sold an additional $982 million worth of stock earlier this week.

Another potential reason for Buffett's sudden stock selling could be the fear that a US regulatory probe into anti-money laundering surrounding fentanyl cash laundering at Toronto-Dominion Bank could be expanded to major US banks.

In a conversation with Sam Cooper, an investigative journalist behind the Substack "The Bureau," and David Asher, a former senior investigator for the State Department, Asher revealed, "And most of what we're seeing is coming from this TD Bank case, and there's a lot more. We'll see which one of the big four US banks gets named next."