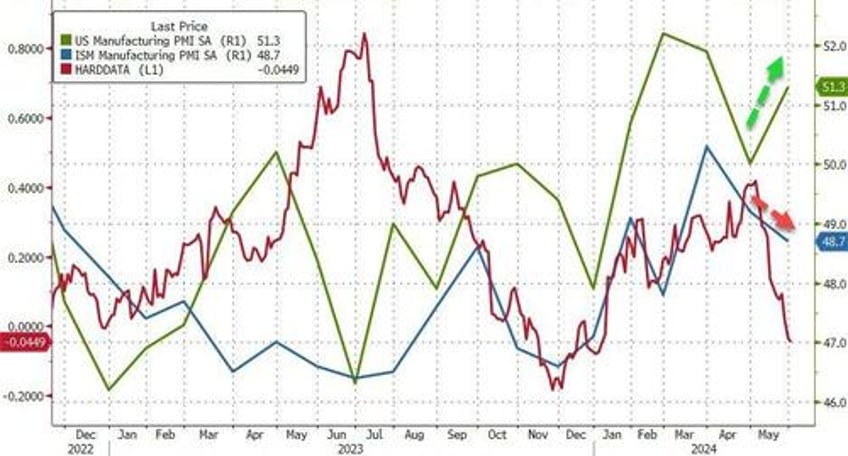

With 'hard' data plunging in May, it is surprising that S&P Global's flash survey of Manufacturing sentiment showed an uptick. Today we get the final print, with many asking will it catch down to ISM's drop.. and will the ISM drop extend...

Sure enough - despite the plunge in real data - S&P Global's Manufacturing PMI survey showed an even stronger improvement from 50.0 final in April to 50.9 flash for May to 51.3 final for May.

However, ISM's Manufacturing PMI tumbled further - dropping from 49.2 to 48.7 versus expectations for a small rise to 49.6. This tied the lowest forecast among analysts.

Source: Bloomberg

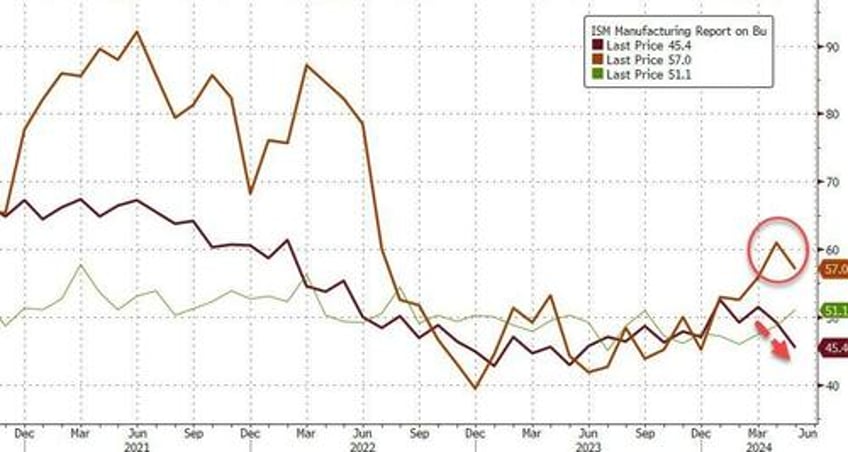

The ISM survey showed new orders declining at their fastest rate since Dec 2023 and Prices Paid down a smidge but well above the last 18 months levels...

Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“It was pleasing to see new orders return to growth in May following a blip in April. Although modest, the expansion in new work bodes well for production in the coming months.

In fact, manufacturers cited confidence in the future as a factor contributing to increases in employment, purchasing activity and finished goods stocks.

But...

“Cost pressures continued to build, however, with inflation on that front the strongest in just over a year.

Although output prices rose at a slower pace in May, this is unlikely to be sustainable should cost burdens ramp up further in the months ahead.”

So hard data crashed, inflation expectations surged... not exactly the 'data-dependence' that dovsh Fed members are hoping to see.