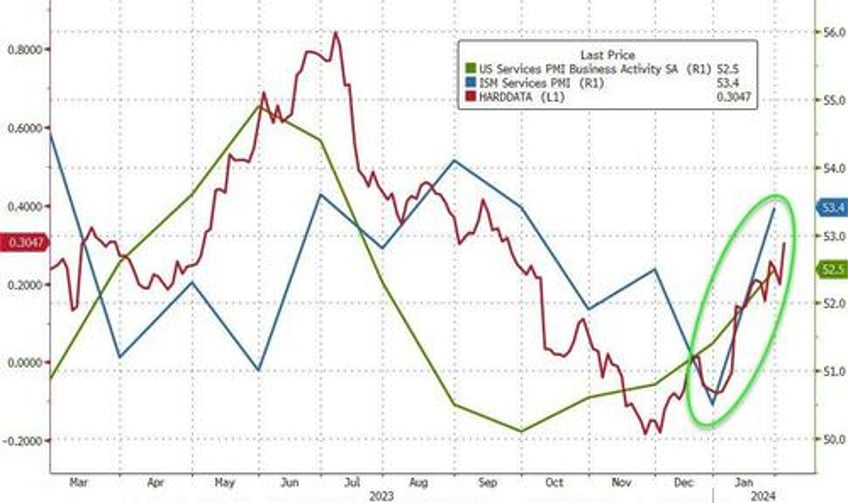

Following Manufacturing surveys' surge in January (both S&P Global and PMI), Services surveys were both expected to rise also in January, tracking the rise in 'hard' data recently.

S&P Global's ISM Services survey rose from 51.4 in December to 52.5 (final) in January (but declined from the 52.9 flash print for January). That is still the highest Services print since June 2023.

ISM's Services survey jumped from 50.5 to 53.4, well above the 52.0 expected. This is the highest Services PMI since October.

Source: Bloomberg

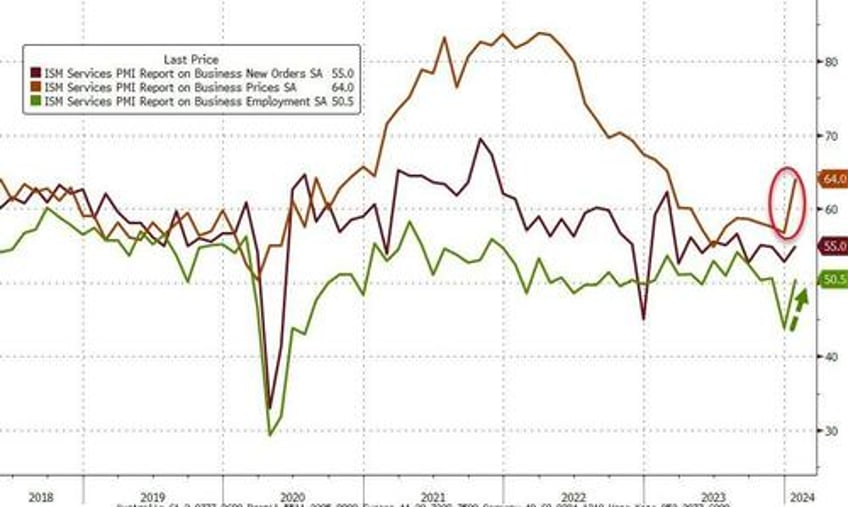

Employment rebounded strongly. New Oreders picked up, but prices exploded higher...

Source: Bloomberg

That's the biggest MoM jump in ISM Services Prices since 2012!

Here's why:

“Transportation impacts of the Suez Canal, due to unrest in the Red Sea and the issues at the Panama Canal are impacting both costs and schedules for the transport of global goods.” [Construction]

So that's bad - but if you prefer to ignore it, here's what S&P Global thinks about prices!:

"Price pressures have meanwhile shifted lower. Overall service sector input cost growth is now running at the second-lowest for over three years, helping pull selling price growth across goods and services down to a level consistent with inflation dropping materially below the Federal Reserve's 2% target in the near future."

So either prices are at their second lower in three years or at their highest in a year!

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

"The US service sector started the year in a sweet spot, with output and demand growth accelerating while price pressures cooled markedly.

The key driver of faster growth was the financial services sector, where looser financial conditions tied to expectations of lower interest rates spurred greater activity in January.

Households are also benefitting from loosened financial conditions, driving renewed growth in consumer-facing services.

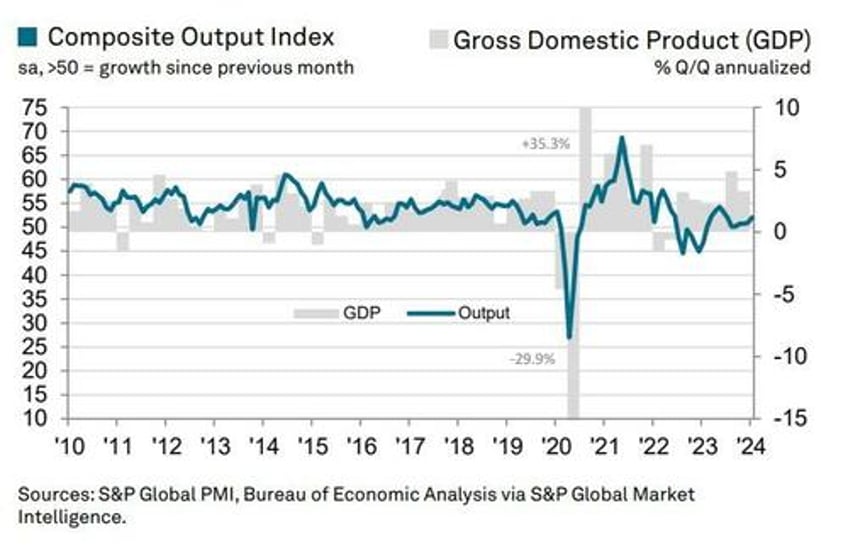

The US Composite index rose from 50.9 to 52.0 (less than the 52.3 flash print though) with Services expansion trumping Manufacturing weakness:

"The buoyancy of the service sector has outweighed a further lackluster performance in manufacturing, and is driving overall output higher at a rate broadly consistent with GDP rising at a 2% pace.

With bad weather having curbed some economic activity in January, February should see some further improvement in overall performance.

Finally, Williamson notes that "business optimism about growth prospects in the service sector has likewise jumped higher, encouraging further payroll growth, albeit the latter limited by labor shortages. "

But here's a PMI respondent's view:

“Most companies I work with are gearing up for a tough 2024. Some may be overreacting, but there is a general sense that election years in the U.S. result in unrest, which is causing everyone to be conservative with spend.” [Professional, Scientific & Technical Services]

Stronger growth and no price pressure - not exactly a recipe for cutting rates?