After the disappointing Manufacturing survey data, the signals from the Services side are not great either - even as 'hard' data has improved.

S&P Global's Services PMI dropped to a five month low at 51.3 (better than the expected/flash at 50.9, but still falling).

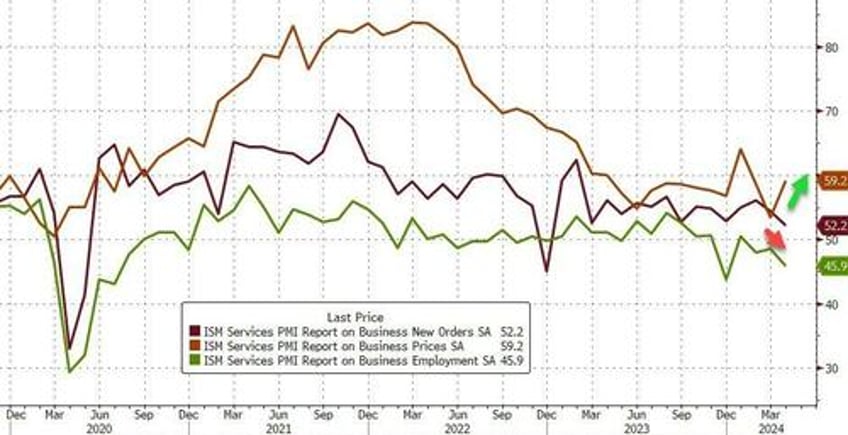

ISM Services PMI was worse, tumbling to 49.4 (from 51.4 and expected to rise to 52.0) - the weakest print (and first contraction) since Dec 2022

Source: Bloomberg

Under the hood was worse with Prices Paid rebounding strongly while New Orders and Employment both slowed...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

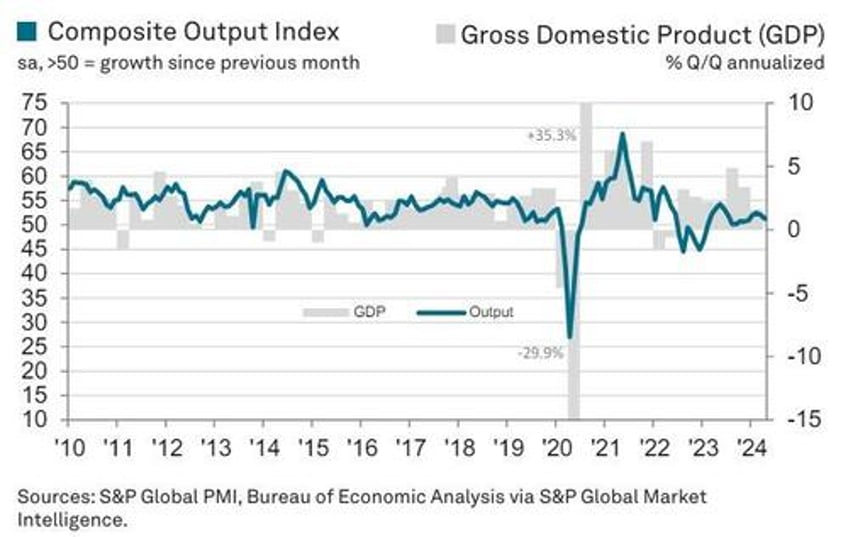

"Service sector growth slowed in April to point to a sluggish start to the second quarter for the US economy. Alongside a concomitant cooling in the rate of growth of manufacturing output, the weaker service sector performance means overall business activity grew in April at the slowest rate seen so far this year. At current levels, the PMI indicates that GDP is expanding at a modest annualized rate of approximately 1.5% so far in the second quarter.

"Demand has weakened, as signaled by the first fall in new orders for goods and services for six months, in part a reflection of both businesses and households adjusting to higher costs and the prospect of higher for longer interest rates.

Business optimism has likewise cooled, dropping to the lowest since November, and companies are taking a more cautious approach to staffing levels."

So Prices Paid UP, Orders DOWN, Optimism COOLED