Italy's right-wing populist government surprised European markets on Monday night with a new tax on bank profits limited to fiscal year 2023. The country's lenders plunged in Milan trading, wiping out billions of euros in market capitalization.

Italian Deputy Prime Minister Matteo Salvini told a press conference that the 40% tax on banks' 'extra profits' derived from higher interest rates amounts to billions of euros that will help fund working families hit by the worst cost-of-living crisis in a generation, including support for mortgages for first-time owners and tax cuts.

Bloomberg reported that Italy's cabinet approved the new tax:

Government to apply 40% levy on highest amount between net interest income of 2022 and 2021 — when the difference exceeds 5%, or on difference in net interest income between 2023 and 2021 — with a floor of 10%

Levy to be paid in 2024

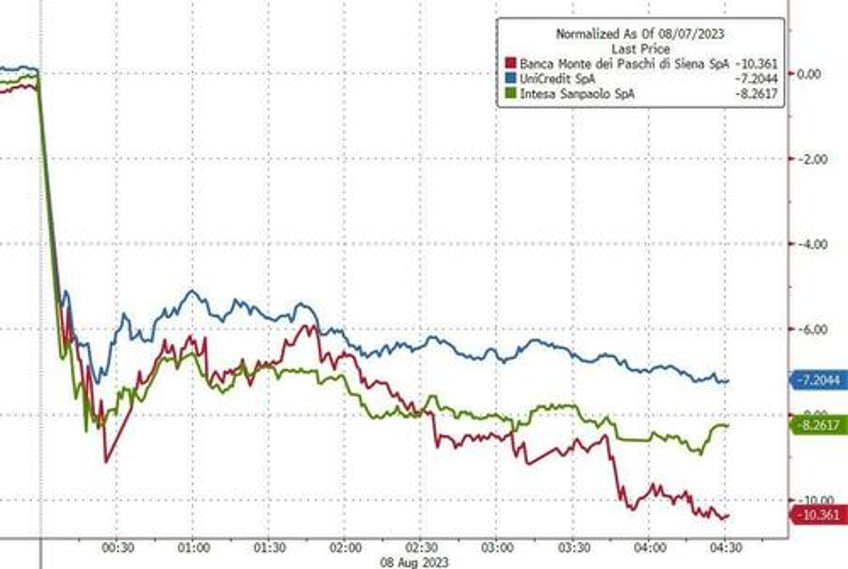

As a result, Italian banks were the worst performers compared to European stocks. UniCredit SpA dropped 7%, and Intesa Sanpaolo SpA sank 8%.

Even though Italy's cabinet approved a proposal to introduce a tax on banks' profits, it's still subjected to approval by parliament -- and can still be challenged in the courts.

"The move comes shortly after Italian banks unveiled a bumper set of earnings with Intesa and Unicredit raising their full-year guidance for the second consecutive quarter on the back of the European Central Bank's rapid policy tightening. Net interest income at UniCredit, for example, surged 42% in the first half," Bloomberg said.

Commentary by Wall Street analysts overwhelmingly said the news is a strong headwind for the banking sector (list courtesy of Bloomberg):

Citi, Azzurra Guelfi

Sees this tax as substantially negative for banks given both impact on capital and profit as well as for the cost of equity of bank shares

Introduction of this tax could lead to Italian banks increasing their cost of deposits in order to reduce the extra profit

Based on data available at this stage, calculates one-off tax is equal to ~19% of banks net profit in 2023

Banca Akros, Luigi Tramontana

According to initial estimate, the one-off tax is expected to generate over €2b tax income for the government

Estimates an average impact of 7% on the EPS of Italian banks under coverage and a negative reaction of market prices to this unexpected bad news

Deutsche Bank, Giovanni Razzoli

Italy's government approved a decree which includes "to our and probably investors' surprise" a taxation in the form of a levy on banks

While most details are not yet available, the move will likely trigger a short-term selloff on Italian banks

Mediobanca, Andrea Filtri

Measure comes as a surprise and will hit share prices today, especially for those banks with "pending top-up to shareholder remuneration, as such Intesa and Banco BPM"

With the level of UniCredit's CET1 ratio at 16.6%, the bank would be in a position to withstand both the levy and the announced share buyback, even in a worse scenario

Equita, Andrea Lisi

News is "clearly negative" for the sector, not only because of the one-off impact but also because of the increased regulatory risk on the sector

Estimates Paschi to be the most impacted name, while in light of lower top line growth and/or greater diversification of revenue mix, sees restrained impact for Mediobanca, asset gatherers and specialty finance firms

Bloomberg Intelligence

Calculates Italy lenders' 2023 net income could be cut ~10% by proposed extraordinary tax on their "extra profits" this year

There's a risk the tax could be extended beyond 2023, despite lenders' net interest income peaking

From Banco BPM to UniCredit, Italian banks' net income 2023 estimates had risen 36% in the past six months

Financials weigh around 30% in the Italian stock market -- the surprise announcement is a fresh headwind for European stocks. Backlash for the cost of living crisis is growing.