On December 13 the financial world was stunned when, just two weeks after Jerome Powell had said he it was "premature" to speculate on rate cuts, the Federal Reserve did a shocking U-turn and pivoted dovishly, ending the Fed's hiking cycle with inflation still running at double the Fed's target of 2%, and said that it had in fact discussed the start of rate cuts, contrary to what Powell said just two weeks earlier.

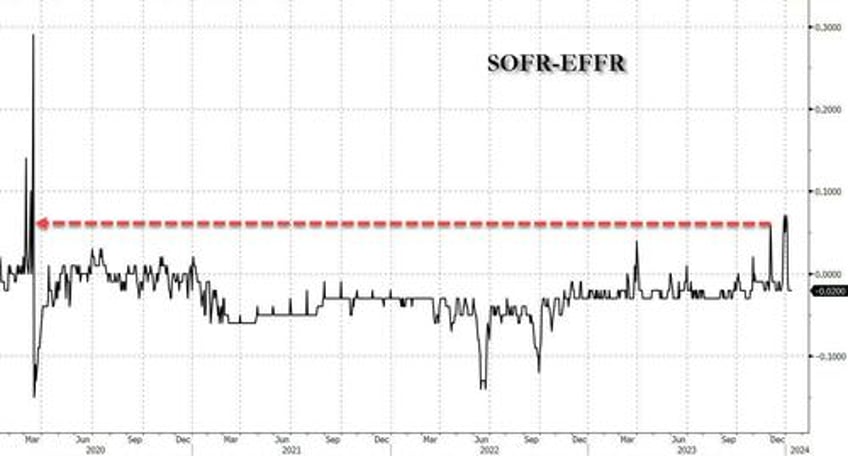

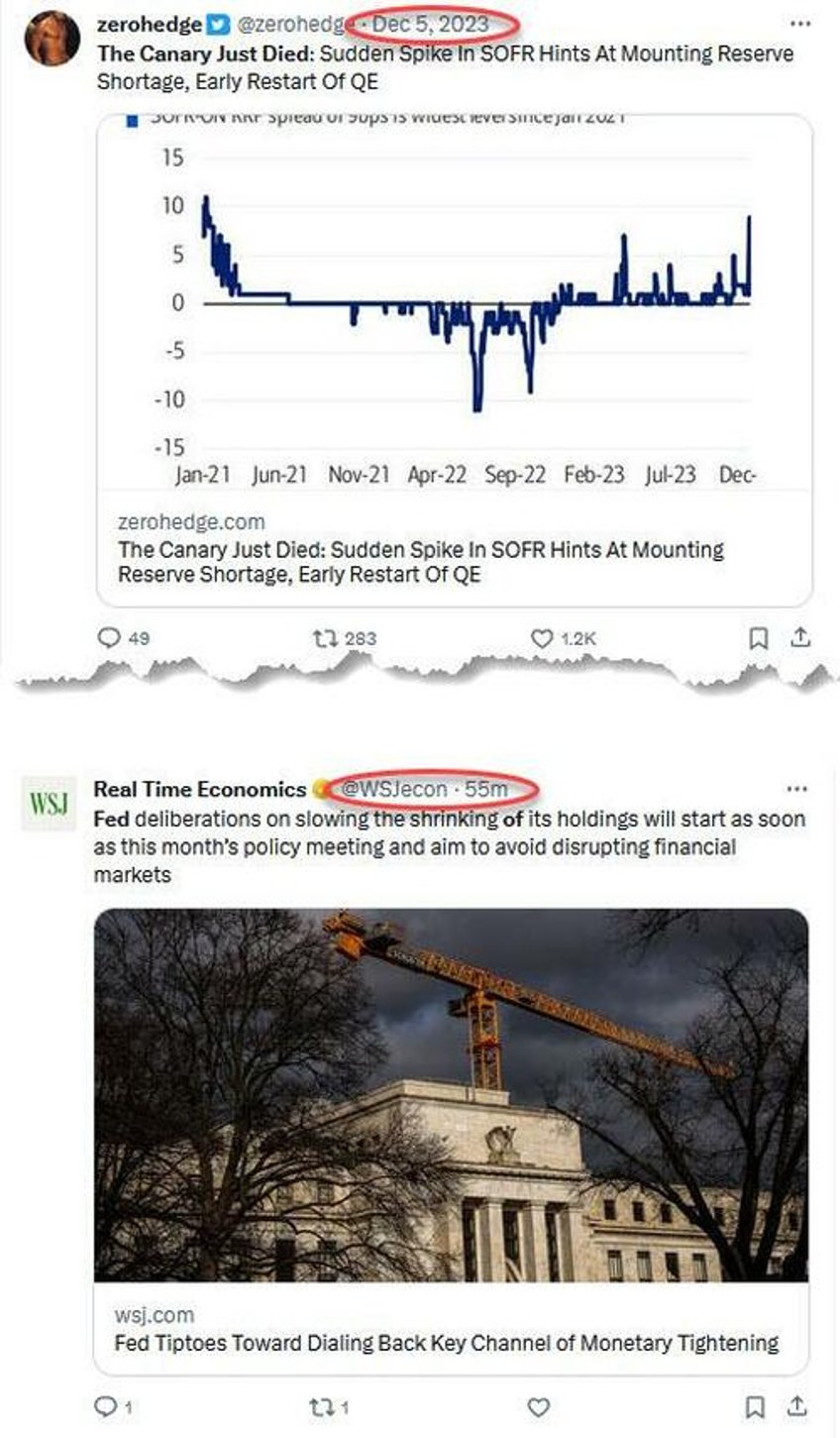

Or rather, we should say "the financial world that had not read Zero Hedge was stunned" because just one week ahead of the Fed's December FOMC meeting, we correctly predicted the Fed's pivot due to one simple reason: as we laid out in "The Canary Just Died: Sudden Spike In SOFR Hints At Mounting Reserve Shortage, Early Restart Of QE", the Fed no longer had a choice and was forced to pursue a dovish pivot because the liquidity in the all-important systemic and interbank plumbing had hit dangerously low levels, resulting in the highest SOFR print on record, and the biggest spike since the last time there was a repo market crisis in March 2020.

As we said at the time, "the spike caught almost everyone by surprise, even such Fed-watching luminaries as BofA's Marc Cabana because it was with "no new UST settlements, lower repo volumes, and lower sponsored bi-lateral volumes." And yet, the spike was clearly there and ominously it was consistent "with the slow theme of less cash & more collateral in the system" - i.e., growing reserve scarcity - and "may have been exacerbated by elevated dealer inventories, bi-lateral borrowing need, and limited excess cash to backstop repo."

And the punchline: "If funding pressure persists, it risks Fed re-assessment of ample banking system reserves & potential early end to QT", and depending on how bad the funding shortage gets, an early restart of QE.

One week later, the Fed capitulated on tight monetary policy and ushered in the era of rate cuts, just as we said it would. But more importantly, one month later it was Dallas Fed president (and former head of the NY Fed's plunge protection team) Lorie Logan who said the quiet part out loud when she confirmed our "canary in the coalmine" note, namely that the Fed's QT is effectively over due to the sudden, unexpected slide in systemic liquidity, primarily due to the rapid drain in the reverse repo facility which now has just $600 million left and is set to be fully drained some time in March...

Reverse repo: $603BN, down $23BN overnight, and on pace for a full drain in March at which point the next reliquification begins pic.twitter.com/4EgABWjLVk

— zerohedge (@zerohedge) January 12, 2024

... and that by extension, another round of QE may be on deck.

Of course, it's one thing for a regional Fed president to opine on such things, it's something entirely different for Powell's preferred media leak conduit to confirm it, and yet this morning that's precisely what happened when Nick Timiraos, aka Nikileaks, aka Powell's favorite media mouthpiece confirmed that QT's days are now numbered writing that "Fed officials are to start deliberations on slowing, though not ending, that so-called quantitative tightening as soon as their policy meeting this month. It could have important implications for financial markets."

If that wasn't enough, Nikileaks also confirms our suspicion about the driver behind said QT runoff: the financial plumbing is starting to clog up:

But whereas the Fed expects to cut short-term interest rates this year because inflation has fallen, its rationale for tapering bond runoff is different: to prevent disruption to an obscure yet critical corner of the financial markets.

Five years ago, balance-sheet runoff sparked upheaval in those markets, forcing a messy U-turn. Officials are determined not to do that again.

Several officials at the Fed’s policy meeting last month suggested beginning formal conversations soon, so as to communicate their plans to the public well before any changes take effect, according to minutes of the meeting. Officials have indicated that changes aren’t imminent and that they are focusing on slowing—not ending—the program.

As we first explained almost two months ago, the reason for the Fed's panic is that the central bank wants to avoid the same repo market cataclysm that market both the liquidity drain in Sept 2019 and the violent eruption in basis trades that sparked bond market contagion in March 2020; here is Timiraos confirming as much:

... in September 2019, a sharp, unexpected spike in a key overnight lending rate suggested reserves had windled to the point they were either too scarce or difficult to redistribute across the financial system. The Fed began buying Treasury bills to add reserves back to the system and avoid further instability.

In 2020, the Covid-19 pandemic created a huge dash for dollars. To prevent markets from seizing up, the Fed resumed buying huge quantities of securities. It stopped buying in March 2022 and three months later set the process into reverse, once again shrinking the portfolio.

... which brings us to today, when the Fed did the math and realized that doing $60BN in QT per month once the reverse repo is fully drained will crash the market:

Policymakers have several reasons to consider slowing runoff. First, the Fed is shrinking its Treasury holdings by $60 billion a month—twice as fast it did five years ago. Continuing to run at this rate raises the risk that the Fed drains reserves so quickly that money-market rates jump as banks struggle to redistribute a dwindling supply of reserves.

Slowing the pace of the runoff later this year might allow the Fed to continue the program for longer than otherwise by “reducing the likelihood that we’d have to stop prematurely,” Dallas Fed President Lorie Logan said in a recent speech.

And by "stop prematurely" she of course means suffering a market crash in an election year, one which would drag the economy into a recession in days. And we all know by now (thanks to former NY president Bill Dudley) that is unacceptable, especially when the alternative is a Trump presidency.

Timiraos also confirms that we were right in cautioning that it's all about the accelerating rate of decline in the reverse repo facility (see "How Treasury Averted A Bond Market "Earthquake" In The Last Second: What Everyone Missed In The TBAC's Remarkable Refunding Presentation"):

there are signs that the cash surplus in money markets is rapidly diminishing. The Fed allows money-market firms and others to park extra cash that would otherwise end up in reserves in an overnight reverse repurchase facility. The facility has shrunk by around $1 trillion since late August to around $680 billion. Logan endorsed slowing runoff once that facility is nearly drained of cash because, after that, forecasting demand for bank reserves will be more uncertain.

This "faster-than-expected decline" in the overnight reverse repurchase facility’s balances is spurring the Fed’s movement toward contingency planning around how to slow runoff:

“It has been a surprise to everyone that overnight reverse repurchase balances have fallen this quickly and that reserves have actually increased over this period,” said Brian Sack, who managed the Fed's Plunge Protection Team at the New York Fed from 2009 to 2012.

Actually Brian, you and others may have been surprised, but it certainly wasn't "everyone": we've been warning this would happen since the start of the year, and most recently one week before the Fed's pivot.

There is another reason why the December SOFR spike freaked out the Fed: whereas previously the central bank was wrong repeatedly in estimating what level of reserves would be seen as "ample" by the market, this time around, officials told TImiraos they are going to rely more on market signals in identifying the right level of reserves.

“Last time, we had lots of estimates of where we thought that terminal level of reserves was, and our estimates were too low,” Philadelphia Fed President Patrick Harker said in an October interview. “At the end of the day, the market will dictate where we are.”

Indeed it will, and that's precisely why our premium subscribers were fully aware that the "canary in the liquidity coalmine" died at the start of December, and the Fed's dovish pivot, the end of QT, and the coming QE are now logically following just as we said they would.

And just in case Timiraos' conveying Powell's message that QT is effectively done wasn't enough, here is JPM's head of fixed income strategy with a note overnight admitting the same

This is how JPM sees the wind down of QT: "We now expect that the FOMC will have the outline of a timeline at the January meeting, communicated mid-February minutes to that meeting. We expect that this plan will be formally agreed to at the mid-March meeting and will be implemented beginning in April" at which point the monthly cap on the runoff of Treasury securities to be reduced to $30bn/mo, from $60bn/mo (full note available to professional subscribers in the usual place).

Bottom line: after several years of tightening, 2024 is when the liquidity floodgate reopen and not only does the Fed start to cut rates aggressively, but with QT tapering, we fully expect the next QE to be launched in the near future, sending the dollar into its next, and possibly final, reserve currency death spiral as printer goes BRRRR.