Remember when Jamie Dimon was yelling and screaming that Bitcoin is a "fraud that will eventually blow up", that he'd "close it down if he was the government", and that crypto's only "true use case is for criminals, drug traffickers, money laundering and tax avoidance"?

Well, it turns out the bank that has paid out $40 billion in fines, penalties and legal settlements as a recidivist criminal enterprise, has decided to double down on crime by its own definition...

DIMON: BITCOIN IS `A GREAT PRODUCT' IF YOU ARE A CRIMINAL

— zerohedge (@zerohedge) October 13, 2017

Jan 2014: "JPMorgan Criminally Charged" https://t.co/3cBmQmqS19

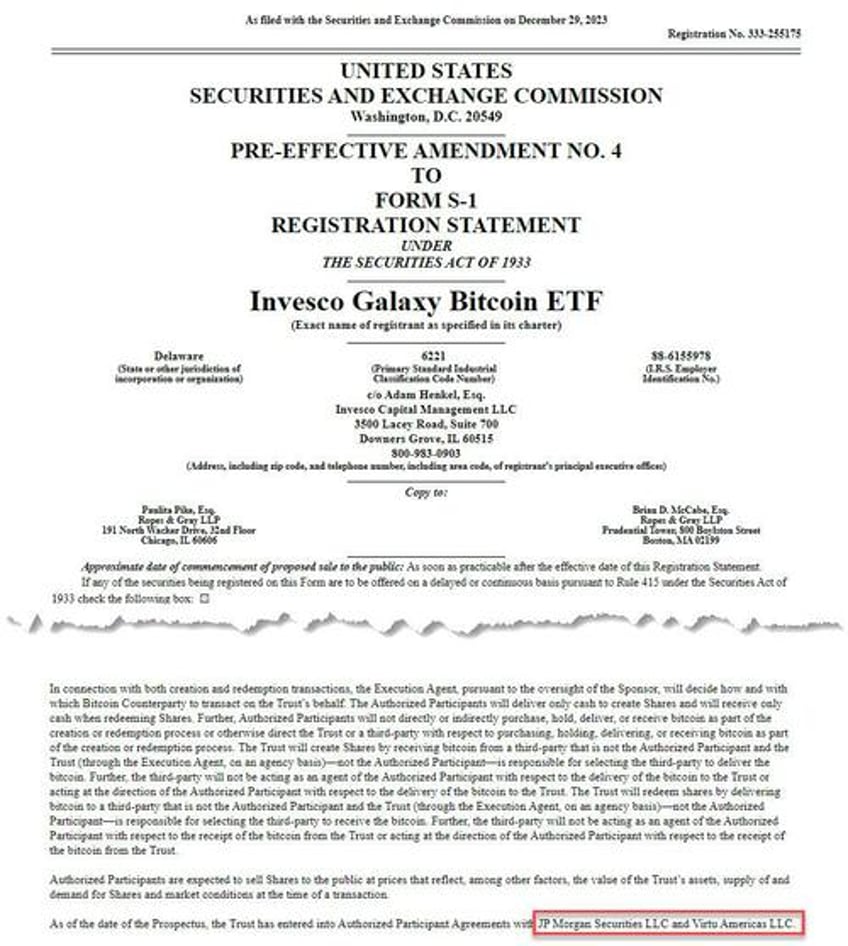

... and today we learned that not one but two giant asset managers - Invesco as well as the world's biggest asset manager and the Fed's own trading desk, Blackrock - both named JPMorgan as their Authorized Participant, i.e., the intermediary firm that will make the ETF possible in the first place by converting bitcoin into cash and vice versa.

In addition to JPMorgan, BlackRock also named Jane Street Capital - best known as the fund where Sam Bankman-Fried learned all he needed to know about HFTing the bitcoin market on his way to becoming the greatest crypto criminal in history - as the broker-dealers who will be responsible for steering cash into and out of its spot-Bitcoin ETF when, not if, it is approved by the SEC some time in January.

JPMorgan will be an authorized participants for both Blackrock's iShares Bitcoin Trust and the Invesco Galaxy Bitcoin ETF according to amended prospectuses filed with the SEC late on Friday. As such, they’ll be responsible for handling the creation and redemption of baskets of shares in the ETF and transfers of cash to and from the fund’s administrator.

Or, as we put it....

So... Jamie Dimon, who has called bitcoin a "hyped up fraud", "worse than tulips", etc, is going to be the Authorized Participant for the biggest bitcoin ETF soon to be approved by @GaryGensler, and run by the Fed's shadow money manager

— zerohedge (@zerohedge) December 29, 2023

Couldn't make this up https://t.co/75KD8M0geu

In addition to BlackRock, Wall Street ETF titans such as Invesco, Franklin Templeton and Fidelity have also filed for spot-Bitcoin ETFs, and Grayscale Investments has applied to convert its Grayscale Bitcoin Trust into an ETF. All of them are expected to be granted in the next few weeks.

Incidentally, it may very well have been due to JPM's insistence that the SEC demands bitcoin ETFs have a cash-create redemption model instead of in-kind. According to Bloomberg's Eric Balchunas, the SEC's preference for a cash model for spot Bitcoin ETFs is that it wants to minimize the number of intermediaries that have access to the actual Bitcoin in the redemption and offering process.

“They don’t like the idea of broker-dealers who are the intermediaries touching Bitcoin,” Balchunas noted. “Many were going to create unregistered subsidiaries to act in place of the actual broker-dealers, but the SEC just didn’t want it,” the ETF analyst said.

The SEC wanted to “close the loop a little more,” Balchunas said, mentioning that he had also heard of regulators being worried about money laundering. He stated:

“If the only people messing with the actual Bitcoin are BlackRock and Coinbase, it’s a little more controllable of what Bitcoin you have [...] They just want a more closed system with fewer intermediaries touching the actual Bitcoin.”

Of course, if JPM - which has already been fined $40 billion in the past 15 years - is aiding the money laundering, then all is well.

While JPMorgan has so far been named as AP for two of the ETFs, it appears that Jane Street is the AP of choice for virtually all of them, which means that with all the frontrunning of ETF orders that Jane Street will do over the next few years, Sam Bankman-Fried would probably have made trillionaire - and perfectly legally at that - if only he had stayed at Jane Street.

As for stupid peasants like the one below, who joyously declared just a few weeks ago that even the bank CEOs are on her side in her idiotic anti-crypto crusade...

When it comes to banking policy, I don’t usually agree with the CEOs of multi-billion dollar banks. But enforcing anti-money laundering rules against crypto to protect national security is common sense & critical. It's time for Congress to act. pic.twitter.com/zZAegAjeb4

— Elizabeth Warren (@SenWarren) December 7, 2023

... the joke's on Pocahontas.