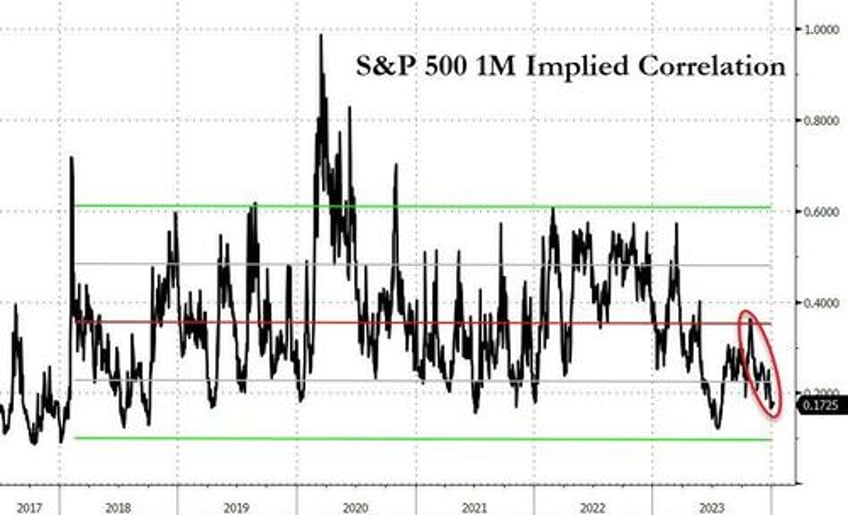

As Nomura's Charlie McElligott notes, it has been a macro tape again of late, but with approach of EPS season kicking-off later this week, it feels like single-name dispersion will again come into focus as a “tie-breaker” for local directionality in currently low Index-level ATM Vols, with Correlation melting back lower to the "old regime"...

What is important to note specifically into earnings season is that EPS revisions have hit NEGATIVE again going-in... and per the backtest, that is a bullish signal for the index, i.e. the old “low bars to beat” phenomenon tends to see larger index upside median returns, and at a higher hit rate.