There were no strong convictions ahead of today's jobs report - perhaps because everyone by now knows the numbers are all bogus and made up on the spot - and perhaps this time it was a good thing because while on one hand the payrolls print came in weaker than expected, driven by a sharp drop in private payrolls, the unemployment rate actually dropped below estimates, painting yet another mixed picture of what to expect.

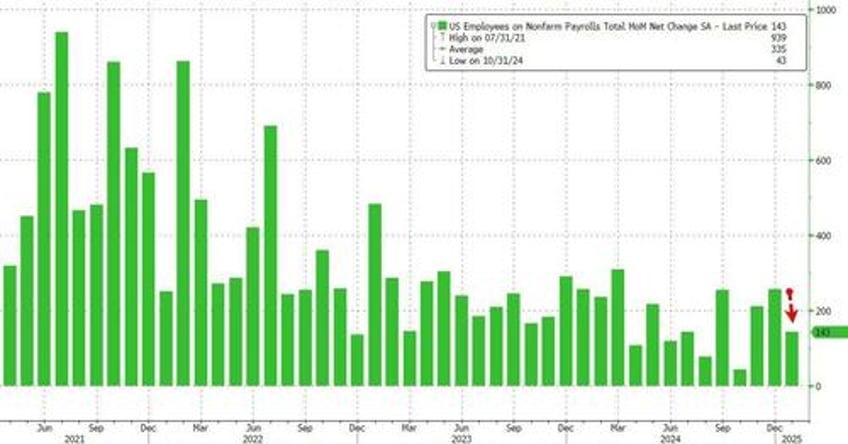

Here's what the BLS reported in Trump's first official jobs report since he returned to the White House: total payrolls printed at 143K...

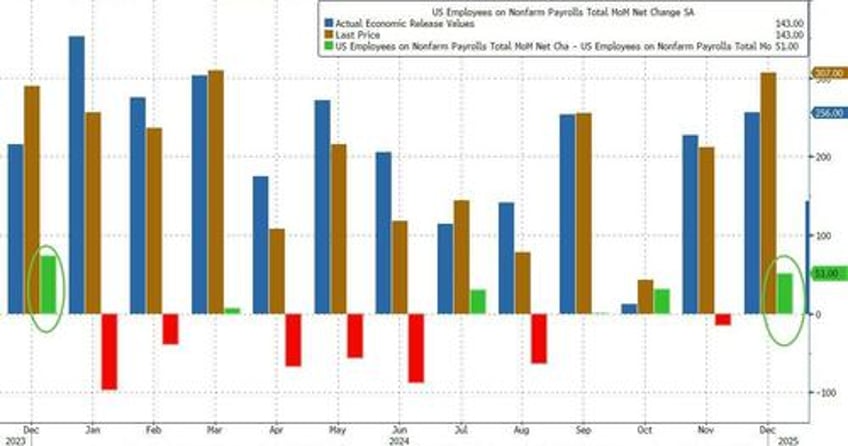

... down sharply from an upward revised 307K (256K originally) and missing estimates of 175K.

Looking further back, the change in total nonfarm payroll employment for November was revised up by 49,000, from +212,000 to +261,000, and when adding the +51,000 revision to December employment in November and December combined is 100,000 higher than previously reported

But while the sequential change in the Establishment survey was notable, what was far more remarkable was the Household survey where we saw massive population related revisions (discussed last night), which pushed the civilian labor force higher by 2.2 million to 170.744 million, while the number of employed workers also increased by over 2.2 million to 163.895 million. As a result, the Household survey has finally caught up to Establishment survey...

... and since the number of Unemployed people actually declined (to 6.849 million from 6.886 million) while the number of employed workers rose by 2.2 million to 163.9 million, the unemployment rate declined to 4.0% from 4.1%, and the lowest since May of 2024!

Despite the drop in the unemployment rate, the participation rate actually rose modestly from 62.5% to 62.6%.

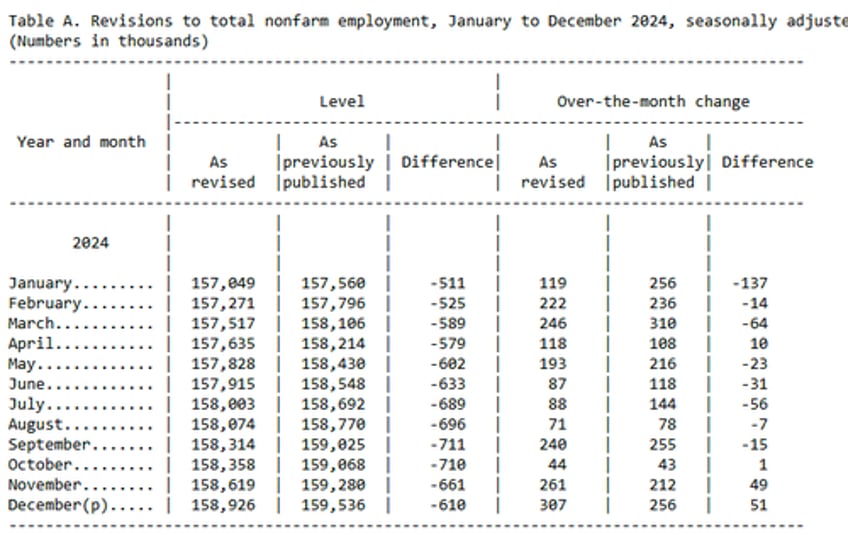

All of this, of course, is in the context of the massive downward revisions to 2024 payrolls which we discussed last night, and which look as follows: roughly 600K jobs lost every month last year.

And while we will do a thorough breakdown of these numbers, perhaps the biggest surprise was in the wage department, because according to the BLS, average hourly earnings printed at 4.1% YoY, beating soundly the 3.8% estimates and unchanged from an upward revised December print (which was 3.9% before).

Developing.