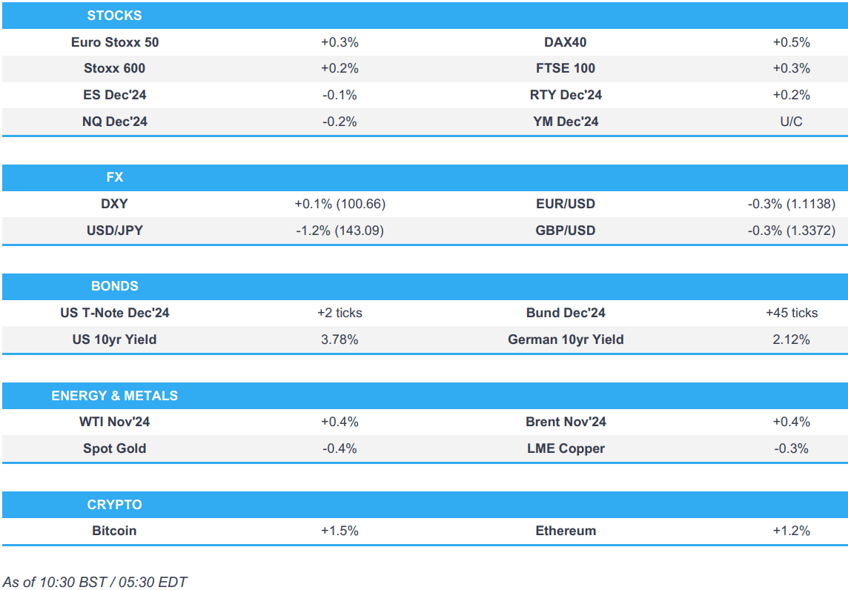

- European bourses are very modestly firmer, whilst US equity futures are mixed ahead of US PCE

- Dollar is stronger vs peers, but losing vs JPY after hawkish candidate Ishiba won the Japanese LDP leadership race to become the next Japanese PM

- Bunds outperform following softer-than-expected inflation metrics out of Spain & France; figures which led to further dovish repricing for the ECB’s October meeting

- Crude oil is modestly firmer with the geopolitical landscape remaining tense, precious metals are subdued whilst base metals are mixed

- Looking ahead, US PCE, UoM Sentiment (Final), Fed’s Collins, Kugler & Bowman

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) are modestly firmer, with the mood somewhat tentative ahead of US PCE. The gains across indices are relatively broad-based and range from +0.1% to +0.4%. Sub-forecast inflation metrics from France and Spain did little to the equity complex despite a more dovish shift in ECB market pricing.

- European sectors are mixed; China-exposed sectors (Luxury, Basic Resources) initially outperformed, but Basic Resources has slowly drifted towards the middle of the pack. Banks and Insurance are at the foot of the pile.

- US equity futures (ES -0.1%, NQ -0.3%, YM -0.1% RTY U/C) are mixed, with the RTY holding modest gains whilst peers remains subdued ahead of the US PCE.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is stronger vs. peers with the exception of the JPY (see below). US macro focus today will be on the August PCE numbers. For now, DXY remains stuck on a 100 handle within a 100.45-88 trading band.

- EUR is softer vs. the USD following soft inflation metrics from France and Spain ahead of next week's EZ-wide print. EUR/USD has been as low as 1.1125 which near-enough matches yesterday's low.

- GBP is on the backfoot vs. the USD, giving back some of the gains seen during yesterday's risk-on session. Cable is currently tucked within yesterday's 1.3312-1.3434 range.

- An eventful session for the JPY amid the LDP leadership race whereby initial indications pointed towards a potential victory for dovish candidate Takaichi and subsequently saw USD/JPY soar towards an overnight peak at 146.49. However, Ishiba's victory in the run-off sparked a hawkish reaction in the JPY and dragged USD/JPY to a 142.80 base; lowest level since September 20th.

- Both Antipodes are softer vs. the USD and giving back some of yesterday's gains. AUD/USD has slipped back onto a 0.68 handle after venturing as high as 0.6904 yesterday.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer but to a lesser extent than peers given that price action on the other side of the Atlantic is more a by-product of EZ-specific events. From a US perspective, attention will be on the August PCE data. The 10yr yield is currently tucked within yesterday's 3.754-3.821% range.

- Bunds are on a firmer footing, lifted by the lower-than-expected inflation metrics out of Spain and France; figures which has sparked some dovish repricing seen for the ECB's October meeting. The German 10yr yield has printed a new low for the week at 2.11%.

- Gilts are being swept up by the broader bullish moves seen across global counterparts. Fresh UK-specific drivers have been lacking during today's session. The UK 10yr yield is now back below the 4% mark at 3.98%.

- Italy sells EUR 7bln vs exp. EUR 5.75-7bln 3.00% 2029, 3.85% 2035, 3.00% 2029 BTP & EUR 1.75bln vs exp. EUR 1.25-1.75bln 2030 CCTeu

- Click for a detailed summary

COMMODITIES

- Upward bias in crude prices this morning following the firm APAC performance amid the Chinese stimulus announced earlier in the week, whilst the geopolitical landscape remains tense. Brent sits in a USD 70.99-72.14/bbl range.

- Subdued trade across precious metals following the prior day's volatility, with traders awaiting the US PCE data. XAU resides in a USD 2,661-2,672.23/oz range.

- Mixed trade across base metals as the complex takes a breather from the rally seen after China unveiled its stimulus bazooka on Tuesday, although base metals hold onto a bulk of its recent gains ahead of US PCE.

- BSEE reported that 25% (prev. 29%) of oil production and 20% (prev. 17%) of natgas production in the Gulf of Mexico is shut (prev. 17%) in response to Hurricane Helene (prev. 29%).

- NHC said hurricane Helene is accelerating North-Northeast through Georgia

- Click for a detailed summary

NOTABLE DATA RECAP

- French CPI Prelim MM NSA (Sep) -1.2% vs. Exp. -0.70% (Prev. 0.50%); CPI Prelim YY NSA (Sep) 1.2% vs. Exp. 1.60% (Prev. 1.80%); Producer Prices YY (Aug) -6.3% (Prev. -5.40%) Consumer Spending MM (Aug) 0.2% vs. Exp. -0.10% (Prev. 0.30%) CPI (EU Norm) Prelim YY (Sep) 1.5% vs. Exp. 2.0% (Prev. 2.2%) Consumer Spending MM (Aug) 0.2% vs. Exp. -0.1% (Prev. 0.3%, Rev. 0.2%) Producer Prices MM (Aug) 0.2% (Prev. 0.2%, Rev. 0.3%).

- Spanish HICP Flash MM (Sep) -0.10% vs. Exp. 0.00% (Prev. 0.00%); CPI MM Flash NSA (Sep) -0.60% vs. Exp. -0.10% (Prev. 0.00%); CPI YY Flash NSA (Sep) 1.50% vs. Exp. 1.90% (Prev. 2.30%); core 2.40% vs. Exp. 2.80% (Prev. 2.70%); HICP Flash YY (Sep) 1.7% vs. Exp. 1.9% (Prev. 2.4%); Spanish GDP Final QQ (Q2) 0.8% vs. Exp. 0.8% (Prev. 0.8%); GDP YY (Q2) 3.1% vs. Exp. 2.9% (Prev. 2.9%); GDP Final QQ (Q2) 0.8% vs. Exp. 0.8% (Prev. 0.8%).

- German Unemployment Rate SA (Sep) 6.0% vs. Exp. 6.0% (Prev. 6.0%); Unemployment Chg SA (Sep) 17.0k vs. Exp. 12.0k (Prev. 2.0k); Unemployment Total SA (Sep) 2.823M (Prev. 2.801M); Unemployment Total NSA (Sep) 2.806M (Prev. 2.872M).

- Italian Industrial Sales YY WDA (Jul) -4.7% (Prev. -3.7%); Industrial Sales MM SA (Jul) -0.4% (Prev. 0.1%)

- EU Industrial Sentiment (Sep) -10.9 vs. Exp. -9.9 (Prev. -9.7, Rev. -9.9); Services Sentiment (Sep) 6.7 vs. Exp. 5.9 (Prev. 6.3, Rev. 6.4); Economic Sentiment (Sep) 96.2 vs. Exp. 96.5 (Prev. 96.6, Rev. 96.5); Selling Price Expec (Sep) 6.2 (Prev. 6.1, Rev. 6.2); Cons Infl Expec (Sep) 10.9 (Prev. 11.3)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is prepared to water down the planned Budget tax raid on 'non-doms' amid fears it may fail to raise any money, according to people familiar with the matter cited by FT.

- BNP now sees the ECB cutting interest rates by 25bps in October.

- ECB Consumer Expectations Survey (Aug): See inflation in next 12 months at 2.7% (prev. 2.8%); 3y ahead sees 2.3% (prev. 2.4%)

NOTABLE US HEADLINES

- Fed's Cook (voter) said she wholeheartedly supported the 50bps rate cut and on the path of policy, will look carefully at the data, outlook and balance of risks. Cook said normalisation of the economy, particularly of inflation, is quite welcome and the labour market is solid but has cooled noticeably and it may become more difficult for some to find employment. Furthermore, she sees significant easing in inflationary pressure, as well as noted that upside risks to inflation have diminished and downside risks to employment have increased.

- NY Fed's Perli said there is plenty of room to further reduce the Fed's balance sheet and noted the pressures in the repo market do not currently appear to be close to the point of affecting the federal funds rate, according to Reuters.

- US President Biden signed the three-month government funding bill on Thursday to avert an imminent shutdown.

GEOPOLITICS

MIDDLE EAST

- "Jordanian army announces the downing of a drone that tried to infiltrate Jordanian territory in the southern military region", according to Sky News Arabia

- "IRNA: Iran's foreign minister said Tehran will not remain idle towards all-out war in Lebanon", according to Al Arabiya.

- "Syrian News Agency: 5 soldiers were killed in an Israeli aggression targeting a military site on the Syrian-Lebanese border", according to Al Jazeera

- "An informed source for Sky News Arabia: The truce initiative has not yet been rejected and the effort continues to reach a truce for 21 days", according to Sky News Arabia.

- Israeli PM Netanyahu said he had a meeting on Thursday to discuss the US ceasefire initiative and that they will continue these discussions in the coming days, according to Reuters.

- Lebanese Parliament Speaker Nabih Berri told L'Orient Le Jour newspaper that Israeli PM Netanyahu lies to everyone and retracted his approval of the initiative, while Berri said that they adhere to the revival of the demand for a ceasefire in Gaza as in Lebanon.

- US and Israeli officials held talks on Lebanon in New York on Thursday and discussions continued for a 21-day ceasefire, according to the White House. It was later reported that Secretary of State Blinken and Israeli Minister of Strategic Affairs Dermer emphasised the need for a ceasefire and Blinken underscored that further escalation of the conflict will only make that objective more difficult.

- French President Macron said the US has to increase pressure on Israeli PM Netanyahu to agree to the 21-day ceasefire, while he added Israel cannot invade Lebanon today and it would be a huge mistake, according to an interview with CBC

- Former US President Trump responded that he would do that when asked if he would make a deal with Iran if he is elected, while he also commented that the war in the Middle East has to end.

- Israeli Walla website stated the Israeli army attacked 1,600 targets in Lebanon during the past day, according to Al Jazeera.

- Israeli Air Force Chief said they will stop any arms transfer by Iran to Hezbollah and are preparing to assist troops in ground operations against Hezbollah.

- Israeli army said missiles were fired from Yemen and the interceptor was launched, while it added that the 'Arrow' aerial defence system made a successful interception.

OTHER

- Former US President Trump said he will meet with Ukrainian President Zelensky on Friday and that he has some disagreements with Zelensky, while he responded "We'll see what happens" when asked if Ukraine should hand over some land to Russia to end the war.

- Romanian Defence Ministry said it is possible one Russian drone from the overnight attack on Ukraine entered Romanian air space for under three minutes.

CRYPTO

- Bitcoin edges higher and climbs above USD 65.5k, benefiting from the positive risk tone seen in recent sessions.

APAC TRADE

- APAC stocks followed suit to the gains on Wall St where sentiment was underpinned and the S&P 500 extended on record highs owing to China's policy support and strong US data, while Chinese stimulus remained the main driving force overnight.

- ASX 200 was rangebound with strength in mining, materials and resources was counterbalanced by losses in defensives, while consumer stocks were also pressured with Star Entertainment shares down by more than 40% after its recent substantial FY loss.

- Nikkei 225 rallied at the open and climbed above the 39,000 level owing to a weaker currency. The index then pared the majority of its early gains as the JPY nursed some of its losses and with participants awaiting the LDP leadership vote, but then caught a second wind in late trade as dovish LPD candidate Takaichi is said to face Ishiba in Japan's LDP runoff.

- Hang Seng and Shanghai Comp rallied again owing to China's stimulus drive with China to issue USD 284bln of sovereign debt as part of fresh fiscal stimulus, while the securities regulator also issued guidance to promote long-term capital entering the market. Furthermore, the PBoC announced its 50bps RRR cut took effect today and set the 7-day reverse repo rate at 1.50% vs prev. 1.70%, as previously guided earlier this week.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced its 50bps RRR cut took effect from today and said the weighted average RRR for financial institutions was now at 6.6% after the new cut, while it set the 7-day reverse repo rate at 1.50% vs prev. 1.70%, as previously guided earlier this week and injected CNY 278bln via 14-day reverse repos with the rate lowered to 1.65% from 1.85%.

- Shanghai and Shenzhen to lift key remaining home purchases curbs to boost market; to remove curbs on non-local residents residents from buying homes; to scrap limits on number of homes Chinese can buy, via Reuters citing sources. Expected to announce the changes in the coming weeks. Capital Beijing considers limiting similar restrictions expect in key districts.

- China's PBoC said the impact of the recently announced incremental interest rate policy on banks' net interest margins remains neutral overall.

- Chinese Aug Services Trade deficit USD 21.3bln; Jan-Aug Services Trade Deficit USD 164.9bln, according FX regulator

Japanese LDP Leadership Election:

- Ex-Defense Minister Ishiba (hawkish candidate) wins Japan's ruling party leadership election and to become the nation's next Prime Minister, Ishiba received 215 votes (208 majority), Takaichi (dovish candidate) received 194 votes

- Japan Economic Security Minister Takaichi gets 181 votes in ruling party leadership race and will face off Ishiba in Japan LDP runoff. Ex-Defence Minister Ishiba gets 154 votes in LDP leadership race, both short of a majority, according to Reuters. Run-off results expected around 07:00BST. Note: Takaichi is an advocate for BoJ easing, and she had previously noted that the BoJ hiked rates too soon.

- Incoming Japanese PM Ishiba says he aims to accelerate Kishida's new capitalism pledge; "we must ensure to exit from deflation"; plans to hold lower house election at an early timing. There is a time lag for wage growth to exceed inflation; must scrutinise what will be the most effective step to cushion the blow from rising inflation.

DATA RECAP

- Chinese Industrial Profit YTD YY (Aug) 0.5% (Prev. 3.6%)

- Chinese Industrial Profits YY (Aug) -17.8% Y/Y (prev. 4.1%)

- Tokyo CPI YY (Sep) 2.2% vs. Exp. 2.2% (Prev. 2.6%)

- Tokyo CPI Ex. Fresh Food YY (Sep) 2.0% vs. Exp. 2.0% (Prev. 2.4%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Sep) 1.6% vs. Exp. 1.6% (Prev. 1.6%)