By Garfield Reynolds, Bloomberg markets live reporter and strategist

If a week is a long time in politics then a couple of weeks is an eternity in rates markets.

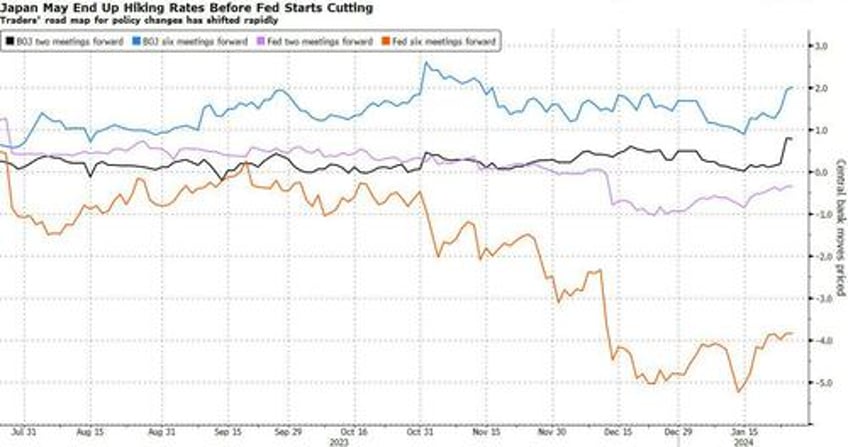

Traders came into this year feeling pretty certain the first cab off the central bank rank would be a 25-basis-point interest-rate cut from the Federal Reserve in March. Those bets have rapidly been unwound after policymakers pushed back against them and data signaled a still strong economy. Swaps contracts now show about a 36% chance the Fed lowers its benchmark that month, tumbling from 86% odds seen Jan. 15.

The most likely first mover is now seen to be the Bank of Japan, even though Governor Kazuo Ueda’s cautious stance meant that traders two weeks ago were favoring the idea he would retain the world’s last remaining negative interest rate until the second half of 2024. Now they see almost an 80% chance the BOJ hikes rates by 10 basis points in April.

Japanese bonds sold off in response Wednesday, and Treasuries also slid as fresh US data underscored the resilience of the economy there. This looks like turning into something of a vicious spiral higher for global yields, especially if Thursday’s European Central Bank meeting also demonstrates a relatively hawkish tone.