- APAC stocks traded mixed following the similar performance stateside; Japanese stocks heavily pressured on return from the long weekend.

- US President-elect Trump's team reportedly studies month-by-month tariff hikes of 2%-5%, according to Bloomberg.

- European equity futures indicate a higher open with Euro Stoxx 50 future up 0.8% after the cash market closed with losses of 0.5% on Monday.

- DXY is higher but back on a 109 handle, NZD marginally outperforms, JPY narrowly lags.

- Looking ahead, highlights include US PPI, EIA STEO, Fed Discount Rate Minutes, ECB’s Lane, BoE’s Breeden & Taylor, Fed’s Schmid & Williams, Supply from Netherlands, UK & Germany.

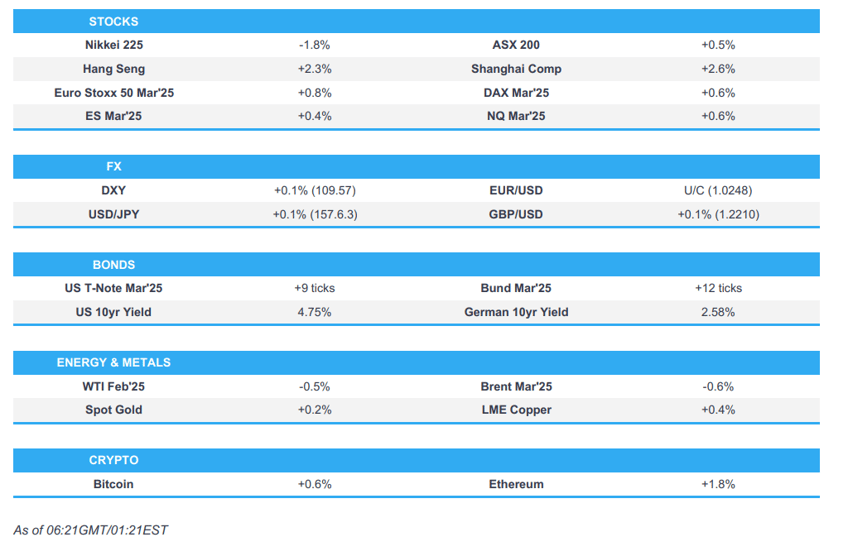

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were mixed on Monday with SPX, DJI and RUT paring some of the post-NFP downside, although the Nasdaq added to losses amid tech, particularly in semiconductors which are being weighed on by Biden export controls and also a report in The Information that some of Nvidia's (NVDA) biggest customers are facing new delays in getting its most advanced AI chips up and running in data centres. Conversely, the Dow was the clear outperformer due to the upside in heavyweight UnitedHealth (UNH), which rallied after the US proposed a 4.3% avg. increase in Medicare Advantage plan payments for 2026.

- SPX +0.16% at 5,836, NDX -0.30% at 20,785, DJI +0.86% at 42,297, RUT +0.24% at 2,194.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump's team reportedly studies month-by-month tariff hikes of 2%-5% with Bessent, Hassett and Miran discussing gradual tariffs, although Trump still hasn’t reviewed or approved the gradual tariff idea, according to Bloomberg.

- US President-elect Trump does not plan to attend the World Economic Forum in Davos but may make virtual remarks to the gathering, according to a source familiar with the planning cited by Reuters.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the similar performance stateside where price action was choppy as most indices attempted to nurse post-NFP losses although the Nasdaq remained pressured on tech weakness, while Japanese stocks were heavily pressured on return from the long weekend.

- ASX 200 gained with outperformance in the commodity-related sectors but with the upside capped after weak consumer confidence data.

- Nikkei 225 slumped as it took its first opportunity to react to the post-NFP higher yield environment and last week's source reports of the BoJ mulling a rate decision for its meeting next week, while comments from BoJ Deputy Governor Himino also suggested the upcoming meeting is live.

- Hang Seng and Shanghai Comp outperformed despite the recent announcement by US and allies of new controls on AI chips, with participants awaiting the PBoC and FX regulator's looming briefing on financial support for the economy, while there was also a report that the Trump team is studying gradual month-by-month tariff hikes of 2%-5%.

- US equity futures (ES +0.4%, NQ +0.5%) remained afloat and marginally extended on yesterday's rebound.

- European equity futures indicate a higher open with Euro Stoxx 50 futures up 0.8% after the cash market closed with losses of 0.5% on Monday.

FX

- DXY initially gave up some ground to its major peers after reports that US President-elect Trump's team is studying month-by-month tariff hikes of 2%-5% although that Trump still hadn’t reviewed or approved the gradual tariff idea. Nonetheless, the DXY then ultimately resumed its recent strengthening trend despite the lack of fresh US specific catalysts with participants awaiting the latest US CPI data on Wednesday.

- EUR/USD briefly found support following the report regarding potential US piecemeal tariff increases but then returned to flat territory.

- GBP/USD traded indecisively on both sides of the 1.2200 level with some key data releases scheduled this week including UK CPI and monthly GDP.

- USD/JPY saw a brief bout of volatility as participants digested a deluge of comments from BoJ Deputy Governor Himino who stated they will likely hike rates if economic forecasts are realised and that while the direction is for further rate hikes, they must carefully watch various upside and downside risks at home and abroad. Furthermore, he stated that the board will likely debate whether to hike rates and make a decision at next week's meeting but added it is not possible to telegraph the monetary policy decision as the outcome of the policy meeting depends on discussions at the meeting.

- Antipodeans were underpinned alongside early strength in CNH after the reports of potential gradual US tariff hikes although most of the moves were pared with AUD also not helped by a deterioration in Australian Consumer Sentiment, while NZD remained firm

- PBoC set USD/CNY mid-point at 7.1878 vs exp. 7.3161 (prev. 7.1885).

FIXED INCOME

- 10yr UST futures remained afloat but lacked firm direction after yesterday's indecision amid quiet trade ahead of the US inflation data midweek.

- Bund futures languished beneath the 131.00 level with attempts to nurse recent losses restricted ahead of German supply.

- 10yr JGB futures were pressured on reopen from the long weekend and as yields climbed ahead of next week's live BoJ meeting including the 40yr JGB yield which rose to a record high, while prices failed to benefit from a 5-year JGB auction which resulted in a lower than previous bid-to-cover but higher accepted prices.

COMMODITIES

- Crude futures took a breather after gaining yesterday on the recent tougher US sanctions targeting Russia's energy sector and with further upside capped amid positive Middle East headlines with Israel and Hamas said to be close to a possible hostage and ceasefire deal.

- EU intends to let its gas price cap expire as scheduled at the end of this month, according to Reuters citing EU diplomats.

- Pressure is mounting for US oil services group SLB (SLB) to exit Russia operations, according to FT.

- Spot gold nursed some of the prior day's losses after trickling lower alongside a firmer dollar.

- Copper futures benefitted amid the mostly improved risk appetite seen in global markets including its largest buyer China.

CRYPTO

- Bitcoin extended on the prior day's intraday rebound and briefly returned to above the USD 95,000 level.

NOTABLE ASIA-PAC HEADLINES

- US President-elect Trump is considering trade lawyer Jeffrey Kessler for a key China role heading the Commerce Department's Bureau of Industry and Security.

- China is increasing its scrutiny of exports by Apple (APPL) and other US tech companies which is hampering their efforts to expand production in Southeast Asia and India as tighter customs checks related to dual-use technology export controls have resulted in delays of days and weeks on shipments of production equipment to Vietnam and India, according to people familiar with the matter cited by Nikkei.

- US lawmakers urged President Biden to extend January 19th deadline to prevent TikTok ban if Supreme Court does not block the law, while was separately reported that China discussed the sale of TikTok's US operations to Elon Musk as a possible option, according to Bloomberg.

- BoJ Deputy Governor Himino said in conducting monetary policy, it is necessary to pay close attention to short-term developments in economic activity, prices, and financial conditions and noted that inflation expectations have risen from below 1.0% to around 1.5%. Himino said they will likely hike rates if their economic forecasts are realised and while the direction is for further rate hikes, they must carefully watch various upside and downside risks at home and abroad. Furthermore, he said in guiding policy, determining the timing of policy change is difficult and important, as well as noted the board will likely debate whether to hike rates and make a decision at next week's policy meeting. Furthermore, he stated it is not a normal state for real rates to stay negative for a prolonged period once shock and deflationary factors dissipate, while he added it is not possible to telegraph the monetary policy decision as the outcome of the policy meeting depends on discussions at the meeting.

- Japanese Economy Minister Akazawa said the BoJ considering a rate hike and the government's aim to exit deflation are not contradictory.

DATA RECAP

- Australian Westpac Consumer Confidence Index (Jan) 92.1 (Prev. 92.8)

- Australian Westpac Consumer Confidence MM (Jan) -0.7% (Prev. -2.0%)

- New Zealand NZIER Confidence (Q4) 16.0% (Prev. -1.0%)

- New Zealand NZIER QSBO Capacity (Q4) 91.3% (Prev. 89.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli army announced sirens were activated in central Israel after a rocket launch from Yemen and Israeli media reported the suspension of flights from Ben Gurion Airport due to rocket fire from Yemen, while the Houthi group said it targeted Israel's Ministry of Defence with a ballistic missile, according to Asharq News. In relevant news, an Al Jazeera correspondent reported more than 20 strikes in two hours on Gaza City and the central and southern Gaza Strip.

- Israel and Hamas are close to a possible hostage and ceasefire deal that will likely be announced on Monday night or Tuesday morning in which 33 hostages will be released during the first phase, with a staged withdrawal of IDF forces from Gaza other than an undefined security perimeter. However, in terms of when the ceasefire deal would be signed and if it would be signed, there was still uncertainty if it was hours away, days away, or could still unravel, according to sources cited by Jerusalem Post.

- A deal to end Gaza war is closer than its ever been and a round of talks is planned in Doha on Tuesday morning to finalise remaining details, according to Reuters citing an official briefed on the matter.

- Turkish intelligence chief discussed Gaza ceasefire efforts with Hamas officials and agreed to continue efforts to achieve a ceasefire, according to a Turkish security source.

- US President-elect Trump said they are getting very close to an Israeli hostage deal and could have a deal done by the end of the week, while it was also reported that Trump's envoy conveyed to Israeli PM Netanyahu a strongly worded message from Trump calling on him to conclude a deal, according to Channel 14 citing an Israeli government official.

- US Secretary of State Blinken is to present a post-war plan for Gaza on Tuesday.

RUSSIA-UKRAINE

- Russia downed more than 200 Ukrainian drones overnight, according to Shot Telegram channel. It was also reported that an industrial enterprise was damaged in the Russian city of Engels after a drone attack.

OTHER

- NATO wants to bring forward an agreement on new weapons and troop goals to summer, while it was also reported that Germany’s Defence Minister said they need to implement NATO's new capability targets as quickly as possible.- North Korea fired an unknown projectile towards the East Sea, while the South Korean military later announced that North Korea fired multiple short-range missiles off its east coast. Furthermore, South Korean acting President Choi said North Korea's missile launch is a violation of UN Security Council Resolutions and they will sternly respond to North Korean provocations.

- Philippines National Security Council spokesperson said they were surprised about the increasing aggression being shown by China in deploying a 'monster ship' in the Philippines' exclusive economic zone and that it is an alarming and clear effort on the part of China to intimidate Filipino fishermen. The spokesperson added that the intention of the Chinese government is to normalise presence in South China Sea waters with the presence of the 'monster ship' and they will not stop challenging Chinese presence in Philippine waters.

EU/UK

NOTABLE HEADLINES

- Bank of France maintained its Q4 GDP growth forecast at zero although ECB's Villeroy said French economic growth could pick up in 2026 and 2027, while he added that France is not a risk of not being able to finance itself and the question is at what cost.

- French PM Bayrou will deliver a crucial policy speech to lawmakers on Tuesday, according to Bloomberg. Speech due @ 14:00GMT.