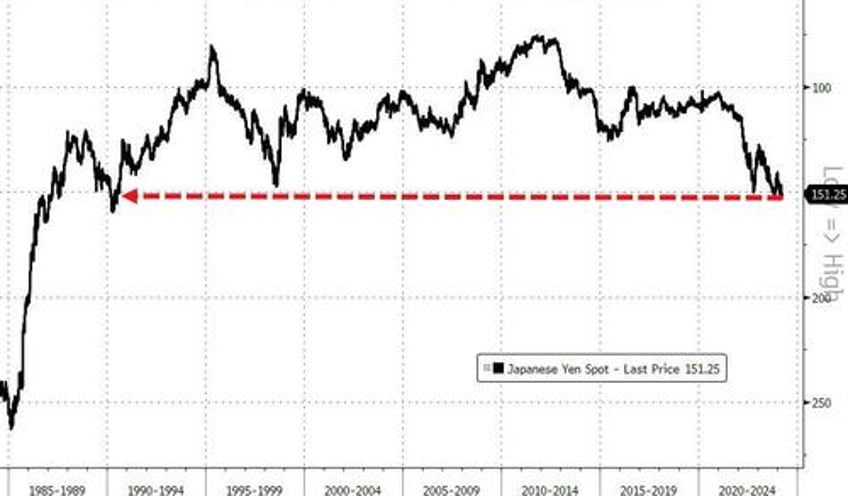

Having tumbled to its lowest against the dollar since 1990, Japanese officials started to show signs of panic overnight about the yen's post-rate-hike weakness... and of course, blamed "speculators".

Source: Bloomberg

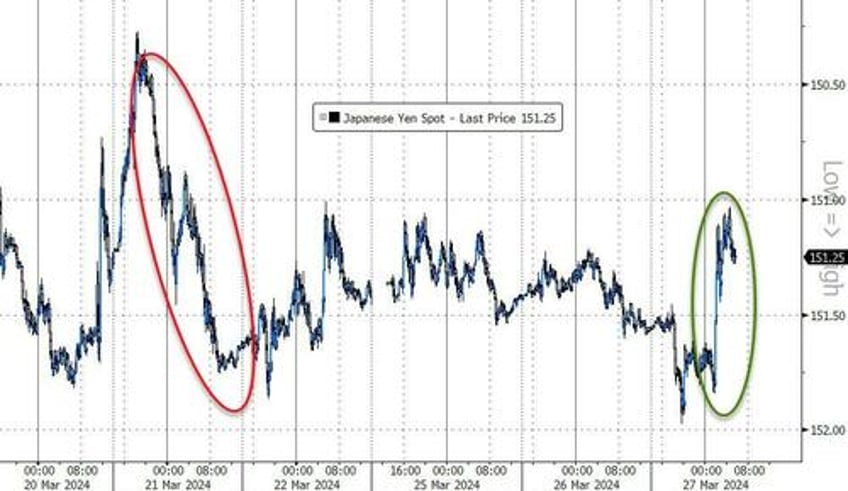

The yen dipped to 151.97 versus the dollar early on Wednesday in Tokyo, before recovering after comments from Finance Minister Shunichi Suzuki, and his top currency official Masato Kanda indicating that Japan was ready to act.

Source: Bloomberg

The officials spoke after an emergency joint meeting of the MOF, BOJ and FSA.

“We are watching market moves with a high sense of urgency,” Suzuki said.

“We will take bold measures against excessive moves without ruling out any options.”

Kanda later emerged from a meeting with officials at the central bank and the finance regulator and said speculative moves in markets wouldn’t be tolerated.

"I do not consider a 4% move in a span of 2 weeks a mild move."

Clearly the jawboning is not working as the market is calling Japanese officials' bluff.

In fact, policymakers are running out of choices short of purchasing the currency to prop it up after the Bank of Japan’s first interest rate hike since 2007 failed to change its trajectory.

“Given recent history, a breach of 152 could instigate intervention,” said Rodrigo Catril, a senior FX strategist at National Australia Bank Ltd. in Sydney.

“The break of the previous high has accelerated the move,” he said, referring to the dollar-yen.

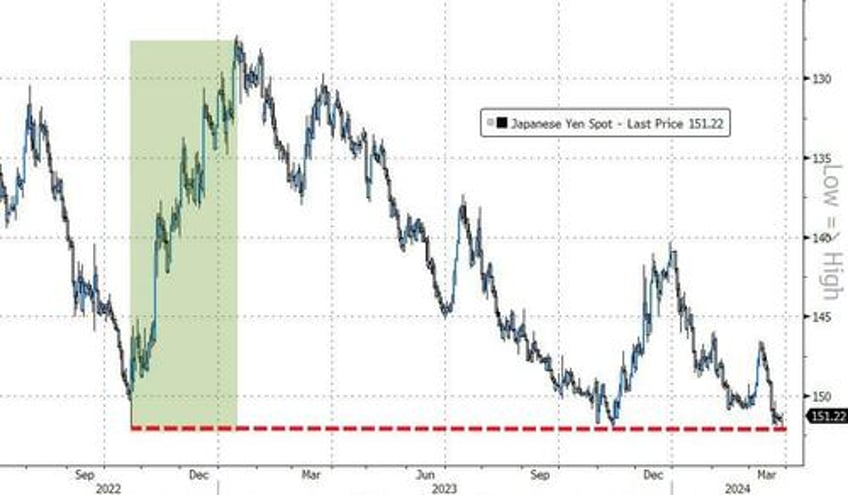

Catril is correct as Suzuki’s reference to bold action is generally interpreted to mean direct intervention in the currency market as yen weakened to a level that prompted Japan to wade into markets in October 2022.

Authorities in Tokyo spent ¥9.2 trillion ($60.6 billion) in 2022 to prop up the yen on three occasions, each time insisting that they were not protecting any specific currency level.

The timing for a large intervention would likely be dramatic given that hedge funds and asset managers combined held a near-record level of bearish positions against Japan’s currency last week, according to data from the Commodity Futures Trading Commission going back to 2006.

Still, for now, it's "all mouth and no trousers" as one London trader said, with everyone eyeing a break of 152.

Finally, there is China.

As The Asia Times reports, many analysts think the PBOC may be finally losing tolerance with Japan allowing the yen exchange rate to drop so far with little blowback in Washington – particularly as China struggles to keep economic growth as close to its 5% target as possible.

It’s still unclear if the drop in the Chinese exchange rate that began Friday is the start of a trend that would surely rock global markets or just a fluke. But the correlation with the Japanese yen’s decline is hard to ignore.

Are the beggar-thy-neighbor currency strategies of the past returning to China's $18 trillion economy? Is this why Japan has been all talk?