In today's world of at times unparalleled idiocy at the top echelons of power, nobody can hold a candle to the government and central bank of Japan.

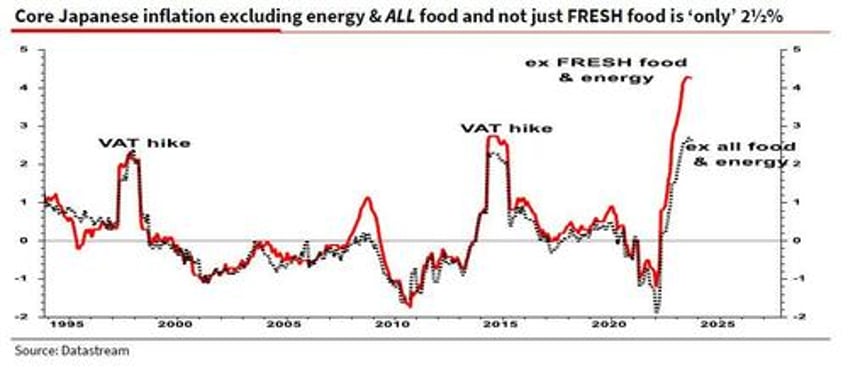

Consider this: as the BOJ injects billions of liquidity into its bond market every single to prevent a crash that could mark the end of Japanese civilization as we know it (for context, the BOJ owns more than half of all JGBs outstanding, blurring the lines between fiscal and monetary policy, and adding to financial instability risks; furthermore the size of the BOJ’s balance sheet - at almost $6.5 trillion - is the largest in the world in GDP terms, and substantially higher than the Fed’s or the ECB’s) Japan has seen the yen collapse at such a rapid pace that it would make banana republic currencies such as the Turkish Lira blush. And as the yen imploded, and historic inflation spread across the otherwise deflating Japan...

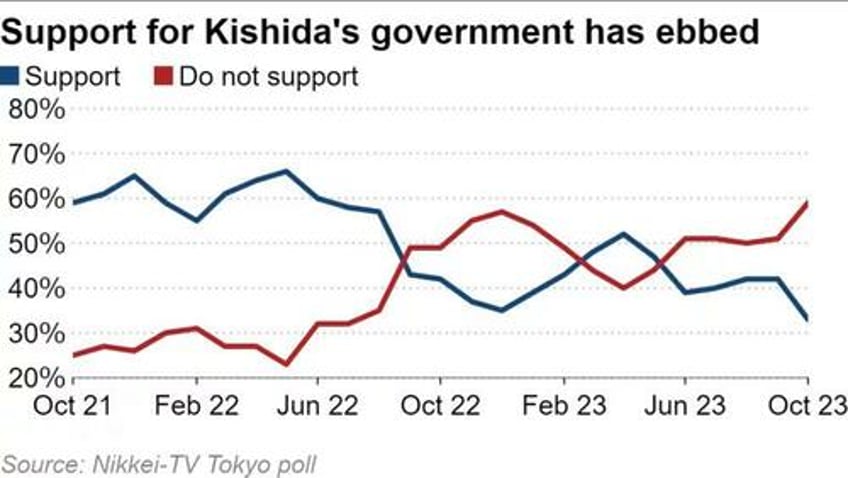

... the approval rating of Japan's PM Kishida cratered...

... as the Japanese learned that the one thing that is worse than deflation is inflation, something we warned of not too long ago.

The blowback against the Japanese Lira begins.

— zerohedge (@zerohedge) August 29, 2023

Let's see how long Kishida allows the BOJ to cremate the JPY once Japan's plummeting standard of living and his approval rating starts correlating to the yen pic.twitter.com/qcKAgvXukz

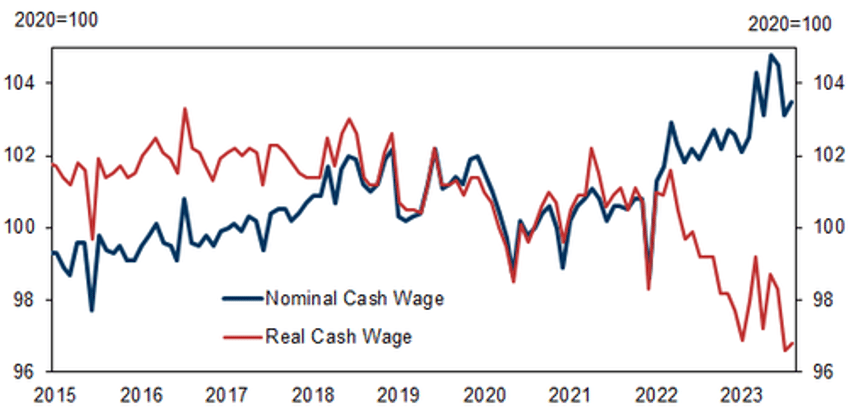

What is just as remarkable is that in the land of the rising sun idiocy, what Kishida is telling his voters is that all shall be well and that wages will magically explode higher, sparking a new golden age in what is arguably the western world's cheapest economy. Of course, what is really happening is just the opposite: while nominal wages have indeed risen, that is entirely due to soaring inflation, meanwhile real wages are the lowest on record.

And while the BOJ had every opportunity to normalize this slow-motion social, monetary and economic collapse a few days ago when it could have propped up the currency at the expense of higher wages by eliminating the Frankenstein monster that is NIRP and YCC, it failed to do so, ensuring that when the day of reckoning finally comes (and it will, as Bloomberg's Simon White explained) it will be catastrophic beyond anything seen during the Lehman collapse (oh, and the yen will explode higher).

Meanwhile, the Japanese population is getting angrier and angrier, watching the value of their savings disappear, and their purchasing power implode, as Kishida is - in fine Japanese tradition - en route to the massive compost heap of Japanese PM, set to resign soon, while admitting failure.

But unlike so many premiers before him, Kishida refuses to go quietly, and instead has opted for the Louis XV way out, namely the "Après moi, le déluge" because while his fate is certain, Kishida hopes to bribe the population one last time before he is kicked out.

And so, in a nation that is already reeling from runaway inflation, the idiot premier - pardon our language but we are quite angry - Fumio Kishida has staked the future of his premiership on a $110BN stimulus plan centred on tax cuts and cash handouts, as he seeks to "tackle the fallout from high inflation and record-low approval ratings."

That's right: taking the first page out of that manual for monetarist morons known as Magic Money Tree (MMT), this imbecile plans to fight inflation with much more inflation.

Kishida’s gambit follows a big reversal of fortunes for the prime minister, who according to the FT, had seized on Russia’s full-scale invasion of Ukraine to increase defence spending and scored a series of diplomatic wins including a historic rapprochement with South Korea.

However, it all came crashing down when the yen imploded this year, unleashing unprecedented inflation on a country that has only known deflation for the past 40 years, and the result is widespread anguish and murderous fury in a society that it otherwise almost supernaturally serene and stoic.

So to avoid an angry mob carrying samurai swords, on Thursday Kishida announced what every self-respecting politician would do in his shoes, namely cash handouts for votes a sweeping stimulus package of about ¥17tn ($113bn), of which ¥13tn will be funded by a supplementary budget for the remainder of the fiscal year until the end of March 2024.

At the heart of the package are measures to address higher costs of living - for which he, his central bank and his ministry of finance - are directly responsible including roughly ¥5tn in temporary cuts to income and residential taxes as well as cash handouts to low-earning households. Because somehow literally handing out money to people will somehow ease inflation.

The package - and don't laugh please - also includes an extension of subsidies to offset rising petroleum and electricity prices as well as support for businesses to raise wages and strengthen supply chains.

Because somehow, somewhere, some idiot Keynesian or MMT advisor of Kishida decided that it would be a good idea to "fight" surging gas prices with subsidies and cash stimulus. Incidentally, for a quick look into how that particular "plan" plays out, look no further than Argentina.

“By combining wage increases [by companies] and a cut in income tax, I want to create a situation where the growth in public income will exceed the rise in prices by next summer,” Kishida said at a news conference on Thursday. “By doing so, an exit from deflation will be in sight.”

But even before the stimulus was signed off by his cabinet earlier in the day, Kishida’s plan had already backfired.

Approval for his administration has fallen to 33%, the lowest since he was appointed prime minister in October 2021, according to a poll by Nikkei this week. Of those surveyed, 65% disapproved of his plan to cut income tax, because while the prime minister may be an idiot, Japan's population is generally one of the smartest out there and realizes that this so-called plan will end with hyperinflation, and the collapse of both the JGB market and the yen.

There's more: with the yen sinking to a multi-decade low, import costs rising and real wages falling, surveys have shown that households are more worried about future tax rises to fund a significant boost in defense spending and more generous childcare benefits.

It gets worse: according to the Nomura Research Institute, the temporary tax cuts and handouts are expected to boost Japan’s real GDP by just 0.2% on an annual basis. Similar measures in the past have failed to spur meaningful consumption since Japanese households tend to save extra cash; this time will be no different; it will, however, spur even more inflation and force the government to push rates to double digits once Japan admits it has become a banana republic just like Turkey, or however it is spelled now in its attempt to "rebrand" itself.

Despite pushing back plans to increase corporate and other taxes, Kishida has suffered from a persistent impression that he will aggressively pursue fiscal discipline — spawning a nickname on social media linking his eyeglasses with his tax-raising image.

“He felt strongly that a tax cut was needed to address his tax hike image, and his willingness to take on a gambit accelerated,” said Takao Toshikawa, editor-in-chief of political newsletter Insideline. “But despite his political instincts that tax rebates would resonate with the public, he lacked communication skill and the ability to deliver a strong message.”

Had the economic package translated into higher popularity, Kishida would have probably called a snap election before the year’s end, according to Toshikawa. That prospect has now diminished, and it remains unclear whether he will call a poll before his term as head of the ruling Liberal Democratic party expires next September. Most likely he will resign long before then as so many of his predecessors who have had to admit there is just no way to save the sinking Titanic known as Japan.

Analysts said the prime minister should have triggered an election after he received a temporary boost in the wake of successfully hosting the G7 summit in May, which was attended by Ukraine’s president Volodymyr Zelenskyy. Since then, his administration has been rocked by scandals involving his son and closest aide, and data management issues with a national identification system.

Members of his own party and economists have criticized the tax cuts, saying measures to fuel an already robust economy are risky at a time when inflation is proving to be stickier than expected.

The epically mistimed stimulus package also comes days after the Bank of Japan took a significant step to end its seven-year policy of capping long-term interest rates, setting the stage for a gradual unwinding of ultra-loose monetary easing measures in hopes of containing the inflation that the moron at the top is so desperate to stoke.

In keeping with the coming endgame, the yield on 10-year Japanese government bonds has recently risen to its highest level in a decade on the back of a surge in US Treasury yields. That has prompted the BoJ to revise its so-called yield curve control policy so that the 10-year JGB yield can rise above 1%.

The tax cuts are only expected to take effect in June, which could come after the BoJ has lifted negative interest rates, with some economists forecasting a policy change in April.

“We believe that the BoJ will be careful not to spike JGB yields through its incoming policy normalisation, but if the fiscal discipline is met with doubt by market participants, this could spell difficulty for the central bank,” UBS economist Masamichi Adachi wrote in a recent note.

The central bank also revised its inflation forecast upward, saying it expected 2.8% core inflation in the 2024 fiscal year, Annual core inflation, which excludes energy and fresh food prices, was 4.2% in September. Should this latest vote-buying stimmy pass, the actual inflation in 2024 will be orders of magnitude higher.