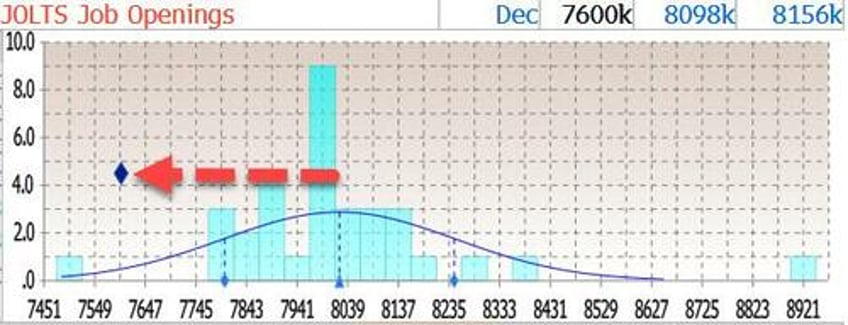

One month after we reported that job openings "unexpectedly" soared on "a record 2 month surge in professional services", moments ago the BLS reported that the biggest rollercoaster series in the US data set just collapsed, when December job openings "unexpectedly" cratered by 556,000, from 8.156 million to just 7.600 milion, the second lowest print since the covid crash...

... and below all Wall Street estimates with the exception of one, SocGen's 7.5 million job openings forecast.

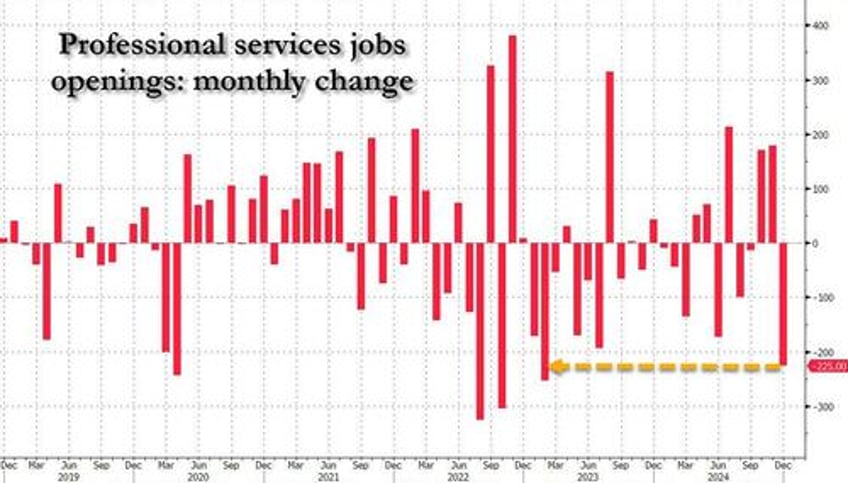

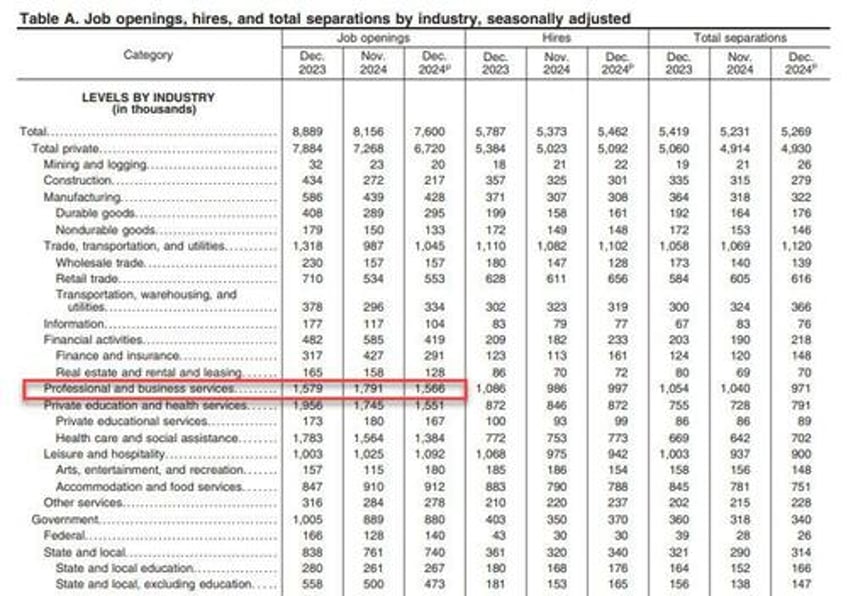

According to the BLS, the number of job openings decreased in professional and business services (-225,000), a sharp reversal from last month's +273,000 surge, as well as health care and social assistance (-180,000), and finance and insurance (-136,000). Job openings increased in arts, entertainment, and recreation (+65,000). This

As a reminder, last month - when commenting on the then surge in professional service job openings - we said "How realistic is this surge in professional services JOLTS? We don't know, but we know that the 2-month increase in pro services job openings was the largest on record!"

Now we know just how "realistic" it was.

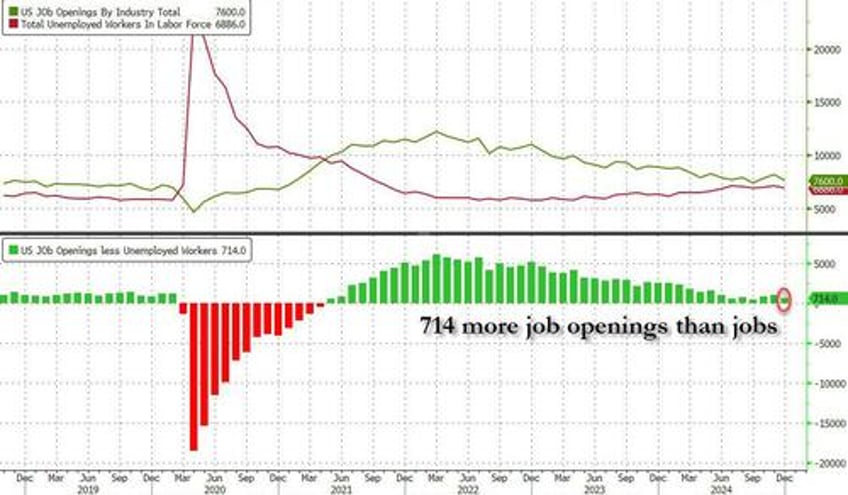

In the context of the broader jobs report, in November the number of job openings was only 714K more than the number of unemployed workers (which the BLS reported was 6.886 million), down from last month's 1.03 million and one of the lowest differentials since the covid crash.

Said otherwise, in July the number of job openings to unemployed was 1.1, a modest drop from last month, and on the low end of the pre-covid range in 2018-2019.

While the job openings data was an downside shock (and a reversal of last month's surprise surge), where the silver lining was this month (again a reversal of last month) was in the number of hires, which staged a modest bounce, rising by about 90K to 5.462 million, just while the number of quits also rose modestly to 3.2 million from 3.13 million, a glimmer of hope in a labor force where the majority are now clearly far less optimistic they can find a higher paying job elsewhere, and would rather be fired than quit.

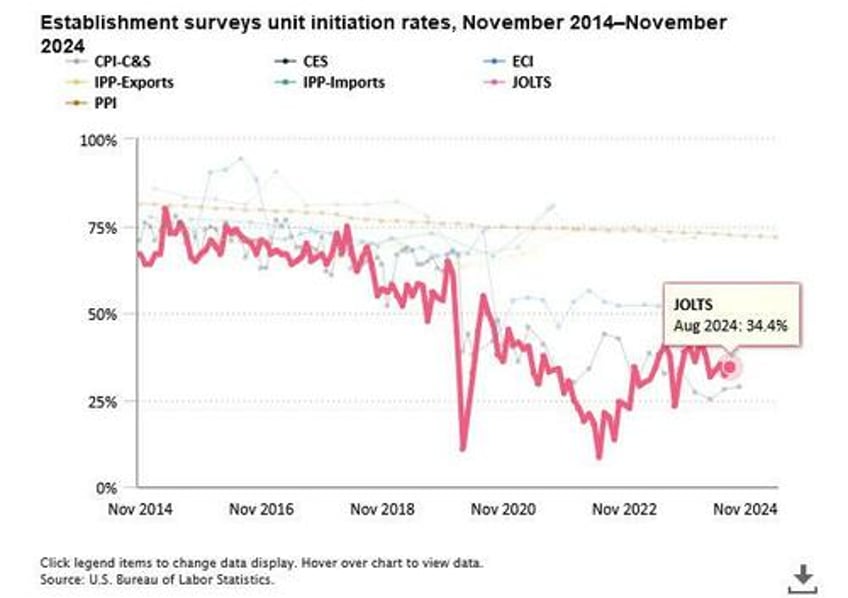

Finally, no matter what the "data" shows, let's not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it - or some 70% to be specific - is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 34%

Conclusion: how to make sense of this sudden collapse in the labor market? Simple: as we mused back in December, all Trump needs to do to get the Fed to restart cutting rates is to tell the BLS to show a sudden collapse in the labor market. Today was the preview. The main show comes on Friday at 8:30am.

Finally, no matter what the "data" shows, let's not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it - or some 70% to be specific - is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 33%