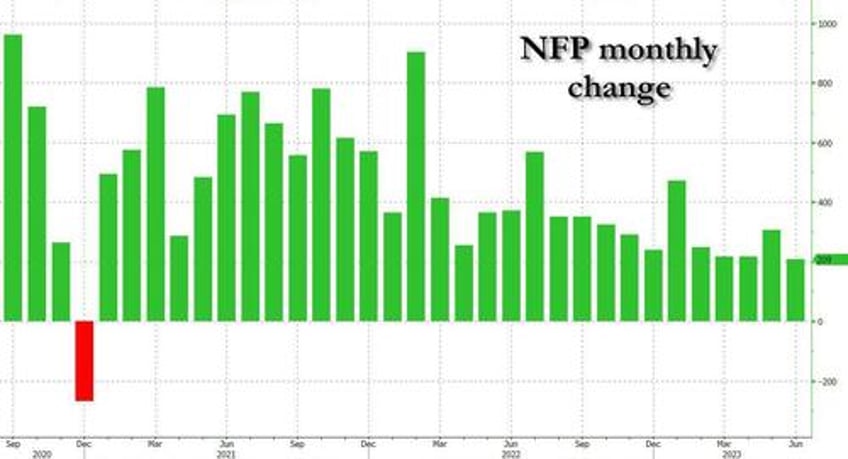

After dropping to the lowest level since Dec 2020 (when it was negative 268K), in July the rate of payroll growth is expected to slow further, with measures of wage growth also seen cooling further. Consensus expects payrolls to slow to 200K from 209K, while hourly earnings rise 4.2% vs a year ago, down from 4.4% last month.

That said, analyst whisper numbers and gauges of the US labor market strength are supportive of a stronger reading: as Newsquawk notes, ADP’s gauge of payrolls surprised to the upside once again, though many analysts dismiss the data series as an unreliable forecaster for the NFP data; weekly claims data has trended lower relative to the June survey week; PMI surveys allude to healthy labor market conditions, and consumers have confidence in the outlook for the labor market. And tracking estimates are also above what the consensus predicts. Looking forward, payroll additions are expected to ease further, but Fedwatchers still suggest that a print in July that is in line with the consensus would still likely keep the prospect of another FOMC rate rise in play.

EXPECTATIONS:

- NFPs: Analysts expect 200k nonfarm payrolls to be added to the US economy in July, slightly below the 209k added in June.

- Unemployment rate: The jobless rate is expected to remain unchanged at 3.6% (note: the FOMC’s latest projections anticipate the jobless rate will rise to 4.1% by the end of this year, before ticking up to 4.5% next year).

- Average Hourly Earnings: Consensus expects a cooling to 4.2% Y/Y from 4.4%, with the monthly print expected at +0.3% M/M (down from +0.4%);

- Average Weekly Hours: expected to remain at 34.4hrs. According to whispers, the bias could be to the upside; traders cite a Bloomberg report which was tracking payrolls growth at 364k this month, and sees the jobless rate falling to 3.5%. That would certainly be viewed as a very hawkish development and would send yields sharply higher still.

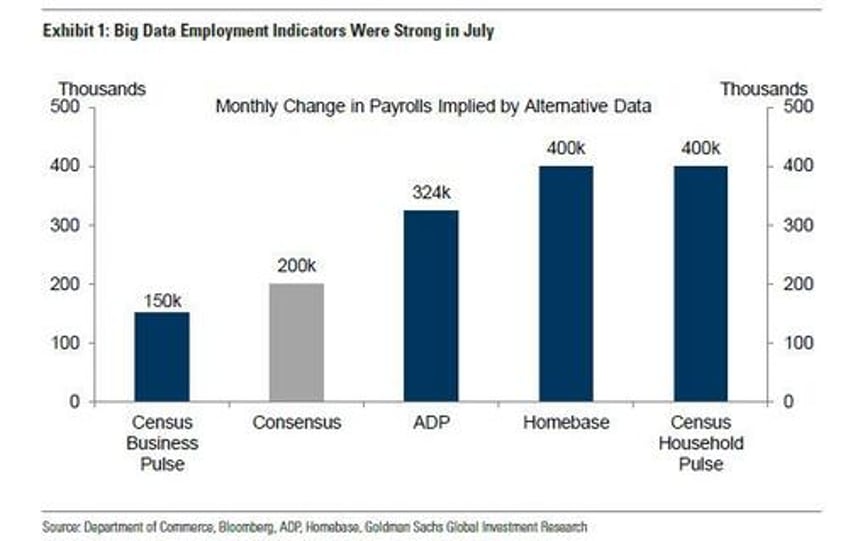

ADP DATA: ADP’s data surprised to the upside, once again, reporting 324k private payrolls were added in July, blitzing

through the consensus view of 189k (the range of forecasts 140-300k); the prior data for June was revised lower to 455k

from an initially stated 497k (which in turn was more than double the NFP print of 209K so it's rather safe to ignore ADP). The wages metrics also cooled sharply again, taking the annual rate for Job Stayers to 6.2% Y/Y (from 6.4%), and for Job Changers to 10.2% from 11.2%. For obvious reasons, analysts continue to be critical of the ADP’s ability to forecast the BLS payrolls data. Pantheon Macroeconomics, a very vocal critic, said that "since its relaunch with new methodology last August, ADP has been both unforecastable and deeply unreliable as an indicator of the official first estimate of private payrolls each month," adding that the data "has no implications for our July forecast." Of course, it very well could be that ADP is right and it is the BLS "data" that is massaged for political purposes.

WEEKLY CLAIMS: Weekly initial and continuing jobless claims data has eased in the July survey week relative to the June survey window; initial jobless claims were at 228k vs 265k (with the moving average at 238k vs 265k), while continuing claims was 1.69mln vs 1.73mln (with the average moving lower to 1.72mln from 1.76mln).

BUSINESS SURVEYS: S&P Global's PMI Data is mixed in its outlook for the labor market; its flash release for July said firms expanded workforce numbers, though the rate of job creation was only marginal, however, and the weakest since January. "Some manufacturing companies noted that the solid rise in payrolls was due to greater ease of hiring, with some also mentioning an improvement in employee retention and improved confidence in the outlook," it said, "in contrast, services firms reported the slowest rise in employment for six months in July, continuing to highlight challenges retaining and attracting staff due to rising wage costs."

CONSUMER CONFIDENCE: The Conference Board reported that Consumer Confidence improved in July, with assessments of the present situation rising on brighter views of employment conditions, where the spread between consumers saying jobs are ‘plentiful’ versus ‘hard to get’ widened further. "This likely reflects upbeat feelings about a labor market that continues to outperform," CB said. Additionally, consumers' assessment about the short-term labor market outlook was also more favourable, with slightly more consumers expecting more jobs to be available, while slightly fewer anticipate less jobs.

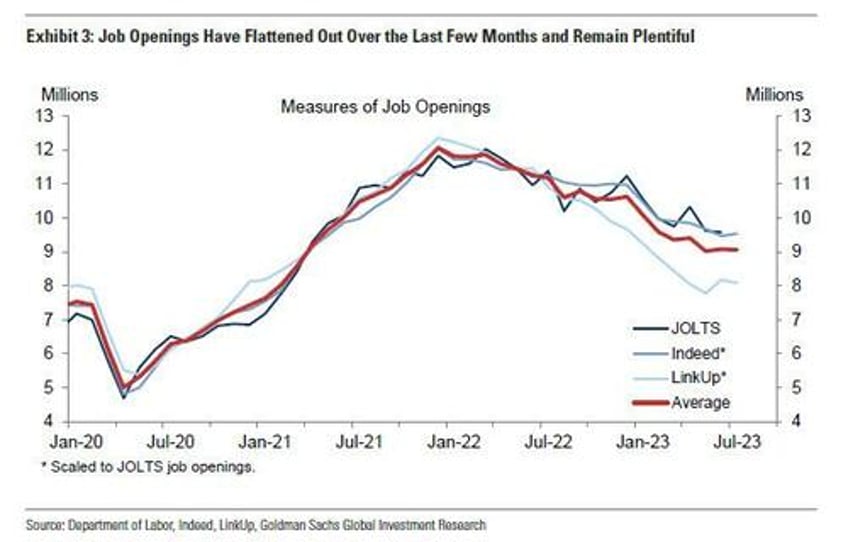

JOLTs: It is also worth noting that the JOLTs data for June (which is one month delayed vs the July jobs data from the BLS due tomorrow) reported job openings of 9.582mln, beneath the expected 9.61mln, and 9.824mln prior. Wells Fargo said that "since the Fed began tightening policy in March 2022, job openings have fallen 20% while the unemployment rate has trended sideways," adding that "this marks an encouraging step towards inflation subsiding without a recession, but with price growth still elevated and a pullback in demand for workers ongoing, a "soft landing" remains far from assured." The number of new hires and quit both also slumped, signaling a sharp slowdown in the labor market.

ARGUING FOR A STRONGER-THAN-EXPECTED REPORT

- Big Data. Alternative measures of employment growth indicate strong job gains in nJuly, with a median pace of +360k across the four indicators tracked.

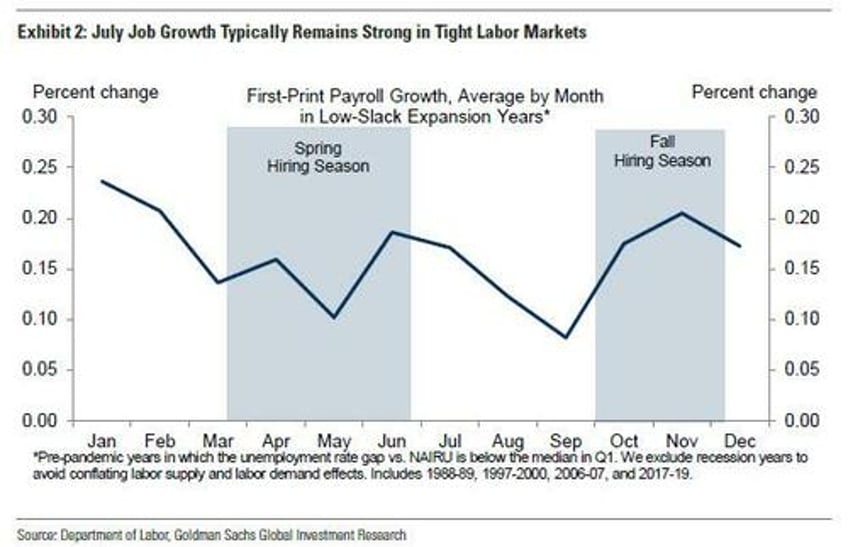

- Arrival of summer student workforce. When the labor market is tight, payroll ngrowth tends to remain strong in July, with average payroll gains 15k above the full-year average (see Exhibit 2). We believe this reflects the interaction between labor availability and the spring hiring season: seasonal labor market slack peaks at the start of the year, troughs in early May, then rebounds in June and July with the arrival of the student summer workforce.

- Job availability. JOLTS job openings were roughly unchanged month-over-month (at 9.6mn) and in line with consensus expectations in June, and online measures have similarly flattened out over the past few months (Exhibit 3). While labor demand has fallen meaningfully from last year’s peak, it remains elevated by 1.0-2.5mn relative to 2019 and represents a positive factor for job growth. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—increased by 4.4pt to 37.2 in July.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT

- Employer surveys. The employment components of business surveys improved on net but remained at weak levels in July. The employment component of Goldman's manufacturing survey tracker edged up to 49.6 and the employment component of our services survey tracker increased to 51.4.

NEUTRAL FACTORS:

- Layoffs. Announced layoffs reported by Challenger, Gray & Christmas declined sharply in July (-36.8% to 24k, SA by GS), compared to 45k on average in the second half of 2022. While initial jobless claims fell to an average of 238k in the July payroll month (vs. 251k in June), the recent string of declines likely benefited from favorable seasonal comparisons. The JOLTS layoff rate was unchanged at 1.0% in June.

VARIANT TAKE: In its preview, Goldman - which has been chronically bullish ahead of payroll reports and mostly on the wrong side of consensus - estimates an above-consensus 250k payrolls in July as "job growth tends to remain strong in July when the labor market is tight—reflecting strong hiring of youth summer workers—and three of the alternative measures of employment growth we track indicate a strong pace of job growth." The bank is also more optimistic than consensus, estimating that the unemployment rate edged down by 0.1% to 3.5% (vs. consensus of 3.6%) reflecting a rise in household employment and unchanged labor force participation at 62.6%. The bank is in line with consensus regarding wages and estimates a 0.3% increase in average hourly earnings that lowers the year-on-year rate to 4.2% "reflecting waning upward wage pressures and positive calendar effects (consensus also 0.3% / 4.2%)."

POLICY IMPLICATIONS: SGH Macro's Fedwatcher Tim Duy suggests that if the data is in line with market expectations, and in the context of a GDP growth rate running above 2%, it keeps the prospect of a FOMC rate hike on the table at the October and/or November meetings, and adds that anything below 200k will give the Fed scope to continue to pause on rate changes. Duy says that July's data could be elevated due to seasonal effects, but payroll growth of around 300k or more over the next two reports would probably be consistent with unemployment below 3.5% by the time of the September meeting. "That combined with a Q3 growth outlook of more than 2% would probably put a September rate hike into play," SGH writes, "that’s arguably an extreme situation (or maybe not if the economy is rebounding from the “recession” of the 4Q21 and 1Q22 and the Fed’s series of rate hikes?), and the Fed would hate it."

The bottom line is that if the whisper numbers based on the "big data" forecasts - or the monthly ADP report - are remotely accurate, and payrolls reverse the recent decline, odds of another rate hike will spike, which in a time of soaring deficits and $1 trillion in debt issuance this quarter will send the 10Y to fresh 2023 highs, fast approaching 4.50%.

Extended preview research available to pro subscribers