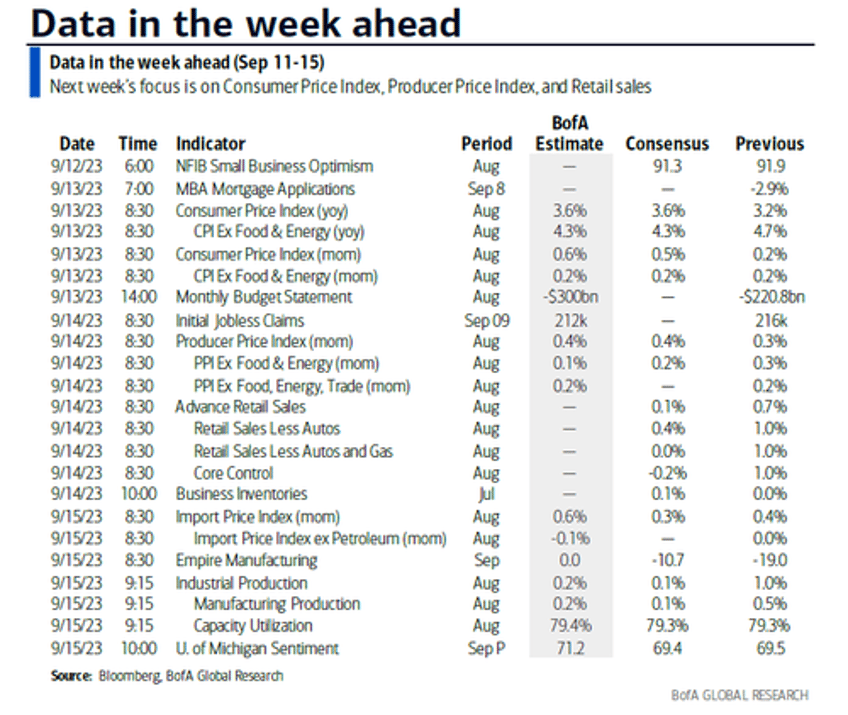

If last week was rather light on important data, you can't say the same about this week's high-impact extravaganza that will occur in a Fed (and buyback) blackout period as next week's FOMC lurks in the wings:

US CPI (Wednesday) will be the obvious standout but US PPI and retail sales (Thursday) are nearly as important given how some of the PPI subcomponents feed into the Fed's preferred core PCE, and for retail sales, we’ll see how much momentum has been lost after a phenomenally strong July print. If that's not enough, the ECB see their first "in the balance" meeting of this cycle on Thursday with markets now pricing in a 38% likelihood of a hike this morning. Elsewhere, the UK sees employment data (tomorrow) and monthly GDP (Wednesday) while Friday is a busy day as we get China's monthly suite of activity data, its latest 1-yr MLF fixing rate and US industrial production and the University of Michigan survey.

It's not just economic data: on Tuesday, the long-awaited Apple "Wonderlust" presentation will unveil the latest iPhone model, as well as a new Apple Watch, AirPods, iOS 17 and USB-C charging ports announcements, Wednesday we will get the pricing of the long-awaited ARM IPO (which is said to be six times oversubscribed), while the UAW union strike is scheduled to begin on Thursday, Sept 14, with potentially disastrous consequences for the US.

As DB's Jim Reid writes, there's no other place to start than US CPI: DB's US economists write that since gas prices have risen nearly 7% in August, headline CPI (+0.61% DB forecast vs. +0.17% previously) will see its largest monthly increase since June 2022. However, core (+0.22% vs. +0.16% last month) is likely to remain relatively becalmed. On these estimates, the year-on-year number for core CPI inflation should fall 0.4% to 4.3%, whereas headline would rise 0.4% to 3.7%, the highest for three months.

With core inflation still relatively subdued, the positive momentum should continue, with the three-month annualized rate falling by about 90bps to 2.2%, while the six-month annualized rate should fall by 50bps to 3.6%. In both cases that would be the lowest since early 2021. So for now the strong headline print should be offset by the positive news on core. However, the risk is always that the longer headline edges up, the more risk of second-round effects down the road.

Talking of components, Thursday's PPI will be nearly as important, as many categories feed into the Fed’s favored core PCE deflator. Health care is the main one and DB economists are concerned that wage growth in the sector could push this higher in the months ahead after recent falls. Airlines are another one to watch. They’ve surprisingly slumped in CPI recently, but risen in the PPI. So this will be an interesting one to get resolved: airfares are one reason why the “core services excluding housing” PCE inflation has been significantly stronger than that of the CPI core services excluding rent and medical care services. The Fed pays far closer attention to the PCE core services ex-housing series because this accounts for a little over half of core PCE inflation.

On Thursday, August’s retail sales will be a very important release after the strong July reading, so it’ll give us a much better idea of consumption trends and the direction of travel for Q3 GDP and beyond. Economists expect some payback across headline (0.1% vs. +0.7% in July), sales excluding autos (0.4% vs. +1.0%) and retail control (-0.1% vs. +1.0%). So don't underestimate how much a strong reading could impact the likelihood of another hike, or a bad reading impact the probabilities of a recession. The final highlight for the US will be the inflation expectations in the UoM sentiment survey. Will it edge up a bit with the recent rise in gas prices?

Over in Europe, all eyes will be on the ECB’s decision on Thursday. DB economists have nervously held their 3.75% terminal deposit rate call for many months now, and as such they think the ECB will stay on hold. However, even if they don't hike this week, don't expect any sign that the council are confident that this is the last hike. A lot of uncertainty remains over European inflation, whilst GDP has been in near-stagnation since last autumn. See our economists' preview note here. Elsewhere in Europe, we have the ZEW survey due for Germany tomorrow, as well as Eurozone-level industrial production on Wednesday.

Speaking of central banks, DB Research has just changed its call on the Bank of Japan’s monetary policy outlook; their economists now expects yield curve control to be removed in October (previously April 2024), and for negative interest rate policy to end in January 2024 (previously December 2024). That follows the interview that BoJ Governor Ueda gave with the Yomiuri newspaper, where he said an end to negative interest rates was possible if they were confident that wages and prices were rising sustainably, and that they could have enough information on the wage outlook by the end of the year.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 11

- Data: Japan August M2, M3, machine tool orders, Italy July industrial production

- Central banks: BoE's Pill speaks

- Earnings: Oracle

Tuesday September 12

- Data: US August NFIB small business optimism, UK July average weekly earnings, unemployment rate, August jobless claims change, Germany September ZEW survey, July current account balance, Eurozone September ZEW survey

- Central banks: BoE's Mann speaks

Wednesday September 13

- Data: US August CPI, monthly budget statement, UK July monthly GDP, trade balance, industrial production, index of services, construction output, Japan August PPI, Italy Q2 unemployment rate, Eurozone July industrial production

- Earnings: Inditex

Thursday September 14

- Data: US August PPI, retail sales, July business inventories, initial jobless claims, Japan July core machine orders, capacity utilization

- Central banks: ECB decision

- Earnings: Adobe, Lennar

Friday September 15

- Data: US September University of Michigan survey, Empire manufacturing survey, August industrial production, import and export price index, capacity utilization, China August industrial production, retail sales, new home prices, property investment, Japan July Tertiary industry index, Italy July trade balance, general government debt, Eurozone Q2 labour costs, July trade balance, Canada August existing home sales, July manufacturing sales, international securities transactions

- Central banks: Bank of England Inflation Attitudes Survey, China 1-year MLF rate

* * *

Turning to just the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday, and the retail sales and PPI reports on Thursday. Fed officials are not expected to comment on monetary policy this week, reflecting the FOMC blackout period in advance of the September 19-20 meeting.

Monday, September 11

- 11:00 AM New York Fed 1-year inflation expectations, August (last 3.6%)

Tuesday, September 12

- 06:00 AM NFIB small business optimism, August (consensus 91.5, last 91.9)

Wednesday, September 13

- 08:30 AM CPI (mom), August (GS +0.63%, consensus +0.6%, last +0.2%); Core CPI (mom), August (GS +0.24%, consensus +0.2%, last +0.2%); CPI (yoy), August (GS +3.58%, consensus +3.6%, last +3.2%); Core CPI (yoy), August (GS +4.30%, consensus +4.3%, last +4.7%): We estimate a 0.24% increase in August core CPI (mom sa), which would lower the year-on-year rate by four tenths to 4.30%. Our forecast reflects a pullback in auto prices (used -3.1%, new -0.2%, mom sa) reflecting declines in used car auction prices and the further rebound in new car inventories and incentives. However, we expect a boost from residual seasonality in the transportation services categories, in particular for airlines (we assume +6% mom sa; webfares also increased sequentially). We also expect another gain in the car insurance category (we assume +1.6%), as carriers continue to offset higher repair and replacement costs. We forecast shelter inflation to remain roughly at its current pace (we estimate +0.40% for rent and +0.48% for OER). We estimate a 0.63% rise in headline CPI, reflecting higher energy (+5.8%) and food (+0.3%) prices.

Thursday, September 14

- 08:30 AM Retail sales, August (GS -0.1%, consensus +0.1%, last +0.7%); Retail sales ex-auto, August (GS +0.3%, consensus +0.4%, last +1.0%); Retail sales ex-auto & gas, August (GS -0.2%, consensus -0.1%, last +1.0%); Core retail sales, August (GS -0.2%, consensus -0.1%, last +1.0%): We estimate core retail sales fell 0.2% in August (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects solid back-to-school shopping trends in the brick-and-mortar segment but a pullback in the nonstore category following record sales on Amazon Prime Day. We estimate a 0.1% drop in headline retail sales.

- 08:30 AM Initial jobless claims, week ended September 9 (GS 225k, consensus 227k, last 216k): Continuing jobless claims, week ended September 2 (consensus 1,695k, last 1,679k)

- 08:30 AM PPI final demand, August (GS +0.3%, consensus +0.4%, last +0.3%); PPI ex-food and energy, August (GS +0.1%, consensus +0.2%, last +0.3%); PPI ex-food, energy, and trade, August (GS +0.2%, consensus +0.2%, last +0.2%)

- 10:00 AM Business inventories, July (consensus +0.1%, last flat)

Friday, September 15

- 08:30 AM Import price index, August (consensus +0.3%, last +0.4%); Export price index, August (consensus +0.3%, last +0.7%)

- 08:30 AM Empire State manufacturing survey, September (consensus -10.0, last -19.0)

- 09:15 AM Industrial production, August (GS +0.1%, consensus +0.1%, last +1.0%): Manufacturing production, August (GS -0.1%, consensus +0.1%, last +0.5%); Capacity utilization, August (GS 79.2%, consensus 79.3%, last 79.3%): We estimate industrial production increased 0.1%, as strong oil and gas production and electric utilities outweigh weak mining production. We estimate capacity utilization edged down to 79.2%.

- 10:00 AM University of Michigan consumer sentiment, September preliminary (GS 69.2, consensus 69.2, last 69.5): University of Michigan 5-10-year inflation expectations, September preliminary (GS 3.0%, consensus 3.0%, last 3.0%)

Source: DB, Goldman, BofA