This week's holiday-shortened economic calendar is extremely light as 2024 comes to a close.

Late last week, and just after midnight on Friday, the big drama was resolved after Congress managed to pass a three-month continuing resolution to fund the government after acrimonious negotiations that threatened a shutdown. So with that big overhang removed, market participants will have only a handful of data releases to digest that will largely serve to sharpen forecasters' estimates of current-quarter real GDP growth.

Monday kicks off with December consumer confidence which unexpectedly came at 104.7, or below the lowest estimate (median est was 113.5 vs. 112.8 previously), even as most analysts were expecting it to edge up to its highest level since July 2023. More important than the headline will be consumers' outlook on the labor market in the jobs plentiful / jobs hard-to-get series within the conference board survey which rose for a 2nd month after hitting a post-covid low in September. Though the percentage of respondents reporting that jobs were plentiful slipped slightly in November to 33.4%, those noting that jobs were "hard to get" fell by 2.4ppts to 15.2% – the lowest level since May (14.3%). Historically, the unemployment rate has been highly correlated with the spread between the two series and at 18.2% as of November, consumers' views on the labor market could signal some downward movement in the unemployment rate.

With respect to Q4 real GDP, last Friday's personal consumption data pointed to stronger consumer spending than we had initially anticipated. This was one reason DB boosted its current-quarter growth estimate to 2.6% (annualized) from 2.1%, previously. If the bank's forecast is close to the mark, real GDP will have grown 3.2% annualized over the 16 quarters of the Biden Administration... and it only cost $2 trillion in debt per year. Though the swift debt-funded recovery from the pandemic played a significant role in that performance, it is nonetheless remarkable that despite the historic tightening of monetary policy over the past two years, inflation-adjusted output will have increased at a 2.9% annualized pace – the same growth rate as the 8 quarters following the 2017 Tax Cut and Jobs Act. Tuesday's durable goods orders (-1.1% vs exp. -0.3% headline / +0.7% ex-transportation vs exp 0.1%/ +0.7% core vs exp. 0.1%) will further inform current-quarter assessment of inflation-adjusted output. DB expects headline orders to get a mild boost from Boeing aircraft alongside a healthy rebound in orders for non-defense capital goods excluding aircraft. That being said, recall that core shipments is the component from the durables report that used to benchmark equipment spending in the GDP accounts and despite the decline in core orders in October, core shipments were up slightly. Though Tuesday's new home sales (664K vs. exp. 670K) will also factor into Q4 growth estimates, this series is highly volatile and often revised, particularly during the low-volume winter months.

Thursday's initial jobless claims (225k vs. 220k) and Friday's advance goods trade balance (-$101.1bn vs. -$99.0bn) will round out this week's data docket. Regarding the former, last week's data showed a notable drop in initial claims which confirmed our prior view that seasonal factors around the Thanksgiving holiday were boosting the series. With respect to the trade balance release, import and export growth has been particularly volatile of late and thus any surprises could meaningfully move Q4 GDP tracking estimates.

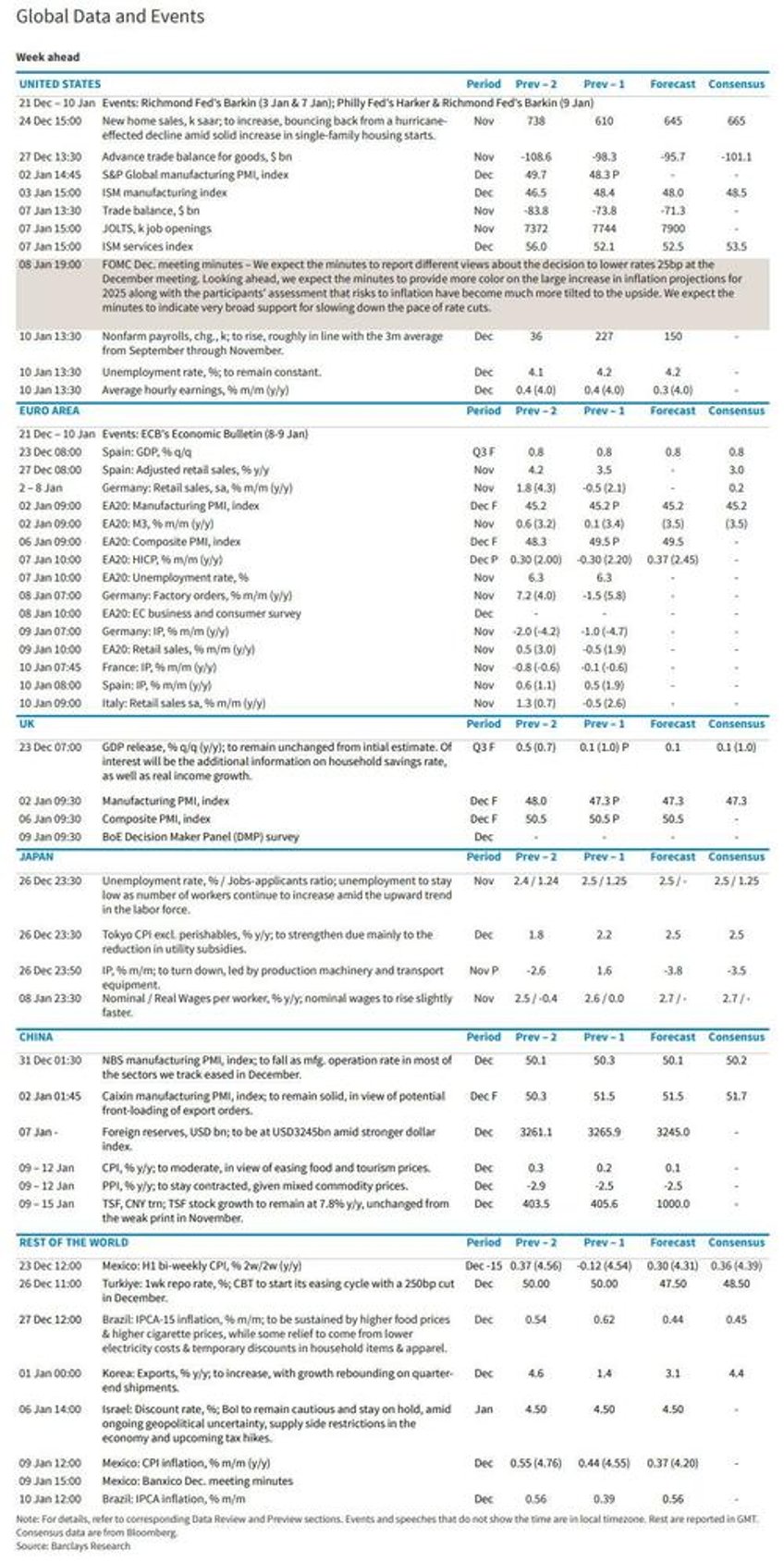

Here is the full global event calendar.

A more detailed analysts comes from Goldman Sachs, which writes that the key economic data release this week is the durable goods report on Monday. There are no speaking engagements from Fed officials this week.

Monday, December 23

- 08:30 AM Durable goods orders, November preliminary (GS -1.0%, consensus -0.3%, last +0.3%); Durable goods orders ex-transportation, November preliminary (GS +0.1%, consensus +0.3%, last +0.2%); Core capital goods orders, November preliminary (GS +0.2%, consensus +0.1%, last -0.2%); Core capital goods shipments, November preliminary (GS +0.2%, consensus +0.2%, last +0.3%): We estimate that durable goods orders declined 1.0% in the preliminary November report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast 0.2% increases for core capital goods orders and shipments, reflecting mixed global manufacturing data.

- 10:00 AM New home sales, November (GS +7.0%, consensus +9.8%, last -17.3%)

- 10:00 AM Conference Board consumer confidence, December (GS 113.4, consensus 113.0, last 111.7)

Tuesday, December 24

- NYSE will be closed early at 1:00 PM. SIFMA recommends an early 2:00 PM close to bond markets.: 10:00 AM Richmond Fed manufacturing index, December (consensus -11, last -14)

Wednesday, December 25

- Christmas Day holiday. There are no major economic data releases scheduled. NYSE will be closed. SIFMA recommends that bond markets also close.

Thursday, December 26

- 08:30 AM Initial jobless claims, week ended December 21 (GS 215k, consensus 221k, last 220k); Continuing jobless claims, week ended December 14 (consensus 1,885k, last 1,874k)

Friday, December 27

- 08:30 AM Advance goods trade balance, November (GS -$102.0bn, consensus -$101.1bn, last -$98.3bn)

- 10:00 AM Wholesale inventories, November preliminary (consensus +0.2%, last +0.2%)

Source: DB, Goldman