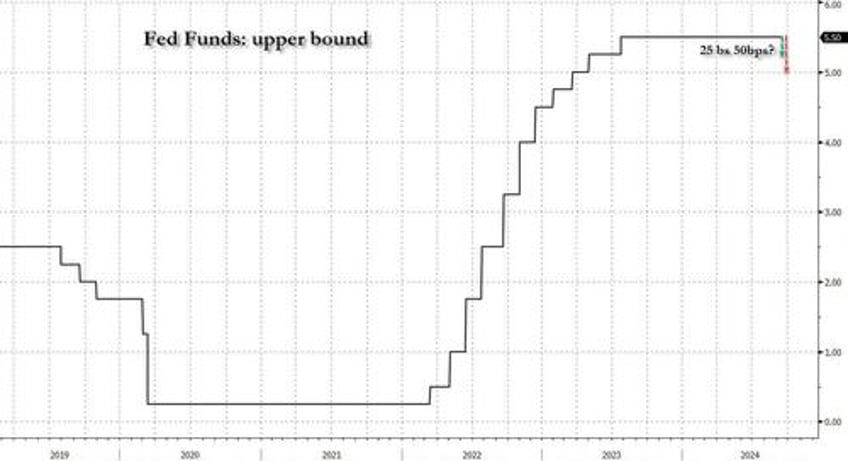

It's all about the Fed this week and the first rate cut since March 2020 when Powell took rates to zero in response to the global covid shock. The only question is whether it will be a 25bps or 50bps rate cut. During a 36-hour monetary roller coaster mid week, we will also get policy decisions in Brazil, South Africa the UK and Japan, but those pale in comparison to the Fed.

This time last week DB's Jim Reid suggested that if we were going to get 50bps from the Fed on Wednesday we probably needed a media leak as we approached or entered this past weekend. Thursday's WSJ (link here) and FT (link here) articles certainly weren't smoking guns towards 50bps but they suggested the prospect was higher than where it was after Wednesday's slightly firmer CPI report. It's hard to know how informed the WSJ article was but as you will remember, the same author (Nick Timiraos) wrote a much firmer endorsement of a surprise 75bps hike just before the June 2022 FOMC which completely moved the needle at the time. There was little doubt that this was well informed. As we will discuss in more detail shortly, DB economists and strategists put both WSJ articles (2022 vs 2024) from this same author into the bank's proprietary AI tool (it’s not called ChatDBT but I'll refer to it that way) and it said that "the June 2022 article conveys a strong sense of urgency and conviction regarding the need for a significant rate hike to combat inflation. The September 2024 article, while discussing the possibility of a rate cut, presents a more balanced and less decisive outlook, reflecting the Fed's cautious approach in navigating economic uncertainty". So it confirmed the prior assumption about the fresh WSJ article that although this could be a signal that things were closer than we thought, there is no slam dunk here.

Back to the Fed, in the absence of any weekend articles that could have been sourced to the Fed, it really leaves the decision on Wednesday on a knife-edge, something that hasn't often been the case by the time we ultimately arrived at each FOMC in recent years. Normally its been fairly obvious that close to the meeting or the Fed have found a way of guiding the market to the eventual outcome. At the moment DB is expecting 25bps but with market pricing where it is (66bps priced in this morning), and if no Fed leaks push us back towards 25bps over the course of the next 12-24 hours, DB economists could easily move to a 50bps today as they don't think the Fed will want to surprise the market too much on the day. We will see. As important as the 25 vs 50 debate will be the communication from the Fed. Would a 50bps be the start of 50s or a one off larger move to start the cycle? Would a 25bps mean the bar for subsequent 50s is high? There will be lots to digest.It will be difficult to deviate the messaging too far away from the latest updated Summary of Economic Projections (SEP) and dot plots though. So in many ways that constrains the messaging unless we see large changes.

DB's economists think the Fed’s growth forecasts are likely to be little changed but the median core PCE inflation forecast could fall by a tenth or two. They believe the unemployment rate forecast will move higher this year – likely into the 4.3-4.4% range – but be mostly unchanged in subsequent years. If the Fed cuts by 25bps on Wednesday, they would expect a median of 75bps of cuts this year and if they cut by 50bps, they would expect the SEP to reflect 100bps of cuts through year-end.

Outside of the Fed the main highlights are tomorrow's US retail sales and industrial production, Wednesday's US housing starts and permits and UK inflation, Thursday's Bank of England decision, US existing home sales and initial jobless claims, and Friday sees the BoJ meeting, China decide on 1 and 5-yr prime rates, Japan's CPI, and German PPI.

We also get some global central bank activity starting with the Bank of England’s policy rate decision on Wednesday. Economists surveyed by Bloomberg are expecting the Bank Rate to remain unchanged at 5% after Governor Bailey warned in August that the BOE will need to be “careful not to cut interest rates too quickly, or too much.” And on Friday, the key point of interest for the day will be the Bank of Japan’s policy rate decision. No change from the prevailing 0.25% target rate is expected by surveyed economists this time around.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 16

- Data: US September Empire manufacturing index, Italy July general government debt, trade balance, Eurozone July trade balance, Q2 labour costs, Canada August existing home sales, July manufacturing sales

- Central banks: ECB's Panetta speaks

Tuesday September 17

- Data: US August retail sales, industrial production, capacity utilisation, September New York Fed services business activity, NAHB housing market index, July business inventories, Japan July Tertiary industry index, Germany and Eurozone September Zew survey, Canada August CPI, housing starts

- Auctions: US 20-yr Bonds (reopening, $13bn)

Wednesday September 18

- Data: US August building permits, housing starts, July total net TIC flows, UK August CPI, RPI, PPI, July house price index, Japan August trade balance, July core machine orders, Eurozone July construction output, Canada July international securities transactions, New Zealand Q2 GDP

- Central banks: Fed's decision, BoC's summary of deliberations, ECB's Holzmann, Vujcic and Nagel speak

Thursday September 19

- Data: US Q2 current account balance, September Philadelphia Fed business outlook, August leading index, existing home sales, initial jobless claims, Italy July current account balance, EU27 August new car registrations, ECB July current account

- Central banks: BoE's decision, ECB's Knot, Nagel and Schnabel speak, Norges decision

- Earnings: FedEx

- Auctions: US 10-yr TIPS (reopening, $17bn)

Friday September 20

- Data: China 1-yr and 5-yr loan prime rates, UK September GfK consumer confidence, August retail sales, public finances, Japan August national CPI, Germany August PPI, France September manufacturing confidence, August retail sales, Eurozone September consumer confidence, Canada July retail sales, August industrial product price index, raw materials price index

- Central banks: BoJ's decision, ECB's Lagarde speaks

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the retail sales report on Tuesday and the Philly Fed manufacturing index on Thursday. The September FOMC meeting is this week. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, September 16

- 08:30 AM Empire State manufacturing survey, September 11.5 (consensus -4.3, last -4.7)

Tuesday, September 17

- 08:30 AM Retail sales, August (GS -0.3%, consensus -0.2%, last +1.0%); Retail sales ex-auto, August (GS +0.1%, consensus +0.2%, last +0.4%); Retail sales ex-auto & gas, August (GS +0.1%, consensus +0.3%, last +0.4%); Core retail sales, August (GS +0.1%, consensus +0.3%, last +0.3%): We estimate core retail sales expanded 0.1% in August (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects mixed card spending and a moderation from the 7.7% annualized pace of retail control growth over the prior two months, but a potential boost from back-to-school shopping. We estimate a 0.3% decline in headline retail sales, reflecting lower gasoline prices and lower auto sales.

- 09:15 AM Industrial production, August (GS +0.2%, consensus +0.2%, last -0.6%); Manufacturing production, August (GS +0.1%, consensus flat, last -0.3%); Capacity utilization, August (GS 77.8%, consensus 77.9%, last 77.8%): We estimate industrial production increased 0.2%, as strong natural gas and electricity production balance weak oil and mining production. We estimate capacity utilization remained at 77.8%.

- 10:00 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver pre-recorded welcoming remarks at the Eleventh District Banking Conference, hosted by the Dallas Fed. Her remarks will not address monetary policy or the economy, reflecting the FOMC’s blackout period.

- 10:00 AM NAHB housing market index, September (consensus 41, last 39): 10:00 AM Business inventories, August (consensus +0.3%, last +0.3%)

Wednesday, September 18

08:30 AM Housing starts, August (GS +6.3%, consensus +5.9%, last -6.8%); Building permits, August (consensus +1.3%, last -3.3%);

02:00 PM FOMC statement, September 17-18 meeting: We expect the FOMC to lower the fed funds rate by 25bp at the September meeting, followed by 25bp cuts at the November and December meetings. We expect the SEP’s median unemployment rate projection to rise to 4.2%/4.3%/4.2% in 2024-2026 (vs. 4.0%/4.2%/4.1% in June) and remain at 4.2% in 2027. We expect the median GDP growth projection to rise slightly in 2024 and the core PCE inflation projection to edge down in 2024 and 2025 in response to softer inflation data since the June FOMC meeting. We will publish our expectations for the fed funds rate projections in our FOMC preview this week.

Thursday, September 19

- 08:30 AM Initial jobless claims, week ended September 13 (GS 225k, consensus 230k, last 230k); Continuing jobless claims, week ended September 6 (consensus 1,855k, last 1,855k)

- 08:30 AM Philadelphia Fed manufacturing index, September (GS flat, consensus -1.0, last -7.0): We estimate that the Philadelphia Fed manufacturing index rebounded 7.0pt to flat in September, reflecting upward convergence to other surveys.

- 10:00 AM Existing home sales, August (GS +1.5%, consensus -1.3%, last -0.6%)

Friday, September 20

- There are no major economic data releases scheduled.

Source: DB, Goldman