Usually the macro calendar goes quieter the week after payrolls but that's not the case now as there’s a lot to digest this week with the US CPI report (Thursday) and Fed Chair Powell's testimonies to the Senate and House committees (Tuesday and Wednesday) the obvious highlights alongside PPI and the start of US Q2 earnings season on Friday with JP Morgan, Citi and Wells Fargo reporting. Besides Powell, we will also get numerous other Fed speakers this week.

Outside of these the day by day highlights are NY Fed 1-yr inflation expectations today, tomorrow’s US small business optimism survey to see if the “K” shaped recovery continues. Wednesday sees China’s CPI and PPI, Japan’s PPI, Norwegian and Danish CPI, Italian IP and a US 10yr Treasury auction. Thursday sees the latest US monthly budget numbers alongside jobless claims which will continue to get close attention given recent mixed signals on the US labor market. There is also a 30yr Treasury auction. On Friday the University of Michigan survey and Swedish CPI will be the highlight outside of the main events mentioned above. In geopolitics, there is a NATO summit Tuesday through Thursday, and Indian PM Modi visits Russia today and tomorrow both of which may generate headlines. The full week ahead is at the end as usual.

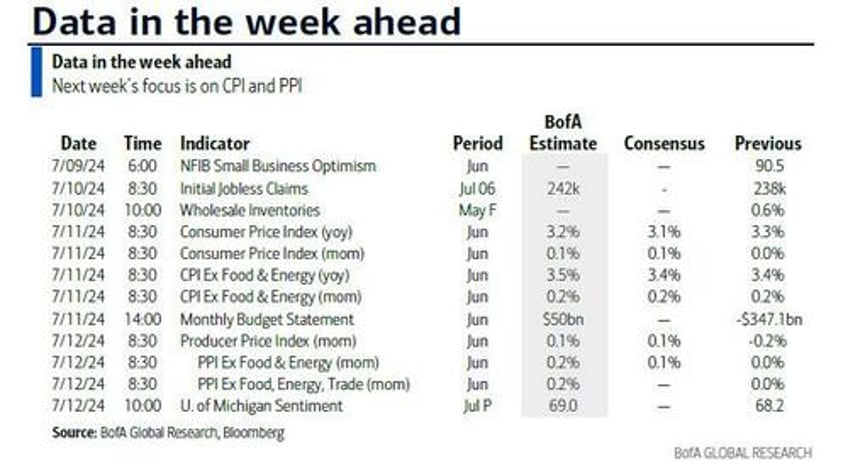

Let's now preview the US CPI and PPI releases and review a mixed payroll print on Friday. The headline CPI should print soft (+0.09% MoM Deutsche Bank forecast vs. +0.01% previously) thanks to falling gas prices. However core is expected to edge up (+0.25% MoM vs. +0.16%).

If DB economists are correct, YoY headline CPI will fall by two-tenths to 3.1%, with core edging up a tenth to 3.5%. However three-month annualized core would fall four tenth to 2.9%, though the six-month annualized rate would stay at 3.7%. For the PPI we always look at the categories feeding into core PCE, namely health care services, airfares and portfolio management. The final of these three should be firm given the recent rally in equities and airfares could bounce back after a weak May. This also could be the end of easy comps as weak July and August prints will soon roll out of the YoY numbers. This is important as if markets do want a September cut then a bit more progress is needed on inflation absent an “unexpected weakening” (in Powell’s words) in the employment situation.

Finally, as noted above, Q2 earnings season begins Friday when JPM, Wells, Citi and BNY all report.

Finally, courtesy of DB, here is a day-by-day calendar of events

Monday July 8

- Data : US June NY Fed 1-yr inflation expectations, May consumer credit, Japan May labor cash earnings, BoP current account balance, BoP trade balance, June bank lending, Economy Watchers survey, Germany May trade balance

- Central banks : BoE's Haskel speaks

Tuesday July 9

- Data : US June NFIB small business optimism, Japan June M3, M2, machine tool orders

- Central banks : Fed's Powell testifies to Senate Banking, Housing, and Urban Affairs committee

- Auctions : US 3-yr Notes ($58bn)

Wednesday July 10

- Data : US May wholesale trade sales, China June CPI, PPI, Japan June PPI, Italy May industrial production, Norway June CPI, PPI, Denmark June CPI

- Central banks : Fed's Powell testifies to the House Financial Services committee, Goolsbee and Bowman speak, ECB's Nagel speaks, BoE's Pill speaks, RBNZ decision

- Auctions : US 10-yr Notes (reopening, $39bn)

Thursday July 11

- Data : US June CPI, monthly budget statement, initial jobless claims, UK June RICS house price balance, May monthly GDP, Japan May core machine orders

- Central banks : Fed's Bostic and Musalem speak

- Earnings : PepsiCo

- Auctions : US 30-yr Bond (reopening, $22bn)

Friday July 12

- Data : US June PPI, July University of Michigan survey, China June trade balance, Japan May capacity utilisation, Germany May current account balance, retail sales, June wholesale price index, Canada June existing home sales, May building permits, Sweden June CPI

- Earnings : JPMorgan Chase, Citigroup, Wells Fargo

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Thursday and the PPI and University of Michigan reports on Friday. Chair Powell will testify to congressional committees on Tuesday and Wednesday, and there are several other speaking engagements from Fed officials this week, including Governors Barr, Bowman, and Cook and Presidents Goolsbee, Bostic, and Musalem.

Monday, July 8

- 11:00 AM NY Fed 1-year inflation expectations, June (last +3.17%)

Tuesday, July 9

- 06:00 AM NFIB small business optimism, June (consensus 90.2, last 90.5)

- 09:15 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will speak on financial inclusion at an event in Washington, D.C. Speech text is expected.

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will present the semiannual monetary policy report to the Senate Committee on Banking, Housing, and Urban Affairs. Speech text and a Q&A are expected. On July 2, Chair Powell emphasized that there had been “a lot of progress” on inflation at the ECB Forum on Central Banking in Sintra, Portugal. Powell reiterated that the FOMC wanted “to be more confident that inflation is moving sustainably down” to its 2% target before starting to cut rates. He also emphasized that the FOMC faced more two-sided risks to achieving its inflation and employment goals, which had been “a big change” from a year ago. On July 3, the minutes to the FOMC’s June meeting emphasized that although inflation remained elevated, there had been "modest further progress" in recent months.

- 01:30 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak on promoting an inclusive financial system at an event in Washington, D.C. Speech text and a Q&A are expected. On June 27, Bowman said, “Should the incoming data indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive…we are still not yet at the point where it is appropriate to lower the policy rate, and I continue to see a number of upside risks to inflation…I remain willing to raise the target range for the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed.”

Wednesday, July 10

- 10:00 AM Wholesale inventories, May final (consensus +0.6%, last +0.6%)

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will testify before the House Financial Services Committee. Speech text and a Q&A are expected.

- 02:30 PM Chicago Fed President Goolsbee (FOMC non-voter) and Governor Bowman speak: Chicago Fed President Austan Goolsbee and Fed Governor Michelle Bowman will give opening remarks at a Fed Listens event focused on the childcare industry, working parents, and employers. Speech text is expected. On July 2, Goolsbee said, “we are on a path to 2%” inflation” and “if you just hold the rates where they are while inflation comes down, you are tightening—so you should do that by decision, not by default.” He added, “We got to this [federal funds] rate when inflation was over 4%, and inflation is now down close to 2.5%, so if you sit with the rate somewhere while inflation goes down you’re tightening. The reason that you would want to tighten is if you think that you’re not on a path to 2%.”

- 07:30 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will speak on global inflation and monetary policy challenges in Australia. Speech text and a Q&A are expected. On June 25, Cook said, “With significant progress on inflation and the labor market cooling gradually, at some point it will be appropriate to reduce the level of policy restriction to maintain a healthy balance in the economy…The timing of any such adjustment will depend on how economic data evolve and what they imply for the economic outlook and balance of risks.”

Thursday, July 11

- 08:30 AM CPI (mom), June (GS +0.11%, consensus +0.1%, last flat); Core CPI (mom), June (GS +0.21%, consensus +0.2%, last +0.2%); CPI (yoy), June (GS +3.17%, consensus +3.1%, last +3.3%); Core CPI (yoy), June (GS +3.43%, consensus +3.4%, last +3.4%): We estimate a 0.21% increase in June core CPI (mom sa). Our forecast reflects a pullback in used car (-1.6%) and hotel lodging (-1.5%) prices and only a partial rebound in the car insurance category (+0.5%) based on decelerating premiums in our online dataset. However, we assume a modest rebound in new car prices (+0.2%), reflecting disruptions to dealer software systems and a (likely related) decline in incentives. We estimate a modestly slower pace of inflation in the housing measures (primary rent +0.36%; OER +0.39%). We estimate a 0.11% rise in headline CPI, reflecting lower energy (-1.0%) and flattish food (+0.1%) prices.

- 08:30 AM Initial jobless claims, week ended July 6 (GS 233k, consensus 239k, last 238k); Continuing jobless claims, week ended June 29 (consensus 1,855k, last 1,858k)

- 11:30 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will speak about economic inclusion in a moderated conversation at the National Credit Union Administration's Diversity, Equity, and Inclusion Summit. A Q&A is expected. On June 27, Bostic reiterated that he expects one rate cut this year in Q4 and said, “I think my reluctance [to cut rates] and my desire to be patient is that I think we need to be absolutely certain that we're going to get back to that 2% target. And I don’t have that confidence right now.”

- 01:00 PM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will answer questions on the US economy and monetary policy in Little Rock, Arkansas. On June 18, Musalem said, “I will need to observe a period of favorable inflation, moderating demand and expanding supply before becoming confident that a reduction in the target range for the federal funds rate is appropriate. These conditions could take months, and more likely quarters to play out.”

Friday, July 12

- 08:30 AM PPI final demand, June (GS +0.1%, consensus +0.1%, last -0.2%); PPI ex-food and energy, June (GS +0.1%, consensus +0.2%, last flat); PPI ex-food, energy, and trade, June (GS +0.1%, last flat)

- 10:00 AM University of Michigan consumer sentiment, July preliminary (GS 66.2, consensus 68.2, last 68.2): University of Michigan 5-10-year inflation expectations, July preliminary (GS 2.9%, last 3.0%): We expect the University of Michigan consumer sentiment index decreased to 66.2 in the preliminary July reading, and we expect the report's measure of long-term inflation expectations fell 0.1pp to 2.9%, reflecting lower gasoline prices and better (lower) inflation news.

Source: DB, BofA